SoundHound AI Shares Soar on Acquisition and Strong Revenue Growth. Is It Too Late to Buy the Stock?

SoundHound AI (NASDAQ: SOUN) shares were strong last week after the company announced robust second-quarter revenue growth and an important deal.

A transformative acquisition

While SoundHound reported strong Q2 results, the news was overshadowed by the acquisition the company announced ahead of its earnings release. It will acquire enterprise artificial intelligence (AI) software company Amelia for $80 million in cash and equity, as well as the assumption of Amelia’s debt and future earn-outs if certain revenue milestones are met.

Amelia is known for its conversational and generative AI platform that helps with customer service, employee onboarding, and back-office tasks. The acquisition will help SoundHound move into other industry verticals such as financial institutions, insurance, retail, and healthcare. The company said the deal will also unlock a lot of new cross-selling and upselling opportunities, as well as new avenues for monetization.

The combined company is projected to generate revenue of more than $150 million next year with Amelia contributing over $45 million of the total. Following the deal, it will have $160 million of cash and $39 million in debt on its balance sheet.

On the earnings front, meanwhile, SoundHound’s Q2 revenue jumped 54% year over year to $13.5 million. However, the company continues to lose money. It reported an adjusted loss of $0.04 per share, an improvement from the year-ago loss of $0.07 per share, while its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss widened to $13.8 million from $10.1 million. Its cumulative subscriptions and bookings backlog, meanwhile, approximately doubled year over year to $723 million. This is revenue that is contracted out and should be realized in the coming years.

The company continued to make progress within its two main verticals: automobiles and restaurants. On the auto side, it said that five new Stellantis brands went into full production with its AI voice assistant offering. Overall, it is now in six of Stellantis’s 14 brands. SoundHound also said an unnamed U.S. electric vehicle (EV) manufacturer will soon go into production with its AI voice assistant across all its vehicles. It expanded a relationship with a European EV maker as well.

On the restaurant side of the business, it signed a contract with one of the largest pizza chains in the world for its phone ordering services, while two coffee chains added its employee assist solution. Meanwhile, sports pub Beef ‘O’ Brady’s, which has about 140 locations across 21 states, rolled out SoundHound’s AI voice ordering system across its restaurants.

The company now expects full-year 2024 revenue to clear $80 million before jumping to over $150 million next year.

Is it too late to buy the stock?

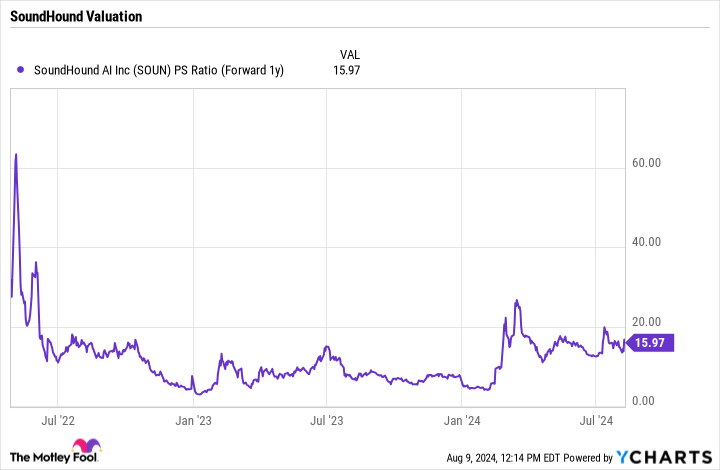

SoundHound shares have been on a wild ride this year. They originally rocketed higher on news that Nvidia had taken a stake in the company, before coming back down to earth. The stock quadrupled and then lost over half of its value in less than three months. That said, it’s still up over 140% year to date.

The company has been doing a good job signing deals in its core automobile vertical and has a large backlog of business. Meanwhile, it continues to establish itself in the restaurant industry. With the acquisition of Amelia, it will now look to push its technology into other verticals, where its AI voice technology can be used for both customer service and employee assist solutions, something it has done well with in the restaurant industry.

From a valuation perspective, SoundHound is trading at a forward price-to-sales (P/S) ratio of nearly 16 times 2025 analyst estimates, which did not yet take into consideration the contribution of Amelia. Based on management’s 2025 guidance for the combined company, that multiple drops closer to 12 times.

Notably, SoundHound is acquiring Amelia at less than 2 times next year’s revenue, which puts into perspective the kind of premium SoundHound stock carries.

SoundHound continues to hold a lot of promise, but given its valuation and short track record, it remains highly speculative.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $668,029!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

SoundHound AI Shares Soar on Acquisition and Strong Revenue Growth. Is It Too Late to Buy the Stock? was originally published by The Motley Fool