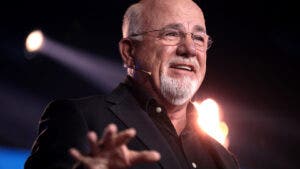

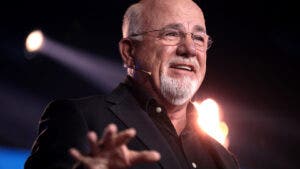

‘You Can’t Earn Your Way Out of Stupidity’: Dave Ramsey On Why $60K-Earning Teachers Often Become Millionaires

Schoolteachers, often underappreciated and underpaid, have long been society’s unsung heroes. Despite their modest salaries, many teachers are quietly building significant wealth. According to a research project by Ramsey Solutions called the “National Study of Millionaires,” many teachers are finding their way into the millionaires’ club.

Don’t Miss:

Dave Ramsey, a respected voice in personal finance and CEO of Ramsey Solutions, brought this surprising trend to the limelight. “You don’t have to make a huge income to build wealth,” Ramsey said. “You can’t earn your way out of stupidity.” His words underscore a surprising reality: Many millionaires are not high earners but smart planners.

See Also: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

According to the U.S. Bureau of Labor Statistics, teachers are on the list of careers most likely to have millionaires, with an average annual salary of $61,690, just behind engineers and accountants. Meanwhile, despite their hefty paychecks, physicians don’t even crack the top five.

Based on a survey of 10,000 millionaires, the report found that most of them did not come from well-off families. A staggering 79% did not inherit their fortune. Instead, they invested wisely – eight of ten had a 401(k). Interestingly, three-quarters of them did not hold high-paying jobs, thus dispelling the myth that wealth is reserved for the superrich.

Trending: Warren Buffett flipped his neighbor’s $67,000 life savings into a $50 million fortune — How much is that worth today?

“These people are systematic,” Ramsey said. “They work with plans and play by the rules.” He highlighted the importance of well-planned spending and investing habits, stating that 85% of millionaires use a shopping list, with 28% consistently sticking to it.

Noting that many are working hard to build up their savings, Ramsey said that some of the attractive offers are certificates of deposit (CDs) with good interest rates and fixed terms.

Another avenue that Ramsey emphasized is high-yield savings accounts, which can yield returns exceeding 4%. “A high-yield savings account is a no-brainer if you’re serious about growing your money. It’s about making your money work for you,” he remarked.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

He also touched on how passion affects financial outcomes. “Don’t take a job just because it pays,” he said. “You ought to make more money if you’re doing something you love. You’re good at it, you care, you’re creative.” However, he cautioned against the belief that a high paycheck guarantees wealth.

Moderate-income earners, like teachers, can make enough money to become wealthy with careful planning. “You don’t have to have a gigantic paycheck to have a secure financial future,” Ramsey said.

Ramsey’s insights extend to the medical field, where many doctors struggle with debt and delayed investments despite their hefty wages.

Brent Lacey, the host of “The Scope of Practice” podcast, resonated with this sentiment, pointing out that physicians often miss out on years of potential investments because of the weight of student loans. “After enduring so much sacrifice, they believe it’s finally their turn to enjoy their earnings,” Lacey remarked, contrasting this with his grandmother, a thrifty public schoolteacher who retired with a fortune.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘You Can’t Earn Your Way Out of Stupidity’: Dave Ramsey On Why $60K-Earning Teachers Often Become Millionaires originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.