This Spectacular Vanguard ETF Is Practically Certain to Beat the S&P 500 Over the Long Term

The S&P 500 (SNPINDEX: ^GSPC) features around 500 companies listed on U.S. stock exchanges. It has a strict criteria for entry, so only the highest-quality names make the cut. Among other things, new additions must:

The S&P 500 is weighted by market cap, so the largest companies have a greater influence over its performance than the smallest. Technology is the biggest sector in the index, with a weighting of 32.4%. It includes companies like Microsoft, Nvidia, and Apple.

But then there is the S&P 500 Growth index. It takes around 231 of the top-performing stocks from the regular S&P 500 and disregards the rest. It selects those stocks based on factors like their momentum and the sales growth of the underlying companies.

Since tech is regularly the fastest-growing sector in the S&P 500, it’s no surprise it has a whopping 50.8% weighting in the Growth index.

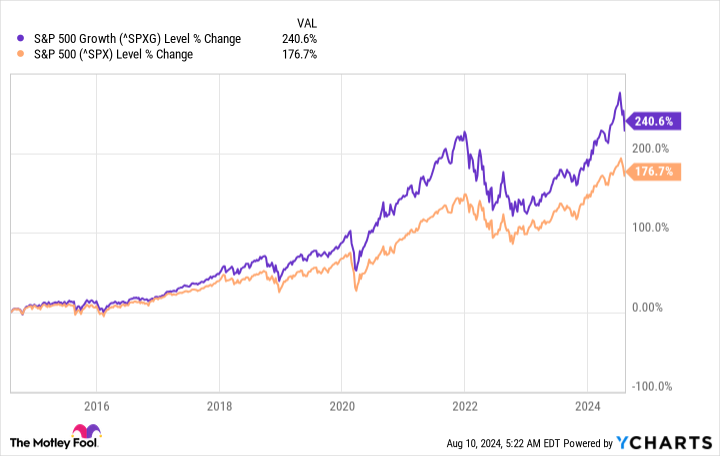

The Growth index is rebalanced every quarter, when the laggards are kicked out in favor of better-performing stocks. That means it typically outperforms the S&P 500 in the long run:

The Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) tracks the performance of the S&P 500 Growth index by holding the same stocks and maintaining similar weightings. It has generated a compound annual return of 15.9% since it was established in 2010, comfortably beating the 13.7% average annual gain in the S&P 500 over the same period.

Therefore, this ETF is a great option for investors looking to beat the S&P 500 over the long term.

Should you invest $1,000 in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This Spectacular Vanguard ETF Is Practically Certain to Beat the S&P 500 Over the Long Term was originally published by The Motley Fool