Prediction: When the Federal Reserve Starts Cutting Rates, These 2 Stocks Will Be Massive Winners

After recent economic data shows that inflation continues to cool off and jobless claims have been a bit higher than expected, it is a virtual certainty at this point that the Federal Reserve is going to cut interest rates at the conclusion of its September meeting, for the first time since March 2020.

Investors aren’t expecting just one cut. According to the CME FedWatch tool, which tracks interest rate expectations of financial markets, the median expectation is for a total of two full percentage points of interest rate cuts by September 2025. If the rate-cut cycle starts as expected and continues for at least the next year, there are some stocks that could be big winners.

The sluggish real estate market could pick up steam

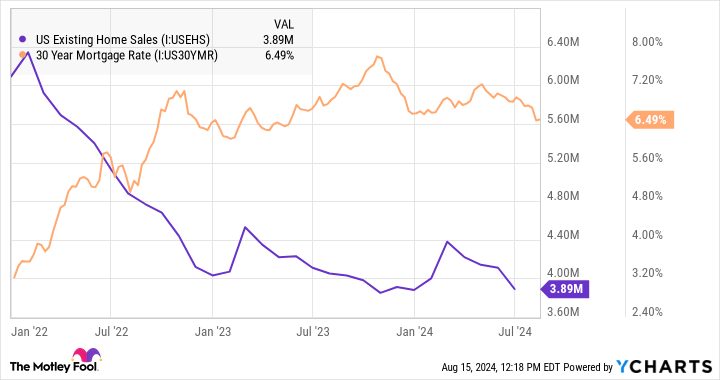

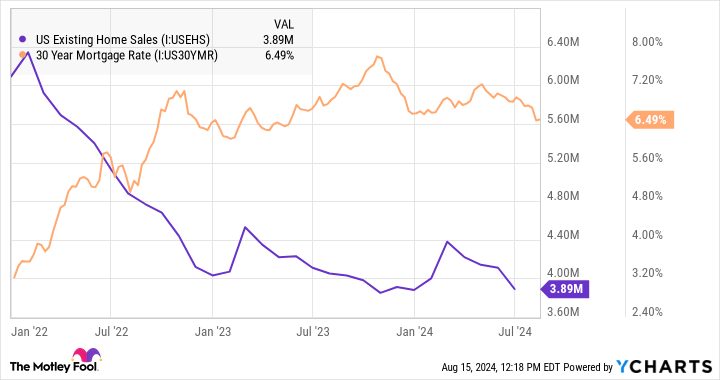

One of the effects of the rising-rate environment of recent years has been rising mortgage rates. And while the average 30-year mortgage rate has cooled off a bit from the peak of about 8%, rates are still in the 6.5% ballpark, more than double their level at the beginning of 2022.

As a result, the real estate market has slowed to a crawl. Existing home inventories are near a generational low, mortgage demand for both purchase and refinancing is low, and as a result, real estate sales are down by more than 35% since before the rate-increase cycle began. In fact, mortgage rates and existing home sales volume have clearly moved in an inverse relationship.

This could be great news for real estate businesses, but one that I’m particularly excited about is Redfin (NASDAQ: RDFN). Management has done a great job of focusing on efficiency during the slow times, as well as on building relationships with top-performing agents. It is very well positioned to take advantage of pent-up demand for homes when rates fall, and it could become profitable quickly in a more favorable environment.

Lower deposit costs could sharply boost profits

Banking disruptor SoFi (NASDAQ: SOFI) has been a bank only since the beginning of 2022, and since that time it has grown its deposit base from zero to $23 billion. This is enough so that about 90% of its loan book is funded by deposits, which generally come at a lower cost than borrowing money.

While a large deposit base creates a favorable cost structure, it’s important to realize that SoFi is an online bank whose savings accounts pay relatively high interest rates — up to 4.6% as of this writing. However, if rates fall, it will almost certainly result in a drop in SoFi’s deposit rates. Meanwhile, the loan book is largely made up of fixed-rate personal loans and student loans, which will continue to pay the same amount.

To be sure, there are plenty of other reasons to love SoFi right now. But this is a way the expected falling-rate environment could provide a tailwind.

Buy as long-term investments

While I think both of these are likely to be big winners as interest rates fall, it’s important to note that there’s no way to accurately predict what the Fed will do. After all, at the start of 2022, virtually nobody was predicting that a sharp rate-increase cycle was about to begin. There are simply too many factors involving inflation, consumer confidence, employment, and more that could turn out differently than expected and cause the Fed to change course.

The point is that while I believe the next couple of years will be great for these stocks, I own both in my own portfolio because I think they’ll be long-term winners, even if the forward trajectory of interest rates doesn’t turn out as expected.

Should you invest $1,000 in Redfin right now?

Before you buy stock in Redfin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Redfin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Matt Frankel has positions in Redfin and SoFi Technologies. The Motley Fool has positions in and recommends Redfin. The Motley Fool recommends the following options: short August 2024 $11 calls on Redfin. The Motley Fool has a disclosure policy.

Prediction: When the Federal Reserve Starts Cutting Rates, These 2 Stocks Will Be Massive Winners was originally published by The Motley Fool