Is Now the Time to Buy the 2 Worst-Performing Stocks in the “Magnificent Seven”?

Big tech stocks are struggling lately as investors grow concerned about whether investments into artificial intelligence (AI) will pay off, and if valuations have simply become too high. Looming concerns about a recession are also a reason the markets seem to be coming under pressure.

Most of the stocks in the “Magnificent Seven” are underperforming the S&P 500 and its 9% gains this year. While shares of Nvidia, Meta Platforms, and Alphabet are up by more than double digits this year, the others are lagging behind. The two worst-performing stocks in the Magnificent Seven are Microsoft (NASDAQ: MSFT) and Tesla (NASDAQ: TSLA).

Is now a good time to add these stocks to your portfolio?

1. Microsoft

Microsoft has been one of the big AI stocks to own in the past couple of years as it has invested billions into OpenAI and enhanced its Office suite with AI capabilities. And so expectations are high for the computer maker. While the company beat expectations in its most recent quarterly report, investors may have been looking for much more.

Sales for the period ending June 30 totaled $64.7 billion and were up 15% year over year. This came in slightly higher than the $64.4 billion that analysts were expecting. Adjusted earnings per share of $2.95 also came in slightly higher than the $2.93 in per-share profit that analysts were expecting.

While Microsoft has a stellar business and many opportunities to benefit from AI’s growth, the bar is set high as it is one of the most valuable companies in the world and it trades at 34 times its trailing profits. For Microsoft to maintain this high valuation, it may need to do more than just beat earnings. Although its 7% gains aren’t all that bad this year, for it to be performing at a high rate, it likely will need to generate much more growth. The big test may be how strong demand will be for its new AI-powered PCs, and whether that can serve as a catalyst for the business.

In the long run, however, Microsoft can still be an excellent stock to own given its vast growth opportunities in PCs, gaming, and cloud computing. The business is robust and while the valuation may seem a bit high, as the company grows in size, so too will its earnings, which will improve its valuation. If you’re looking for a stock that you can buy and hold for decades, Microsoft can make a good addition to your portfolio today.

2. Tesla

The worst-performing stock in the Magnificent Seven is Tesla. If not for a recent rally that it has been on, it would be down far more than just the 20% it currently is. That’s how bad of a year it has been for the electric vehicle (EV) maker.

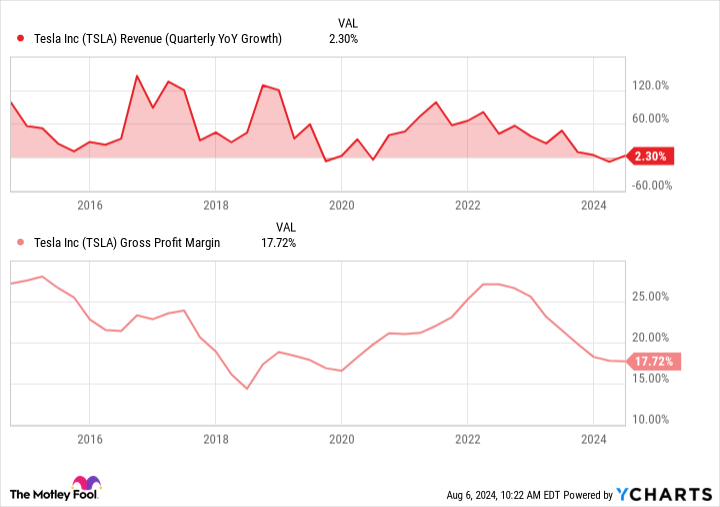

Consumer demand for Tesla’s EVs hasn’t been as strong as it has been in the past, and you can blame part of that on poor economic conditions, as well as an increase in competition. Tesla has reduced prices in response to other EV makers offering lower-priced products.

The problem is that Tesla needs higher prices in order to keep its margins elevated. Without high margins, that puts pressure on its bottom line. And the lower its bottom line is, the more expensive the stock is on a price-to-earnings basis. Typically, investors have been willing to pay a premium for Tesla’s stock, but given that the business is struggling to generate growth these days, it’s not as easy to justify doing so anymore.

Both the company’s margins and growth rates have been trending in the wrong direction in recent quarters, which is creating a cause for alarm for investors.

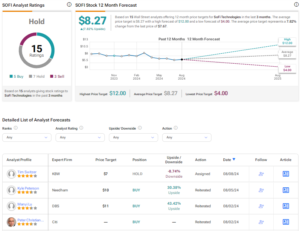

Tesla isn’t as clear of a buy as Amazon appears to be. It’s trading at a higher earnings multiple (55) and growing competition could make it difficult for it to improve upon its financials anytime soon. With plenty of uncertainty in its future, investors may want to hold off on buying the stock right now.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is Now the Time to Buy the 2 Worst-Performing Stocks in the “Magnificent Seven”? was originally published by The Motley Fool