TSMC Sales Grow 45% in July on Strong AI Chip Demand

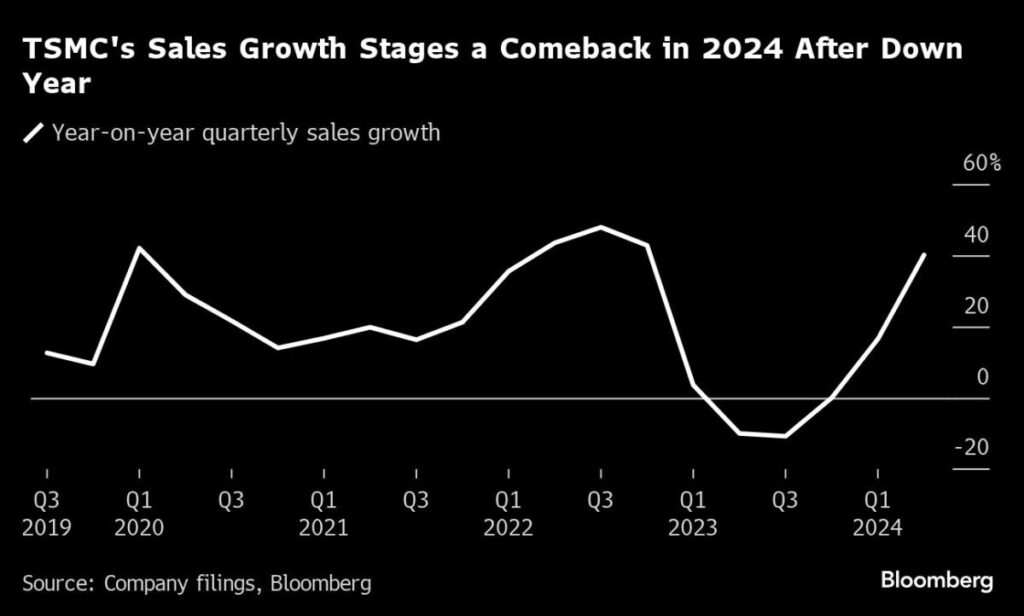

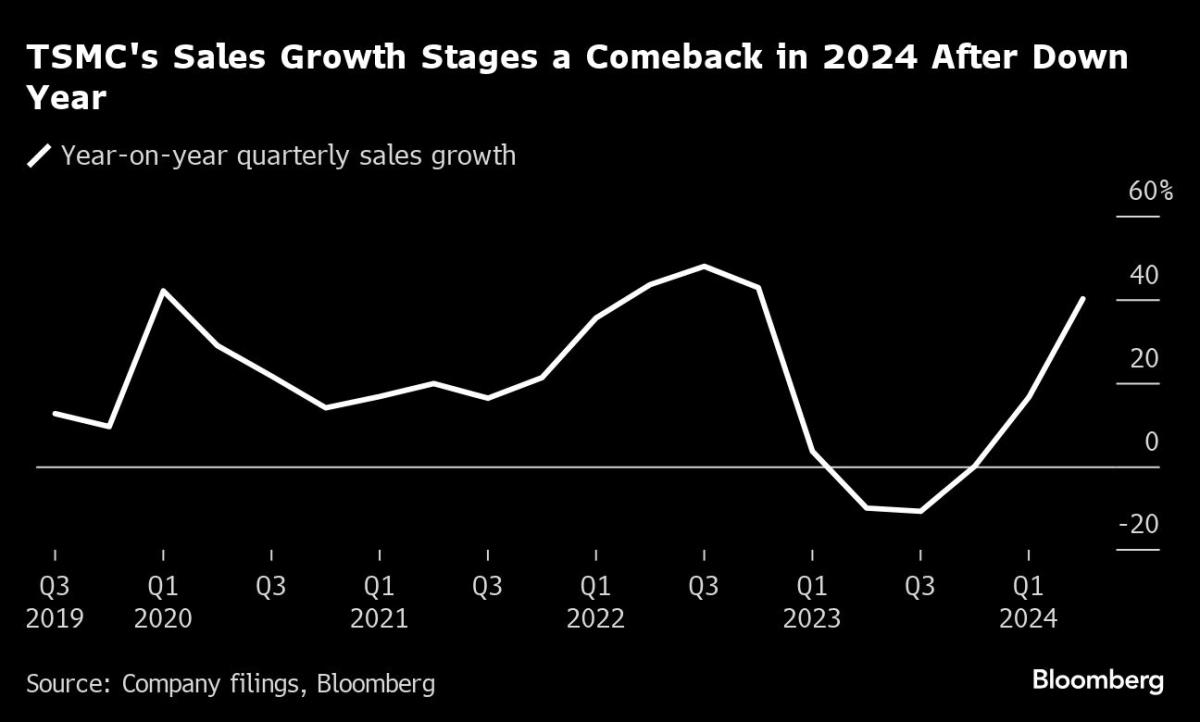

(Bloomberg) — Taiwan Semiconductor Manufacturing Co.’s revenue rose 45% in July, accelerating its pace of growth from the June quarter and bolstering hopes for sustained strong demand for artificial intelligence chips from the likes of Nvidia Corp.

Most Read from Bloomberg

Sales for the month reached NT$256.95 billion ($7.9 billion). For the third quarter, analysts project TSMC revenue should grow 37% to NT$747.4 billion, with the July result suggesting TSMC may surpass those expectations.

Taiwan’s biggest company is one of the key bellwethers for AI demand, as the go-to chipmaker for leading accelerator makers Nvidia and Advanced Micro Devices Inc. It’s also the sole supplier of processors for Apple Inc.’s iPhones, at a time the mobile device market is showing signs of bouncing off post-Covid era lows. Last month, the world’s largest contract chipmaker raised its full-year growth outlook to beyond the maximum mid-20% it had guided toward previously.

TSMC offered an upbeat assessment of its business and prospects when it last reported earnings, with Chief Executive Officer C.C. Wei signaling the company may have room to raise prices as more of its customers transition to its most advanced technology and have to compete for limited capacity. High-performance computing, led by AI, contributed 52% of TSMC’s revenue last quarter, the first time it has accounted for more than half.

Still, investors have started to question whether the billions of dollars Big Tech firms have invested in the infrastructure to support the AI boom will result in substantial returns, while a potential delay in Nvidia’s development of a new generation of AI chips is spurring concerns over the progress of the emerging technology.

Worries about the global economic outlook over the past week interrupted the AI rally that had seen key players like TSMC gains billions in market value. Investors opted to cash out of some of the year’s biggest gainers, pushing TSMC’s shares down 10% in a day, though the company recovered much of that in subsequent days as money managers saw a good buying opportunity.

–With assistance from Vlad Savov.

(Updates with additional details from TSMC’s latest earnings report)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.