Prospect Capital Defends Record, Says It Has Access to Funding

(Bloomberg) — Private lender Prospect Capital Corp. defended its 20-year track record, pushing back against criticism over its frequent use of arrangements that allow borrowers to pay interest with more debt and its reliance on individual investors for funding.

Most Read from Bloomberg

In a statement posted on its website this week, the firm said it has access to “diversified funding sources across multiple investor bases,” including dozens of bank lenders, and that it sees so-called payment-in-kind as appropriate for some borrowers.

“Prospect’s payment-in-kind interest can be an efficient funding mechanism for certain portfolio companies where such companies are making accretive investments in their business with valuations substantially above Prospect’s cost basis,” the firm said. Prospect didn’t immediately respond to a request for further comment on Friday.

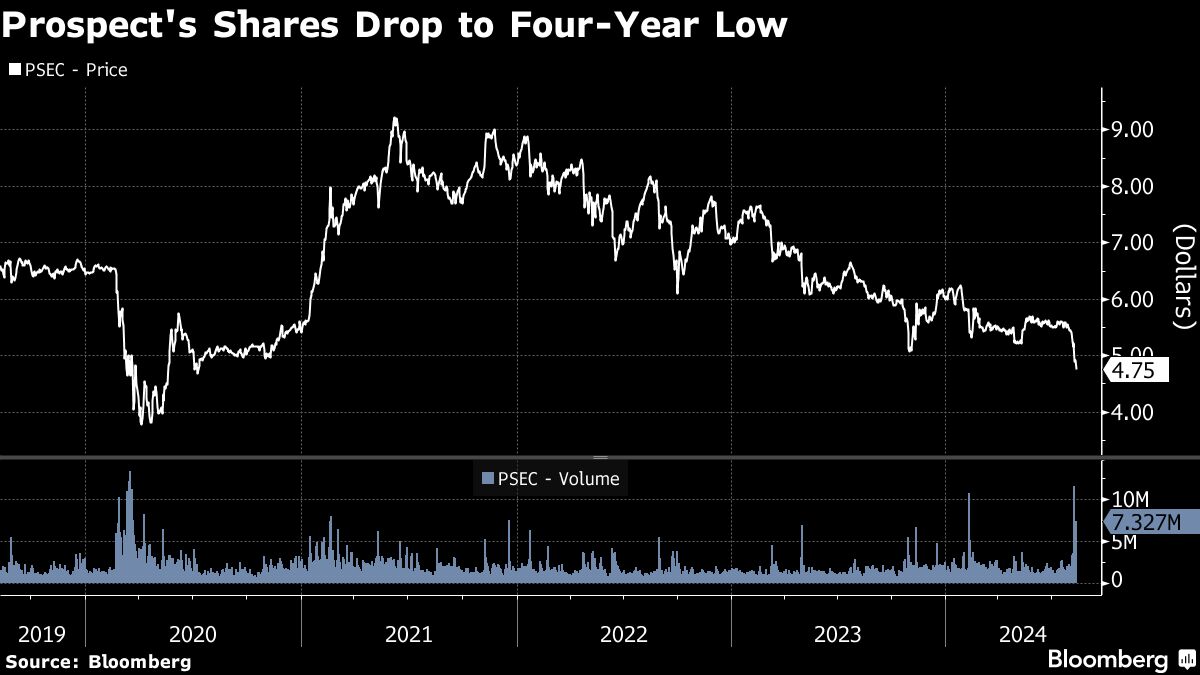

A Bloomberg News report on Tuesday highlighted growing concerns among analysts over an $8 billion private credit fund Prospect runs and the potential risks posed by the PIK arrangements. Shares in the fund, which is structured as a business development company and is publicly traded, have dropped 9% to their lowest in four years since the Bloomberg report was published.

Analysts interviewed by Bloomberg raised concerns over Prospect’s reliance on preferred equity and small-size bond sales to individual investors to plug a cash shortfall that partly stems from a strained loan book. Meanwhile, the firm has continued to distribute hefty dividends to shareholders, a strategy analysts described as unsustainable.

In its statement, Prospect said it has completed a number of institutional bond sales and that it has chosen to wait for lower rates to potentially issue more, favoring other markets in the interim. It also stressed that is has an “intensive screening” process and diversified investment strategy, even within a real estate investment trust that represents a fifth of the fund’s overall portfolio.

It also touted other attributes of the fund, including a share of non-accrual loans, or those on which lenders are in danger of losing money, of just 0.4%, and low leverage as of March. It said the fund maintains investment-grade ratings from five credit graders and has generated “superior total returns” in comparison to peers.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.