Can the Government save US ecommerce from Temu and Shein?

Investing.com — The U.S. government is currently grappling with a rising challenge in e-commerce: the growing influence of Chinese retail giants Temu and Shein.

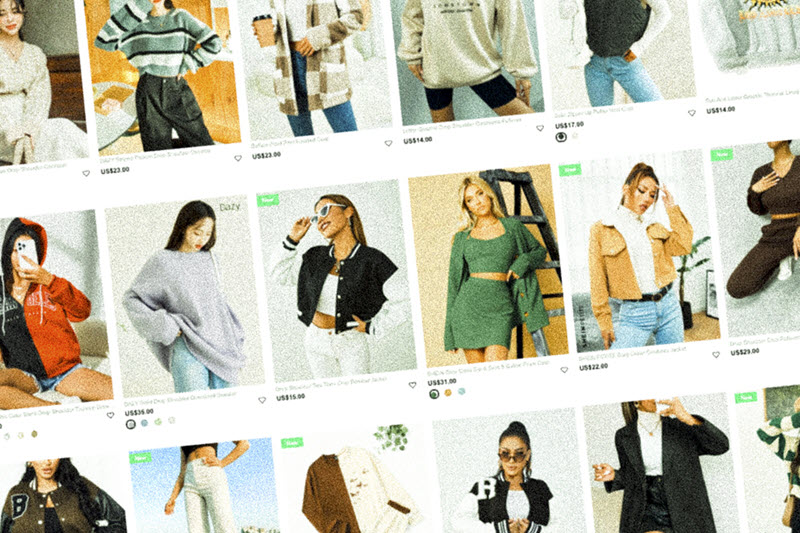

Both platforms have disrupted the U.S. market with their ultra-low-cost products and unique consumer-to-manufacturer business models, offering massive price advantages over domestic competitors.

With the Biden administration’s recent proposals to tighten trade regulations, particularly by targeting the de minimis rule, which allows goods under $800 to enter the U.S. without tariffs, the question arises—can the government actually save U.S. e-commerce from these formidable players?

As per analysts from MoffettNathanson, any assumption that regulatory changes will cripple Temu and Shein’s operations is overly optimistic and short-sighted. The de minimis rule, which has been exploited over a billion times annually by Chinese sellers, represents a vital artery for these companies.

However, even if the government successfully closes this loophole, MoffettNathanson argues that the companies are unlikely to pack up and leave.

Instead, they have been pivoting, increasingly storing goods in U.S. warehouses, ensuring they can maintain swift delivery times, even under stricter trade regulations.

Temu, for instance, has been preemptively stocking its best-selling products locally in the U.S., mitigating potential impacts of the rule change. The report notes that over two-thirds of Temu’s most popular items are now located in U.S. warehouses, ensuring fast delivery times of two to four days.

This move is not just defensive but strategic, signaling long-term ambitions to further entrench their presence in the U.S. market. Similarly, Shein has been making inroads by establishing warehouses and fulfillment centers in the U.S., further insulating itself from any immediate regulatory shocks.

The broader backdrop driving this is China’s slowing domestic consumption and retail growth, forcing its manufacturing base to pivot toward Western markets.

MoffettNathanson flags that China’s retail sales growth decelerated sharply from 12% in 2014 to flat in 2022. With a manufacturing base built for global demand, China now views the West as a critical outlet for its vast output of discounted goods.

This economic imperative means that even with increased regulatory pressures, Chinese platforms like Temu and Shein will likely continue to find ways to penetrate Western markets.

In terms of competition, the proposed regulatory changes may drastically alter the U.S. e-commerce landscape. If Chinese competitors like Temu and Shein are hindered, Etsy (NASDAQ:) could benefit.

Etsy’s customer acquisition costs have skyrocketed as it struggled to compete with aggressive marketing by its Chinese counterparts. A pullback by Temu and Shein could reduce this pressure, allowing Etsy to regain some of its lost marketing leverage.

However, MoffettNathanson warns that Etsy’s advantage would be modest, given that competition from other global players remains fierce.

Amazon (NASDAQ:), on the other hand, appears well insulated from the rise of Temu and Shein. The retail giant has shown resilience, improving its advertising efficiency and reducing referral fees for low-cost items to remain competitive in categories where Temu and Shein have gained ground.

Amazon’s Prime membership, coupled with its unmatched fulfillment capabilities, provides it with a buffer against the pricing pressures posed by Chinese platforms.

eBay (NASDAQ:), which has benefited from the influx of Chinese goods, faces more uncertainty. The platform’s relatively low fees have made it an attractive option for Chinese sellers seeking to minimize costs while accessing U.S. consumers.

However, MoffettNathanson’s research suggests that eBay’s exposure to regulatory changes may be less than initially feared. Many of its China-sourced goods, particularly in the lucrative parts and accessories category, are already stored in U.S. warehouses, meaning they wouldn’t be affected by changes to the de minimis rule.

Ultimately, while the U.S. government can attempt to curtail the influence of Temu and Shein through regulatory interventions, MoffettNathanson’s analysis suggests that it is unlikely to stop the tide of Chinese goods flooding into the market.

Both companies have shown remarkable adaptability, and their deep integration into the U.S. retail landscape makes it improbable that they will simply withdraw in the face of rule changes. Furthermore, China’s economic imperatives ensure that the West will remain a critical destination for its discounted goods.