Down Between 12% and 24% From Their 52-Week Highs, 3 Magnificent Dow Dividend Stocks to Buy Now

The Dow Jones Industrial Average is known for containing 30 industry-leading components from a variety of stock market sectors. But even Dow stocks can endure steep sell-offs.

Dow components Salesforce (NYSE: CRM), Chevron (NYSE: CVX), and Home Depot (NYSE: HD) are down between 12% and 24% from their 52-week highs and are all down year-to-date despite gains in the broader indexes like the Dow, S&P 500, and Nasdaq Composite.

Here’s why all three dividend stocks stand out as solid buys for patient investors.

Salesforce is a balanced buy

It may have surprised investors when Salesforce — a growth stock — was added to Dow in August 2020. At the time, Salesforce was inconsistently profitable and didn’t pay a dividend. But Salesforce has matured a lot as a company in recent years. Today, it is no longer focused purely on revenue and reinvesting everything back into the business. The company is highly profitable, announced its first-ever quarterly dividend earlier this year, and is buying back a ton of its stock.

Companies like Salesforce reward employees with stock-based compensation, which can dilute existing shareholders. Over the last decade, Salesforce’s outstanding share count has increased by 54%. However, it has bought back stock in recent years to help offset stock-based compensation and has reduced its share count by 1% over the last three years.

Salesforce has taken a page from Microsoft‘s playbook. Microsoft paid a record $10.7 billion in stock-based compensation over the last 12 months — up 123% in five years, but has managed to reduce its outstanding share count by 2.6% over that time thanks to buybacks. It takes a highly profitable business to execute this kind of strategy. But if done right, it can help companies recruit and retain top talent without diluting shareholders.

Salesforce stands out as one of the most balanced tech stocks out there. The dividend yield is just 0.7% — but again the company just began paying dividends. The forward price-to-earnings (P/E) ratio is just 24.5 — suggesting Salesforce is fairly inexpensive compared to its historical valuation. The biggest red flag with Salesforce is that growth has slowed, and the company hasn’t done a great job monetizing artificial intelligence. However, it would be a mistake to overlook Salesforce’s industry-leading position and runway for long-term growth in enterprise software.

There are plenty of other tech stocks that are in favor — but many of them command expensive price tags. Salesforce stands out as a good buy if you are looking for a more reasonable valuation and a company that isn’t going full throttle on growth, but rather is focused more on profitably and returning capital to shareholders through buybacks and dividends.

Chevron is still a top pick in the oil patch

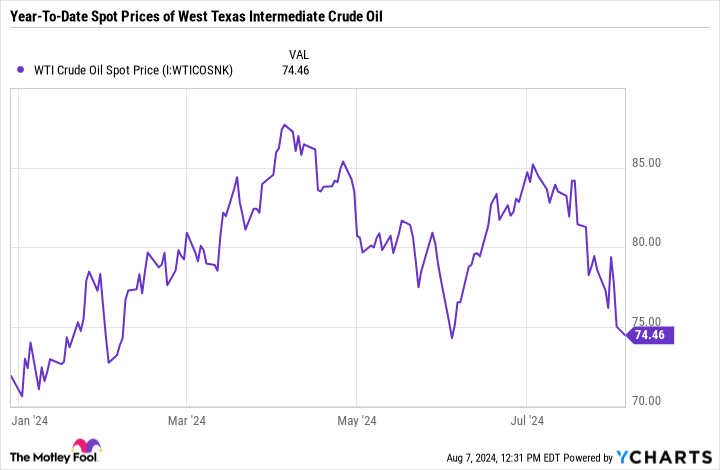

Despite strong results, Chevron is hovering around a 52-week low. Oil prices are partially to blame.

West Texas Intermediate (WTI) crude oil prices — the U.S. benchmark — have spent most of the year above $75 per barrel. However, oil prices have been falling recently, and WTI prices are now under that mark.

Chevron’s closest peer — ExxonMobil — is up nicely on the year and is within just 5% or so from an all-time high. Although they are similar businesses, ExxonMobil and Chevron do have some distinct differences, especially regarding their merger and acquisition activity.

While Exxon completed its acquisition of Pioneer Natural Resources in May, Chevron has yet to make progress on its acquisition of Hess. It’s been 10 months since Chevron first made the announcement to buy the exploration and production company for $53 billion, but a variety of roadblocks stand in its way.

Although Chevron isn’t as spotless as Exxon right now, it stands out as a particularly compelling buy. Consistent dividend raises paired with a sell-off in the stock have pushed Chevron’s yield up to 4.6%. Over the last two years, Chevron returned $50 billion to shareholders through dividends and buybacks — illustrating the extent of its outsize earnings.

Chevron can fund its operations and dividend even when oil is $50 per barrel, giving it a nice margin of error relative to current oil prices. Add it all up, and Chevron is a quality dividend stock to buy now.

Home Depot can emerge from an industrywide slowdown even stronger

Home Depot is roughly flat on the year for a variety of arguably valid reasons. For starters, Home Depot’s growth has ground to a halt. The company is sensitive to ebbs and flows in the broader economy. So far this earnings season, a variety of companies have indicated that consumers remain selective on spending, especially on discretionary goods.

Home Depot benefits from a strong economy and a hot housing market. Lower interest rates are excellent news for Home Depot because they mean cheaper borrowing costs, lower mortgage rates, and less expensive financing on home improvement projects. Unfortunately, that is not the environment we are in today.

However, there are degrees to cyclical companies. For example, some companies are truly boom or bust based on economic factors or commodity prices. But Home Depot is more so boom or stagnate.

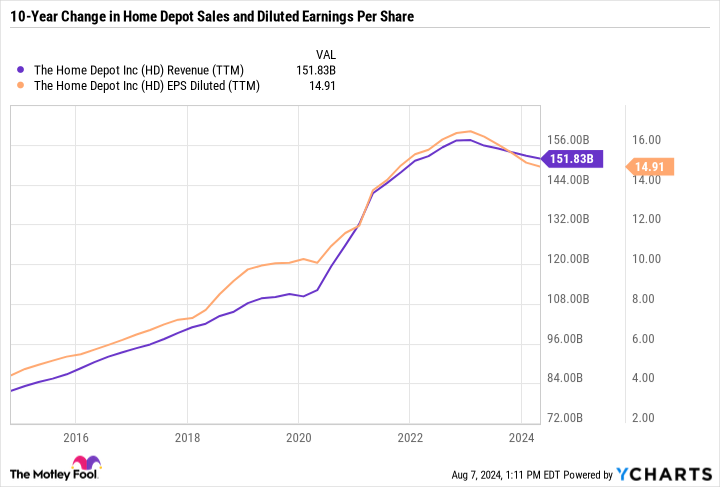

Over the last decade, Home Depot’s sales have nearly doubled, and diluted earnings per share have more than tripled. But over the last couple of years, you can see that Home Depot’s earnings and sales are slightly down.

While Home Depot’s performance could continue to disappoint in the near term, there’s no reason to believe anything has changed about the underlying investment thesis. Earlier this year, Home Depot made a massive $18 billion acquisition because it had the dry powder needed to invest no matter the market cycle. It’s also worth understanding that Home Depot’s dividend is affordable, seeing as the company’s payout ratio is a healthy 57%.

With a P/E ratio of 23.2 and a yield of 2.5%, Home Depot is a balanced, industry-leading business worth buying now.

Zoom out and think long-term

Salesforce, Chevron, and Home Depot may operate in entirely different industries. But all three companies are similar in that they are undergoing slower growth or even negative growth (in the case of Home Depot).

Short-term-minded investors may quickly pass on all three companies, but long-term investors focus on where a company will be several years from now rather than where it is today. Salesforce, Chevron, and Home Depot show no signs of losing their industry-leading positions — making all three stocks worth considering now.

Should you invest $1,000 in Salesforce right now?

Before you buy stock in Salesforce, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Salesforce wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron, Home Depot, Microsoft, and Salesforce. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Down Between 12% and 24% From Their 52-Week Highs, 3 Magnificent Dow Dividend Stocks to Buy Now was originally published by The Motley Fool