Brutal Selloff Skims Froth From Japan’s $6 Trillion Stock Market

(Bloomberg) — Japanese equities shed $1.1 trillion in value as they kicked off August with a record three-day loss. For bullish investors, that’s providing a fresh reason to buy what has been one of 2024’s hottest trades.

Most Read from Bloomberg

The stocks that were hit the hardest are the ones that had soared the highest, bringing prices down to more attractive levels. The valuation improvement campaign that has boosted the international appeal of Japanese shares continues apace, and some of the froth has been removed from the now $6.1 trillion market.

While the Bank of Japan’s sudden interest rake hike last month caught traders off guard, the central bank followed up with comments that it won’t tighten so quickly as to risk further market turmoil. That’s help put a lid on sudden gains in the yen, removing a key threat to the stock rally.

In terms of major global catalysts, the latest US labor-market data helped ease concern about whether the Federal Reserve is easing fast enough to head off a potential recession. And the world’s major technology companies are steaming ahead with plans to spend billions on artificial intelligence infrastructure.

“It’s not like we had a major economic or financial crisis,” said Tetsuro Ii, chief executive of Commons Asset Management Inc., adding that it will probably take just two or three months for the market to fully recover. Investors now recognize that monetary policy in Japan and the US has “entered a new stage,” having taken this as a cue to exit crowded positions.

The benchmark Topix is down 12% since the end of June. Stocks that had outperformed earlier in the year have suffered more. An MSCI Inc. gauge of the nation’s semiconductor-related stocks — whose AI-fueled surge was a key driver of this year’s rally — has fallen 25% in that span. A measure of banks, which had surged on anticipation of higher rates, is down 16%.

“I wouldn’t call it a bubble but the market just got carried away,” said Toru Yamamoto, chief strategist at Daiwa Asset Management Co. “When you need to cut risks, the most bloated positions will get slashed.”

Japan had become one of the favorite markets of global traders this year amid expectations that inflation will return after more than two decades of price stagnation and hopes that Japanese companies will return more cash to shareholders at the urging of the Tokyo Stock Exchange.

The recent slide make stocks cheaper, potentially making them even more attractive to overseas investors such as Warren Buffett, who has poured funds into Japanese trading houses.

The Topix is now trading at 13 times estimated forward earnings, compared with 20 times for the S&P 500 Index. The Japan chip gauge is down to 21 times from 35 times earlier this year.

“People felt the market was rising a bit too much last month” but with the selloff it “came back to where it should be,” said Masayuki Murata, general manager of balanced portfolio investment at Sumitomo Life Insurance Co. At current valuations, “you could say we are at bargain-hunting levels.”

The derivatives market shows sentiment remains positive on Japan, with open interest in bullish Nikkei calls rising faster than bearish puts. As a result, the put/call ratio has fallen back to its near lowest level in about six-and-a-half years, suggesting bets on a rebound in the market are becoming popular.

There are still risks, particularly from the yen strengthening as the BOJ tightens further while the Fed eases. The currency’s fall to multi-decade lows had helped propel stocks higher, as a cheaper yen is seen boosting Japanese exporter’s profits from overseas.

The geopolitical tensions between Washington and Beijing that took the wind out of the tech stocks last month remain in play, especially with the US election looming.

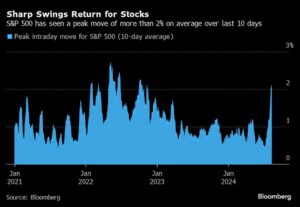

The Nikkei Volatility Index, Japan’s version of the “fear gauge” closed at 45 Friday. While that’s down from the intraday spike of 85 on Monday, it’s still well above the long-term average around 22.

For Ben Bennett, head of investment strategy for Asia at Legal & General Investment Management Ltd., crowded positioning became a reason to avoid Japan stocks.

“The question is whether this stretched positioning has been reduced significantly,” he said. “I suspect it will take more than a few days of volatility to get that positioning back to neutral. If anything, I think investors who are bullish Japanese equities might even add to positions given the recent weakness.”

Given the various pressures on a market at elevated levels, the latest turbulence wasn’t a surprise to Arihiro Nagata, managing director at Sumitomo Mitsui Banking Corp.

“I think a correction was waiting to happen on any trigger,” he said. “It was hard to predict, but I think the positioning has become light and the market has become inexpensive.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.