Cisco Gives Upbeat Sales Forecast Even as It Cuts Jobs

(Bloomberg) — Cisco Systems Inc., the biggest maker of computer networking equipment, gave a bullish revenue forecast for the current period thanks to a rebound in orders, but announced plans to cut thousands of jobs as part of a strategy shift.

Most Read from Bloomberg

Sales will be $13.65 billion to $13.85 billion in the fiscal first quarter, which ends in October, the company said in a statement Wednesday. Analysts had estimated a number at the very low end of that range.

Cisco shares, down 10% this year, gained more than 5% in extended trading following the announcement. They had closed earlier at $45.44 in regular New York trading.

The workforce reduction isn’t about trying to boost profits, according to Chief Financial Officer Scott Herren. Cisco needs to rapidly shift further into cybersecurity, cloud systems and artificial intelligence-related products, so it’s freeing up resources to do that, he said in an interview.

The cuts will reduce Cisco’s headcount of 90,400 by about 7% — indicating a loss of more than 6,300 jobs. The move will bring short-term costs of about $1 billion, Cisco said. It also has been digesting the purchase of Splunk Inc., which it acquired earlier this year.

Even with the push to sell more software and services, Cisco still counts on installations of new equipment for much of its revenue. On that front, it saw improvement in the latest quarter — a sign corporate customers are investing in their networks again. They had previously been more focused on installing gear they’ve already purchased.

“The period of inventory digestion by our customers is now largely behind us,” Chief Executive Officer Chuck Robbins said on a call with analysts. He pointed to strong demand across all regions and major product lines, including from government clients.

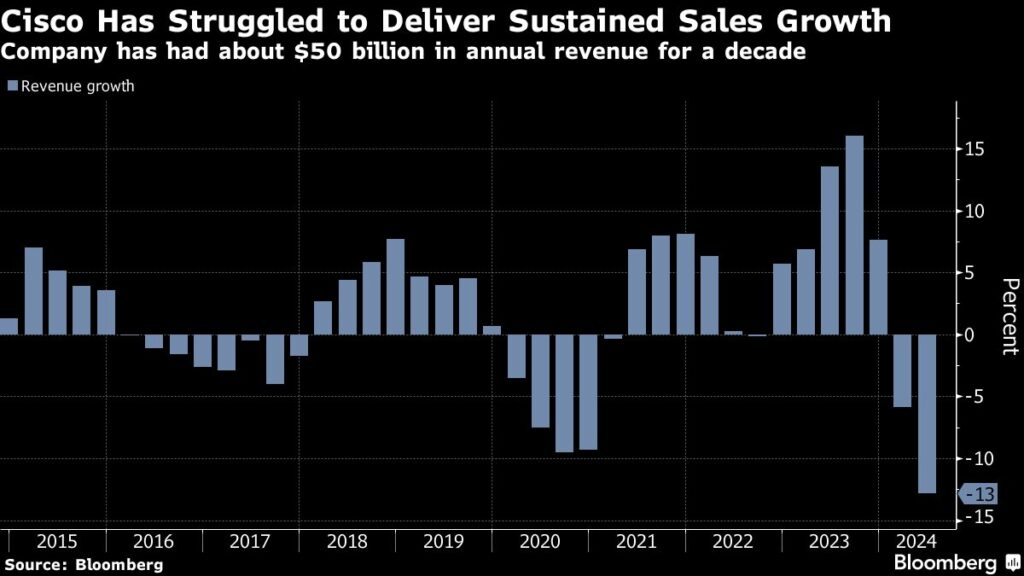

Though revenue declined 10% to $13.6 billion in the fourth quarter, that beat the $13.53 billion that analysts had predicted. Profit was 87 cents a share, minus some items. Wall Street projected 85 cents.

Cisco reported a 14% gain in orders, a closely watched indicator of future revenue. Orders had been flat in the third quarter compared with a year earlier, excluding the newly acquired Splunk. Without Splunk, orders were up 6% in the fourth quarter, Cisco said.

In the first quarter, profit will be 86 cents to 88 cents a share, excluding some items, Cisco said. That compares with a prediction of 85 cents. For fiscal 2025, revenue will range as high as $56.2 billion, a projection that is above Wall Street’s consensus estimate.

The company is trying to persuade investors that new products and services will help Cisco benefit from spending on data centers and artificial intelligence. Unlike some hardware makers, notably Nvidia Corp., the company hasn’t yet been able to point to multiple billions of revenue from that area.

Cisco’s management team has tried to focus investor attention on its deferred revenue, which they say shows the success of a shift from one-time purchases to long-term contracts.

(Updates with executive comments starting in fifth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.