Is It Too Late to Buy Palantir Technologies Stock?

Palantir Technologies‘ (NYSE: PLTR) stock rocketed higher after the company released stellar results for the second quarter of 2024 on Aug. 5 that turned out to be better than analysts’ expectations.

Shares of the company that’s known for providing software platforms to both government and commercial customers shot up more than 10% in a single session as it not only beat the market’s expectations but also raised its full-year guidance. With its latest pop, Palantir stock is now up 55% in 2024 and has started recovering from its recent pullback.

This company is getting a nice shot in the arm thanks to the growing adoption of artificial intelligence (AI) software. Does this mean it is too late for investors to buy? Let’s find out.

Palantir Technologies’ growth is accelerating

Palantir reported Q2 revenue of $678 million, an increase of 27% from the same period last year. This was an improvement over the 21% growth Palantir reported in the first quarter of the year. The company’s non-GAAP (adjusted) earnings increased 80% year over year to $0.09 per share. Wall Street would have settled for earnings of $0.08 per share on revenue of $653 million.

Palantir expects its revenue to land at about $699 million in the current quarter, at the midpoint of its guidance range. That would be an improvement of 25% from the same period last year and is well ahead of the $681 million consensus estimate. Palantir has also raised its full-year revenue guidance by 2% from the prior range to almost $2.75 billion now, indicating that its top line could increase 23% this year.

However, investors should note that commercial customers have been rapidly adopting Palantir’s Artificial Intelligence Platform (AIP) to quickly integrate AI into their operations. This explains why Palantir is expecting its revenue from commercial customers in the U.S. to increase 47% this year to more than $672 million.

But a closer look at comments made by Palantir management on the latest earnings conference call indicates that it could be at the beginning of a massive growth curve. Palantir’s Chief Revenue Officer Ryan Taylor said that “the revenue expectations from the AI ecosystem’s infrastructure build-out have grown from $200 billion to $600 billion per year in just nine months.”

Palantir is tapping this massive opportunity by helping enterprises deploy AI for their use cases, which is the reason the company has witnessed a nice surge in the number of deals it has been striking. Palantir struck 96 deals last quarter that were worth $1 million or more. That was a jump of nearly 50% from the prior year when it closed 66 deals worth $1 million or more.

This spurt in deal activity is the reason why Palantir finished the quarter with remaining performance obligations (RPO) worth $1.37 billion, an increase of 41% from the year-ago period. RPO refers to the value of contracts that Palantir has signed and will be recognized as revenue in future quarters. So, the faster growth in this metric as compared to the growth in its revenue indicates that it is building a robust future revenue pipeline.

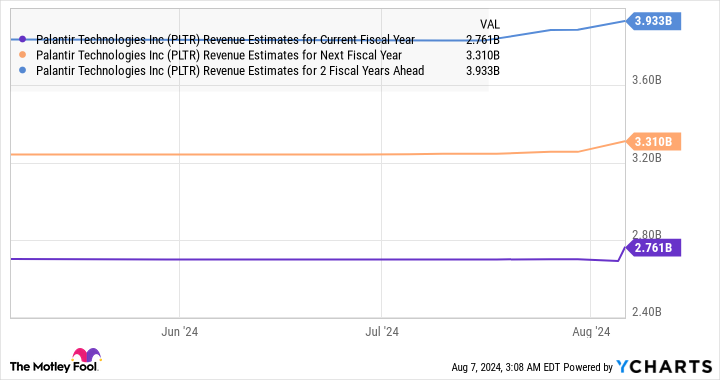

Another metric that indicates an acceleration in Palantir’s growth is the remaining deal value (RDV), a measure of the total remaining value of its contracts at the end of the quarter. Palantir’s RDV increased 26% year over year in the previous quarter to $4.3 billion. As such, there is a good chance that the company could continue to raise its guidance and witness faster growth, which is probably why analysts have increased their growth expectations as well.

Should investors buy the stock now?

Investors looking to add Palantir stock to their portfolios right now would have to pay a rich valuation. It is trading at 23 times sales, which is a big premium to the U.S. technology sector’s average of 7.3. However, growth investors may be tempted to buy the stock as it is undervalued with respect to the growth that it is expected to deliver.

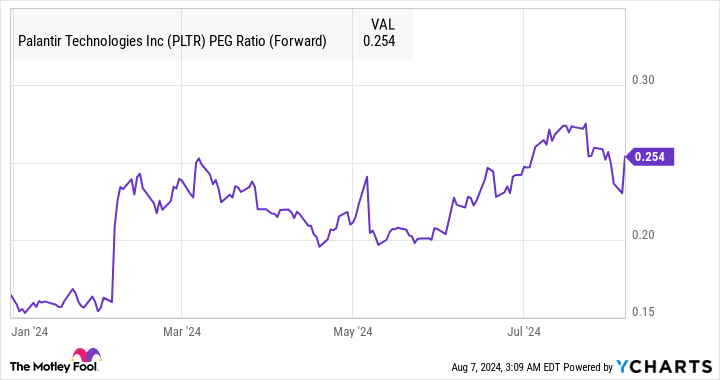

The price/earnings-to-growth ratio (PEG ratio) is a forward-looking valuation metric that considers a company’s future earnings growth. A stock with a PEG ratio of less than 1 means that it is undervalued. As the following chart shows, Palantir’s PEG ratio is well below 1.

Palantir’s recent results are proof that its growth is picking up, and that trend seems here to stay, as its RPO and RDV indicate. Moreover, the huge long-term opportunity in the AI software market, which is expected to generate $135 billion in revenue next year, signals that Palantir is scratching the surface of a big growth opportunity.

That’s why investors looking to add an AI stock to their portfolios can still consider buying Palantir following its latest pop.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Palantir Technologies Stock? was originally published by The Motley Fool