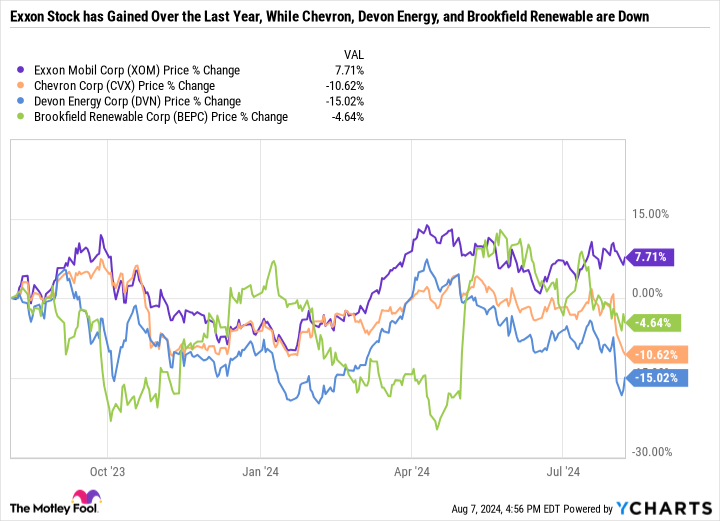

ExxonMobil Is a Rock-Solid Dividend Stock, but So Are These High-Yield Stocks That Are Down Between 4% and 15% Over the Last Year

ExxonMobil (NYSE: XOM), the largest U.S.-based energy stock by market cap, has been a reliable dividend stock for decades. Despite the volatility of oil and natural gas prices, Exxon has paid and raised its dividend for 42 consecutive years.

While Exxon is knocking on the door of an all-time high, other companies in the oil and gas and renewable energy industries have seen their stock prices tumble. Here’s why Chevron (NYSE: CVX), Devon Energy (NYSE: DVN), and Brookfield Renewable (NYSE: BEPC) (NYSE: BEP) stand out as top high-yield dividend stocks to buy now.

Like Exxon, Chevron has been a consistent passive income powerhouse

Daniel Foelber (Chevron): In a vacuum, Chevron reported a good quarter. But not relative to its U.S. peer, ExxonMobil.

Everything is working for Exxon right now, which may be why it has outperformed Chevron over the last year.

Exxon just reported its best second-quarter results in over a decade. Its acquisition of Pioneer Natural Resources was a success, while Chevron’s similar-sized acquisition of Hess is chock-full of uncertainty.

Hess, Exxon, and CNOOC are part of a consortium to drill offshore Guyana in the coveted Stabroek Block. The low cost of production and rich reserves are a key reason why Chevron wanted to buy Hess in the first place. However, Exxon and CNOOC are resisting the acquisition and pushing the case to arbitration proceedings.

On the earnings call, Chevron reiterated its confidence that the deal will go through. But that’s mostly based on its own shareholder vote. “Absent Hess, we’ve got a 10% growth in free cash flow,” said Chevron CEO Michael Wirth on the second-quarter earnings call. “We’ve got projects coming on and numerous basins in the world and in our chemicals business as well. So we’re really focused on that and creating value there. But if another opportunity were to present itself that were compelling, we’re certainly in a position to consider it.”

For several quarters now, Chevron has made the case that Hess is a good fit, but it is still thriving without it. But the market hates uncertainty, and having a $53 billion deal up in the air is just one more unchecked box that may lead some investors to prefer Exxon over Chevron right now. After all, it has been nearly 10 months since Chevron first announced plans to buy Hess. It takes time to integrate an acquisition, begging the question of whether Chevron would be better off throwing in the towel and buying a different exploration and production company.

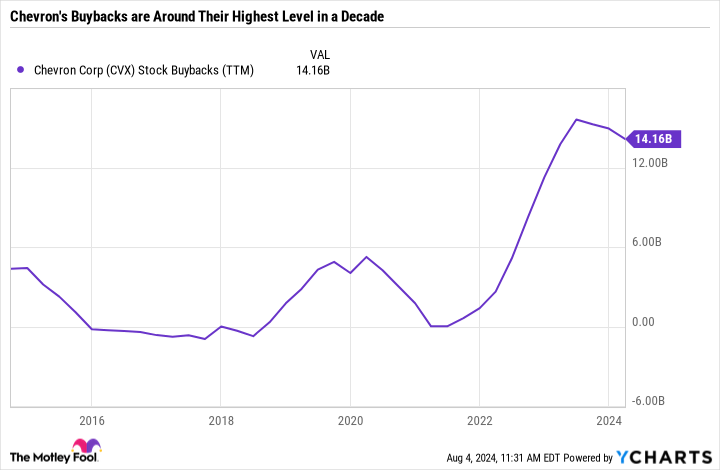

In a way, it is doing just that by ramping up the pace of buybacks. As you can see in the chart, Chevron is now repurchasing around triple the amount of stock it was buying pre-pandemic.

Companies make acquisitions to boost profits. But stock buybacks accomplish the same goal, just in a different way. Instead of increasing earnings per share, buybacks reduce the number of shares outstanding. With fewer shares to go around, there are greater earnings per share.

Chevron has an incredibly efficient cash cow of a business. If the Hess deal does fall through, it wouldn’t be the worst idea to do a massive buyback. Chevron stock isn’t overpriced and is arguably a good value compared to riskier plays in the oil patch.

With 37 consecutive years of dividend raises and a 4.5% yield, Chevron stands out as an excellent dividend stock to consider now.

A cash flow generating oil and gas stock to buy

Lee Samaha (Devon Energy): It’s hard to know precisely what Devon Energy will pay in dividends this year. That’s mainly because it has a flexible capital return policy to shareholders. Management targets returning 70% of its free cash flow through a fixed dividend of $0.22 per share a quarter, a variable dividend payment, and opportunistic share buybacks. The remaining 30% is allocated toward improving the balance sheet, such as the $2.5 billion debt reduction program announced on the announcement of the $5 billion purchase of Grayson Mill, adding to its assets in the Williston Basin in North Dakota.

Assuming the worst-case scenario of merely the fixed dividend of $0.88 a year gives a dividend yield of 2.1% at the current price. However, the trailing total dividend (which includes the variable dividend) is $2.05, implying a 4.95% dividend yield.

While it’s difficult to know what Devon will pay out this year, not least as the dip in the share price makes share buybacks more attractive, management is clear it’s expecting significant free cash flow generation in the coming year.

For example, based on a price of oil of $70 a barrel, at the time of the announcement of the Grayson Mill deal, management said it expected a 9% FCF yield. Since the share price was around $47 at the time, and the share price is $41.34 at the time of writing, interpolating the numbers suggests a 10% FCF yield at the current price.

If 70% of FCF is going toward returning cash, then Devon could, theoretically at least, be trading on a 7% dividend yield. While it’s highly unlikely not to make share buybacks, there should be plenty of cash left over for a highly attractive dividend, provided the price of oil behaves.

Stable cash flows support Brookfield Renewable’s high-yield dividend

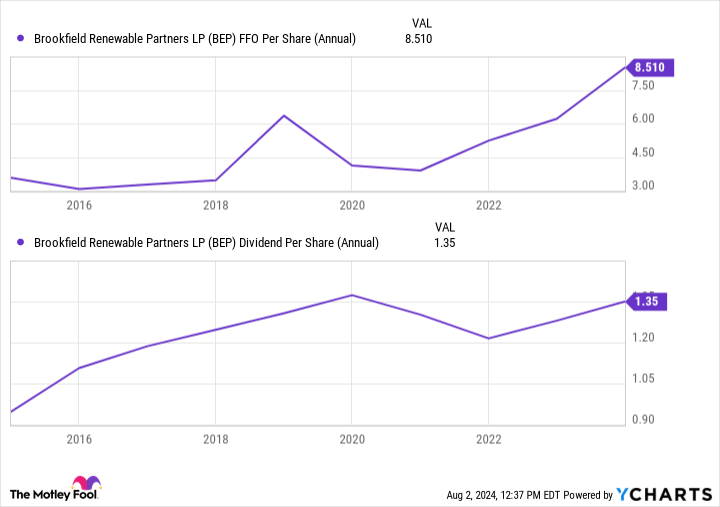

Scott Levine (Brookfield Renewable): The appeal of high-yield dividend stocks is undeniable. But an industry leader that provides prodigious passive income to investors? That’s considerably more alluring. This is the case with green energy powerhouse Brookfield Renewable. Operating a global portfolio of renewable energy assets, Brookfield Renewable generates consistent cash flows through its long-term power purchase agreements with customers, providing ample support for its dividend, which currently represents a forward yield of 5.1%.

With an average contract length of 13 years, Brookfield Renewable is afforded great insight into future cash flows. This luxury helps the company plan accordingly for capital expenditures such as acquisitions and dividends. This is clearly illustrated by the significant degree to which the company’s funds from operations have underpinned the dividend in the past.

In the years ahead, management plans to maintain the same responsible approach to the dividend. While targeting annual funds from operation growth of 10% per share, management estimates it will hike the payout by 5% to 9% annually. And if this isn’t enough to mitigate the fears of conservative investors who question the Brookfield Renewable’s financial well-being in light of its high dividend, perhaps they’ll feel better after learning of the company’s investment grade balance sheet, rated BBB+ by Standard & Poor’s.

It’s neither only income investors nor renewable energy aficionados who will find Brookfield Renewable appealing right now. With shares trading at 4.4 times operating cash flow — a discount to their five-year average cash flow multiple of 5.7 — value investors will also be encouraged to power their portfolios with Brookfield Renewable right now.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has positions in Brookfield Renewable. The Motley Fool has positions in and recommends Brookfield Renewable, Chevron, and S&P Global. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

ExxonMobil Is a Rock-Solid Dividend Stock, but So Are These High-Yield Stocks That Are Down Between 4% and 15% Over the Last Year was originally published by The Motley Fool