Warren Buffett Bet On Ulta Beauty, Heico in Q2. See How His Portfolio Changed.

Investopedia / Photo Illustration by Alice Morgan / Alison Czinkota / Getty Images

Ket Takeaways

-

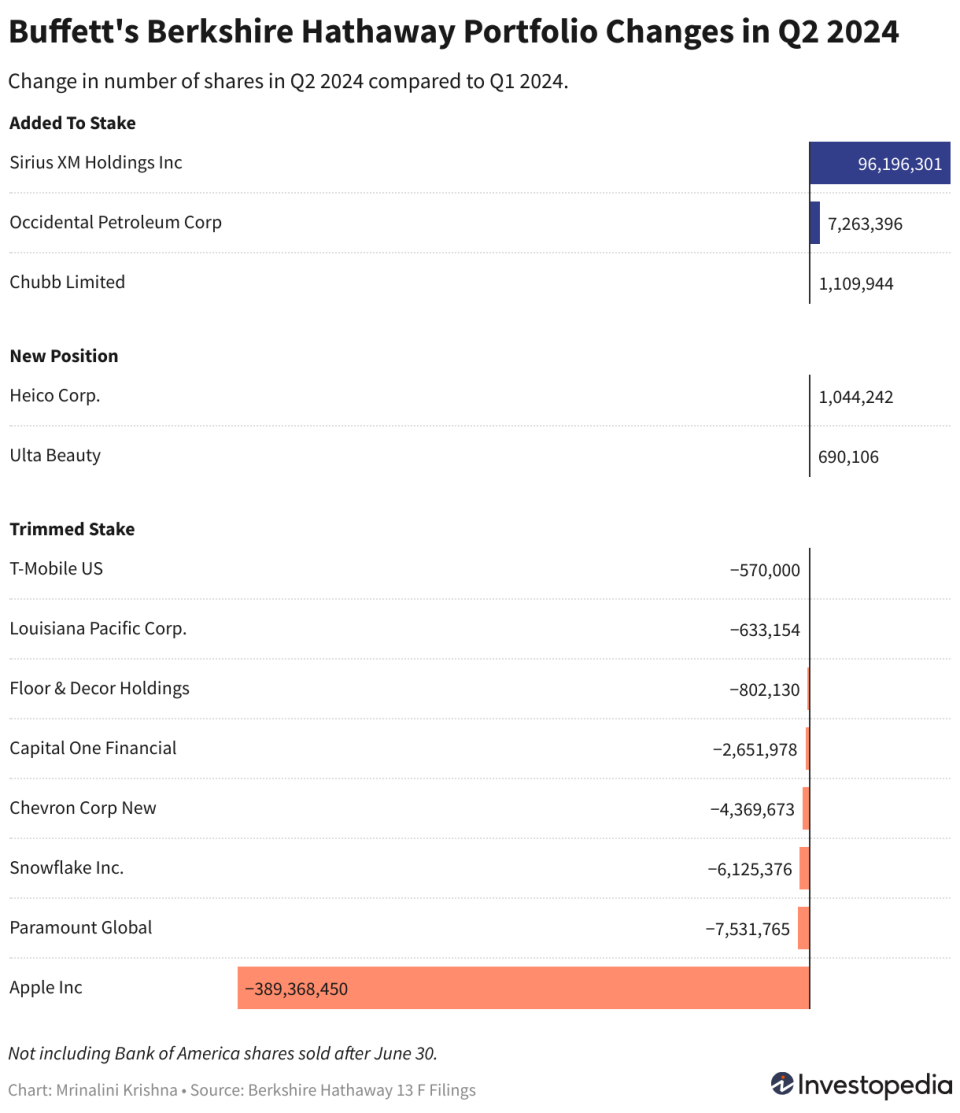

Warren Buffett’s Berkshire Hathaway added new positions in Ulta Beauty and Heico Corp. in the second quarter, according to a regulatory filing released Wednesday.

-

Berkshire cut its Apple stake by half in the quarter, though the tech company remains its top holding, accounting for nearly a third of the portfolio.

-

Buffett also trimmed positions in Chevron, Floor & Decor and T-Mobile, while exiting holdings of Paramount Global and Snowflake.

-

Additions to existing positions included buying shares in Occidental Petroleum and Chubb Limited.

Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) bought shares of beauty products company Ulta Beauty (ULTA) and aerospace and electronics manufacturing company Heico Corp. (HEI) in the second quarter of this year, a regulatory filing showed Wednesday.

The 13-F filing also confirmed that Berkshire significantly trimmed its holdings in Apple Inc. (AAPL). The position in Apple still accounts for roughly a third of Berkshire’s portfolio.

It is important to note that 13-F filings only provide a snapshot of the portfolio at the end of the quarter. This filing for Berkshire offers no insight into any transactions since June, so its missing all the Bank of America (BAC) shares the company sold in July. Nor does it provide any details about gains or losses made from any sales.

Here’s what Berkshire’s portfolio looked like on June 30.

New Additions and Exits In Berkshire Portfolio

Berkshire Hathaway bought about 690,000 shares of Ulta Beauty valued at roughly $266 million as of June 30. The beauty company’s shares soared 14% in extended trading Wednesday after the stake was revealed.

Buffett also bought about a million shares of Heico Corp., which saw its stock rise nearly 4% in after-hours trading.

The filing reflected the company’s exit from Paramount Global (PARA), a rare bet gone wrong for Buffett. He had admitted to selling all shares in the company for a loss at the Berkshire annual shareholder’s meeting held in May and had offloaded a big part of that stake in the first quarter.

The company also sold all of its stake in technology firm Snowflake (SNOW). At the end of the first quarter, Berkshire had held 6.1 million shares in the company valued at about $989 million.

Berkshire Trims Apple, Chevron, Buys More OXY, Chubb

By the end of the second quarter, Berkshire nearly halved its Apple stake to 400,000 shares valued at $84.2 billion, in line with what was reported during its second quarter earnings. Buffett had reduced his holding in the technology company by 13% in the first quarter.

Among other notable trimming of stakes, Berkshire sold nearly 4.3 million shares in Chevron Corp. (CVX). Despite the sale, Chevron’s weight in the Berkshire portfolio went up to 6.6% as of June 30, compared to 5.8% at the end of Q1.

The company also shed 2.6 million shares in Capital One (COF), a little over 800,000 shares in Floor & Decor (FND) and roughly 570,000 shares in T-Mobile (TMUS).

That said, Buffett made some additions to existing positions in his portfolio. He bought 7.2 million more shares of Occidental Petroleum (OXY) in the quarter, taking the entire stake to roughly 255 million shares valued at nearly $16 billion or 5.7% of the total portfolio.

Berkshire also added a little more than 1.1 million shares of Chubb Limited (CB), the mystery stock investment it unveiled at the end of the previous quarter, taking its total share count to 27 million.

Read the original article on Investopedia.