Prediction: This Stock Will Be Warren Buffett’s Top Performer by 2030

Everyone knows about Warren Buffett’s monster Apple (NASDAQ: AAPL) investment. The huge hundred-billion-dollar winner — which Buffett recently trimmed — is quoted time and time again as one of Berkshire Hathaway‘s best investments. However, the investment has been held for fewer than 10 years, while Buffett has been investing for more than 60.

Buffett has bought and held American Express (NYSE: AXP) for many years longer than Apple. And yet few people discuss this huge winning investment. Even though the stock is up over tenfold since Buffett’s initial purchase, shares still look cheap today. Here’s why American Express is poised to crush the market again and can be Buffett’s top performer through 2030.

American Express: One of Buffett’s favorite brands

American Express operates one of the only credit card networks around the world. However, unlike other networks like Visa and Mastercard, American Express acts as the bank and actually issues its own credit cards. This vertically integrates digital payments, making American Express a unique business in the credit card world.

Catering to wealthier clientele, the company has built a premium brand that has been honed for decades. It offers high-fee credit cards such as the American Express platinum card, which has an annual fee of $695 a year. People are willing to pay these fees for the large travel benefits, cash-back deals, and other perks of the American Express ecosystem. As a classic network effect, it would be virtually impossible to rip and replace American Express from the payments ecosystem, making it a wide-moat business.

Buffett loves top brands such as American Express, Apple, and Coca-Cola. It is no surprise then to see Berkshire Hathaway still own over 20% of the business. It made its first investment back in 1991. Since then, American Express has posted a total return of close to 8,000%, which is better than Coca-Cola over that same time frame.

Growing card members, expanding international acceptance

Around 10 years ago, American Express went through a rough patch. It struggled to gain new users and lost a huge contract for the Costco Wholesale credit card partnership.

Since then, with new management at the helm, the company has set itself back on the right rack. Total cardmembers are growing again and have been for several years. Last quarter, the company added 3.3 million new cards, accelerating from a 3 million gain in the same quarter a year ago. New cards are the lifeblood of American Express’ business, so it is great to see new customers joining the platform. Over the next decades, these customers should provide a ton of value to American Express’ business as these wealthy customers make purchases with these cards and pay the high annual fees.

To keep up this growth, American Express is investing aggressively to grow the number of places that accept American Express card payments. This is the other lifeblood of the payments business. If a merchant doesn’t accept your credit card as a form of payment, you don’t make any money because shoppers can’t use their cards to make the purchase. Since 2017, the company has grown its international accepting locations fourfold, which will drive even more payments growth in the coming years. It has virtual acceptance parity with Visa and Mastercard in the United States today.

Buy this ultimate dividend grower and never sell

Through increased card fees, payment volume, international acceptance, and more credit card loans, American Express believes it can grow its revenue by 10% annually over the long term. Management thinks earnings per share (EPS) can grow even faster.

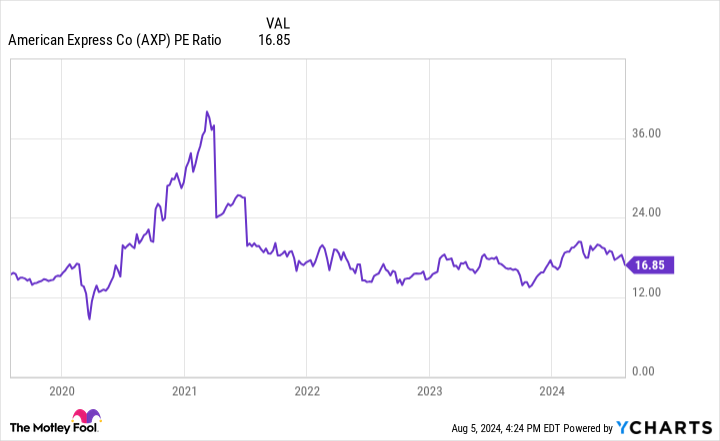

This growth — if you agree with management — will give American Express a ton of capacity to grow its dividend payments. The stock currently has a dividend yield of 1.23%, which looks quite low. But the stock is not wildly expensive and trades at a below-market price-to-earnings (P/E) ratio of 17. Over the last 10 years, American Express’ dividend per share has grown by 165%.

If revenue and earnings keep growing at 10% or more, I think that the stock can more than double its dividend per share again by 2030. Combined with a low starting valuation, I think American Express can be Buffett’s top-performing stock from now until 2030.

Should you invest $1,000 in American Express right now?

Before you buy stock in American Express, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and American Express wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $643,212!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

Prediction: This Stock Will Be Warren Buffett’s Top Performer by 2030 was originally published by The Motley Fool