Traders Bet on Wild Swings With CPI Print Set to Test the Market

(Bloomberg) — Wall Street’s summer to forget is approaching its climax, with all eyes on this week’s consumer prices report, which traders hope will give the Federal Reserve the ammunition it needs to begin cutting interest rates at its next meeting in September.

Most Read from Bloomberg

But for now, the bet is for more volatility.

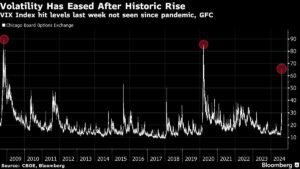

Some wild swings last week brought the Cboe Volatility Index (^VIX), or VIX, which measures the magnitude of price moves in the S&P 500 Index, to levels not seen since the height of the pandemic in 2020. Based on the cost of at-the-money put and call options, traders are positioning for the S&P 500 (^GSPC) to move 1.2% in either direction on Wednesday when the consumer price index report is released, according to Citigroup Inc.

Should that pricing hold through Tuesday’s close, it would be roughly in line with the implied moves on Aug. 23, when Chair Jerome Powell is expected to deliver remarks at the Jackson Hole economic symposium, and Aug. 29, the day after Nvidia Corp.’s earnings report.

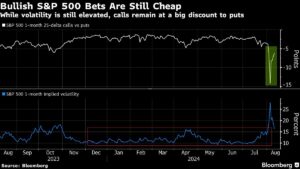

“The options market isn’t sending an all-clear signal just yet for stocks,” said Rocky Fishman, founder of derivatives analytical firm Asym 500. “When volatility is high, it’s historically a good time to buy equities, but to some extent that’s already happened, so CPI will be an important catalyst.”

What’s more, while the S&P 500 rallied back from Monday’s 3% plunge — which coincided with the unwinding of a massive, yen-fueled carry trade that rattled global bond markets — to finish roughly flat for last week, options pros aren’t exactly buying the recovery.

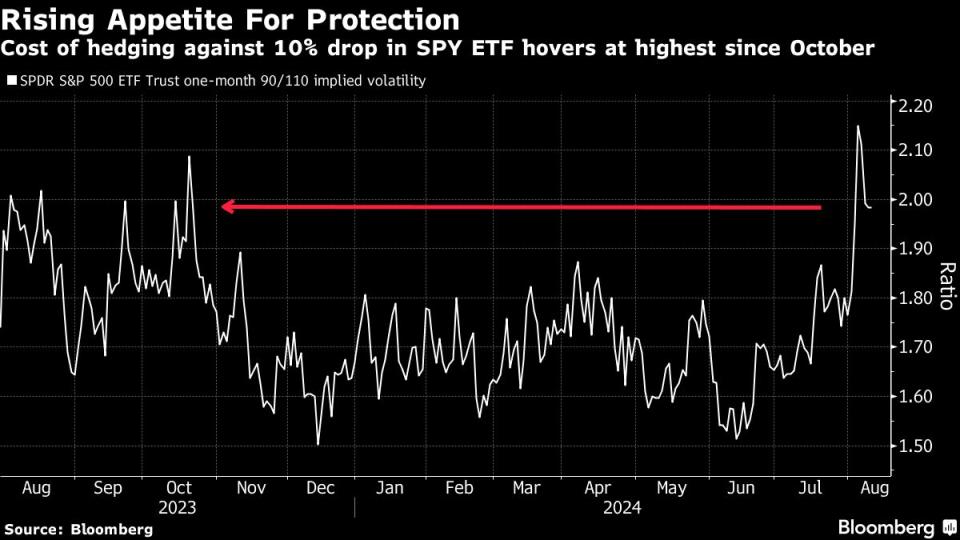

Costly Insurance

Contracts protecting against a 10% decline over the next 30 days by the SPDR S&P 500 ETF Trust, or SPY, the largest exchange-traded fund tracking the broad equities index, is roughly the highest since October and twice as much as contracts profiting from a 10% rally, data compiled by Bloomberg show.

Traders question whether the implied moves when Powell speaks will be even higher following the inflation print, given that he may map out plans to lower rates soon. His message later this month could help investors telegraph how many cuts to anticipate in the next year after he signaled in late July that policymakers are closer to reducing borrowing costs as early as September.

“We’re at an inflection point where what had been bad economic news is now perceived as good news since it would be a catalyst to force the Fed to pivot,” said Thomas Urano, co-chief investment officer and managing director at Sage Advisory in Austin, Texas. “But if data continues to soften, that backdrop will disappoint stock investors and lead to larger swings in stocks.”

That said, the yield on benchmark US 10-year Treasury notes has returned to levels seen before the latest jobs report, wiping out most of the recent steep declines after unemployment rose for a fourth straight month, which fanned fears that the Fed’s aggressive monetary tightening was crimping the economy.

Indeed, labor market figures, including the August jobs report that hits just before the next meeting, will be as crucial to traders as inflation data. Fed officials have increasingly emphasized their mandate for full employment as well as managing price pressures, with the unemployment rate rising last month to 4.3%, well above Fed forecasts for joblessness at year’s end.

“The labor market is slowing, and it is extremely important that we not let it slow so much that it tips itself into a downturn,” Fed San Francisco President Mary Daly said on Aug. 5.

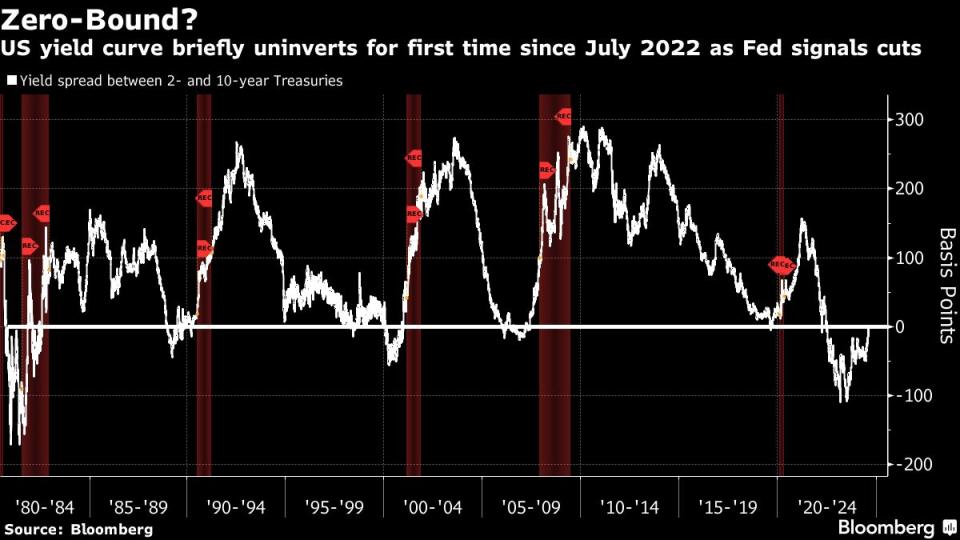

Inversion Signals

The gap between two- and 10-year Treasury yields normalized early in the week for the first time in two years, a move that has occurred prior to the previous four recessions. It has since inverted again as angst recedes, but the reality is the economy hasn’t flashed as reliable signals since the pandemic upended normal business activity.

“All the quantitative easing money that was accumulated in the capital markets and then was allocated via private-credit distribution has muted the impact of an inverted yielded curve — but that doesn’t mean the concept of it is useless,” Urano of Sage Advisory added. “It’s still relevant, just takes longer to manifest now.”

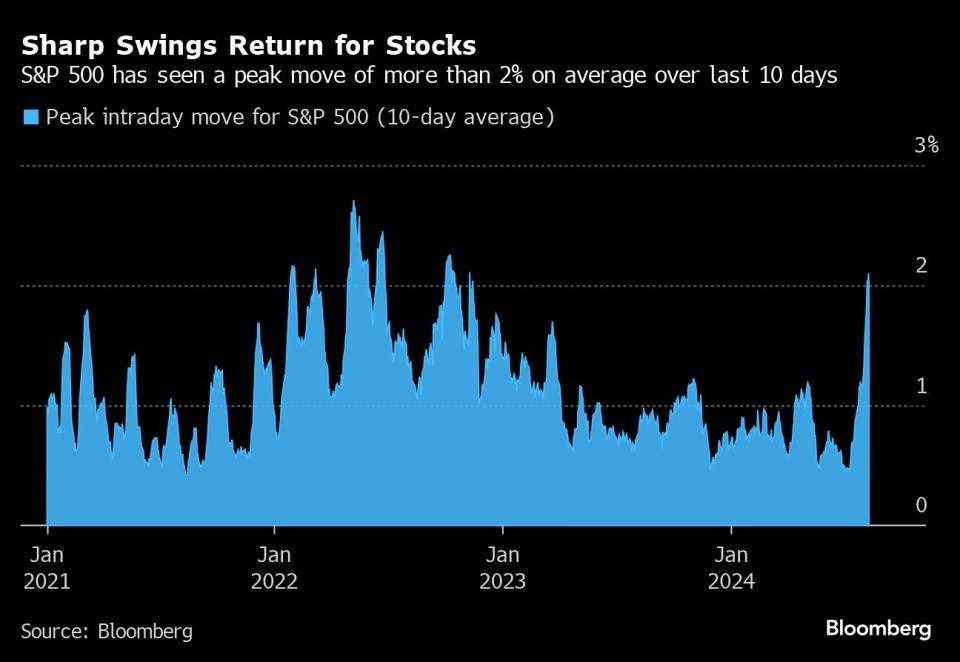

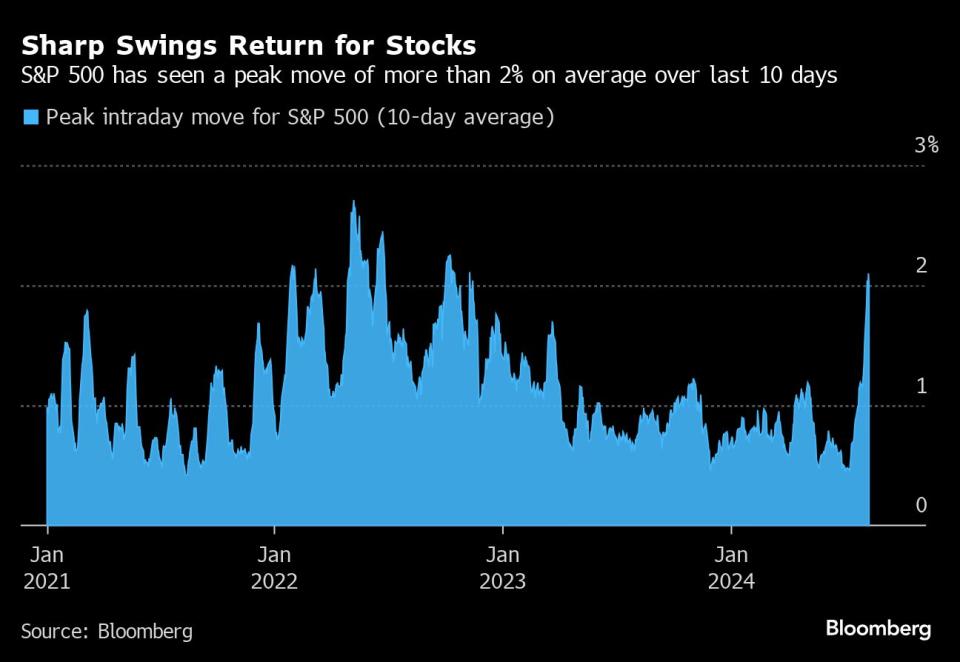

In the stock market, lingering fears of growth risks has led to a position-heavy reversal of momentum trades and defensive leadership, according to Thomas Salopek, head of cross-asset strategy at JPMorgan Chase & Co. He sees more pain and sharp swings for stocks ahead. The S&P 500 has seen a peak intraday move of 2% in either direction on average over the last 10 sessions, the highest since November 2022, according to data compiled by Bloomberg.

That explains why traders are expecting a significant move off of Wednesday’s inflation report. The core CPI figures, which strips out volatile food and energy components, is projected to rise 0.2% month over month and climb 3.2% from a year earlier. That’s near the Fed’s 2% target.

But if the number comes in measurably higher or lower, traders will likely rejigger their expectations. And that could set off another round of market mayhem.

“If the Fed cuts rates dramatically because the economy is slowing, that’s not historically good for stock returns,” said Brooke May, managing partner at Evans May Wealth, who’s firm is snapping up Big Tech stocks. “But the economy isn’t as bad as people think. I expect more volatility and wouldn’t be surprised to see more downside for stocks in the coming weeks.”

—With assistance from Matt Turner, Sydney Maki and Steve Matthews.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.