Forget Intel: Consider These 2 Millionaire-Maker Stocks to Buy Instead

Intel‘s (NASDAQ: INTC) stock has been battered and beaten this month, and August has only just begun. The company’s share price has plunged 34% since July 30 amid a sell-off affecting countless stocks. Growing fears of a recession and dismal earnings from Intel sent investors into a panic.

While I firmly believe in holding through a market dip rather than selling a tech stock like Intel, it doesn’t necessarily mean now is the time to buy more.

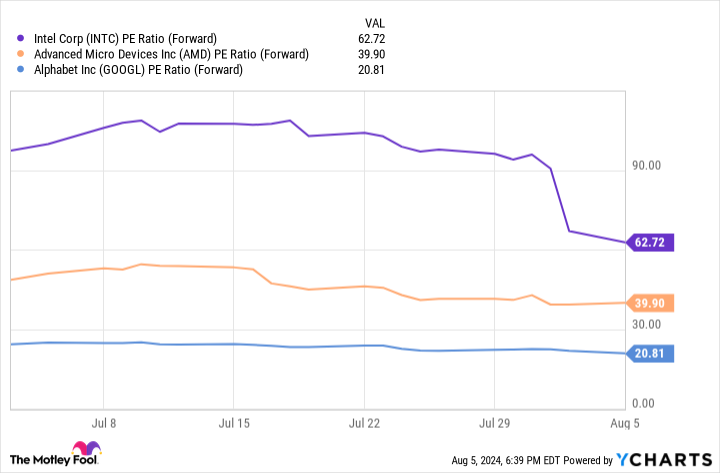

The above chart shows that despite recent declines, Intel’s forward price-to-earnings (P/E) ratio is significantly higher than other tech stocks. Advanced Micro Devices (NASDAQ: AMD) and Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) offer similar exposure to budding markets like artificial intelligence (AI) and cloud computing yet are trading at a better value than Intel.

In addition to Intel’s stock being poorly valued, its latest quarter (the second quarter of 2024) missed revenue and earnings-per-share (EPS) expectations. Meanwhile, recent earnings from AMD and Alphabet illustrate a positive growth trajectory.

So forget Intel and consider buying these two millionaire-maker stocks instead.

1. Advanced Micro Devices

AMD’s stock has tumbled 24% over the last month as tech stocks have fallen out of favor. However, the company boasts a long history of growth that has seen it create many millionaires, with its share price up more than 3,000% since 2014.

The company has enjoyed immense success over the years, taking on a crucial role in the chip market. AMD’s hardware powers products across tech, from game consoles like Sony‘s PlayStation 5 to consumer-built PCs, laptops, data centers, and AI models. As a result, AMD is easily one of the best stocks to gain exposure to different areas of tech.

AMD’s closest competitors are Nvidia and Intel, and the three companies are fierce rivals in AI chips. Nvidia dominates the industry, while Intel has yet to make real headway. However, recent earnings indicate AMD’s AI division is on a promising growth path and gaining on Nvidia.

In Q2 2024, AMD’s revenue rose 9% year over year, beating expectations by $120 million. Meanwhile, earnings per share of $0.69 outperformed estimates by $0.01. The quarter benefited from a 115% year-over-year revenue increase in its AI-focused data center segment and a 49% rise in client sales.

AMD’s gaming segment suffered from reductions in semi-custom chip sales, with revenue falling 59%. However, that didn’t stop solid growth in the quarter as the company pivoted its business toward AI. Operating income for the period hit $269 million, significantly improving on the $20 million in losses reported a year ago.

AMD’s Q2 2024 proves it’s enjoying impressive returns on its hefty investment in AI and gaining in the industry. Its quarterly free cash flow has soared 81% year to date, increasing its spending power. In addition to being a better-valued stock, AMD is a no-brainer buy over Intel right now.

2. Alphabet

Alphabet’s share price has tumbled 17% since early July, in tandem with the tech sell-off. However, its forward P/E of 21 makes it one of the best-valued stocks in tech and too good to pass up. Meanwhile, like AMD, recent earnings hint at a lucrative future for the tech giant.

The Google company reported its Q2 2024 earnings at the end of July, with revenue rising 14% year over year to $85 billion. The quarter saw solid growth in advertising, with sales increasing by 11%. However, Google Cloud delivered the most gains, with revenue soaring 28% year over year and beating competitors Amazon Web Services and Microsoft in cloud growth for the period.

At the start of the year, Alphabet seemed to fall behind its cloud rivals, but earnings prove it’s quickly catching up. In addition to impressive revenue growth, Google Cloud’s operating income nearly tripled and hit more than $1 billion for the first time. Success in cloud computing is promising for Alphabet as it diversifies its earnings, allowing it to lean less on advertising and secure a promising role in AI.

Alphabet has a long history of making people rich and undoubtedly created more than a few millionaires, with its stock up 470% over the last decade. With its bargain price, Alphabet’s stock is worth picking up over Intel and is an excellent way to invest in tech.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $641,864!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget Intel: Consider These 2 Millionaire-Maker Stocks to Buy Instead was originally published by The Motley Fool