Stocks and US Futures Rally as BOJ Calms Nerves: Markets Wrap

(Bloomberg) — Stocks rallied after the Bank of Japan moved to reassure markets in the wake of historic volatility sparked in part by its unexpected interest rate hike last week.

Most Read from Bloomberg

Futures on the S&P 500 and Nasdaq 100 gained after the underlying indexes rebounded more than 1% on Tuesday amid a wave of dip buying. The Stoxx Europe 600 index climbed more than 1%, with mixed earnings reports from some of the region’s biggest companies doing little to dampen the risk-on mood. Japanese stocks led a broad rally in Asia.

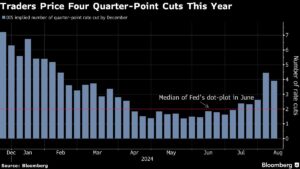

Bank of Japan Deputy Governor Shinichi Uchida sent a strong dovish signal by pledging to refrain from hiking interest rates when the markets are unstable. The yen weakened by more than 2% against the dollar after his comments, which were the first public remarks by a BOJ board member since the bank raised rates on July 31.

That rate hike set off a three-day tumble in Japanese shares, a surge in the yen and a rapid unwinding of the currency carry trade that dragged down risk assets globally. Worries over a slowdown in the US economy and sky-high valuations for tech shares helped fuel a dramatic selloff on Monday, capping a three-week, $6.5 trillion stock wipeout.

“I wouldn’t underestimate importance of what the Bank of Japan has been saying overnight,” Jennison Associates Managing Director Raj Shant said on Bloomberg TV. “I think that’s really helpful. This carry trade has been many, many years in the making, and probably indirectly affects a lot of asset classes around the world.”

Volatility is waning as the S&P 500 recovers from its worst one-day drop since September 2022. The Cboe Volatility Index declined another 17% on Wednesday following its biggest plunge since 2010.

Still, the recent turmoil was a “stark reminder of how quickly things can change,” said Justin Onuekwusi, chief investment officer at St James Place. “While overall corporate balance sheets are healthy and recession risks are low, we are starting to see earnings tail off a bit and companies’ guidance is outlining a more uncertain future.”

Treasury yields ticked higher and a Bloomberg dollar index rose for a second day. Meanwhile, the weaker yen boosted higher-yielding currencies. The Mexican peso, a carry trade target that tumbled after the BOJ rate hike, rose more than 1% against the dollar Wednesday. The Australian dollar and its New Zealand counterpart both advanced.

In US premarket trading, Fortinet Inc. shares soared after the cyber-security company forecast adjusted earnings per share that beat estimates. Super Micro Computer Inc. plunged after an earnings report that revealed margin pressure at the computer hardware maker. Airbnb Inc. slumped on a disappointing outlook.

Novo Disappoints

And in Europe, Novo Nordisk A/S shares dropped after the Danish drugmaker cut its profit forecast for the year. German lender Commerzbank AG, sportswear maker Puma SE and skin-care products maker Beiersdorf AG also slumped after earnings misses.

On the plus side, shares in Continental AG rose after the German manufacturer posted improving returns at its struggling car-parts unit, which it may spin off in its biggest-ever restructuring.

Dutch lender ABN Amro Bank NV gained after the Dutch lender raised its outlook for lending income, showing how Europe’s high interest rates continue to provide tailwind for the banking industry. The banks sub-index outperformed the benchmark.

In commodities, oil extended a recovery, with investors on edge over the possibility of a strike by Iran against Israel. Copper headed for its lowest close since March as stockpiles surged by the most in four years, underscoring the weak demand in Asia.

Key events this week:

-

US consumer credit, Wednesday

-

Germany industrial production, Thursday

-

US initial jobless claims, Thursday

-

Fed’s Thomas Barkin speaks, Thursday

-

China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 1.2% as of 6:58 a.m. New York time

-

Nasdaq 100 futures rose 1.5%

-

Futures on the Dow Jones Industrial Average rose 0.8%

-

The Stoxx Europe 600 rose 1.5%

-

The MSCI World Index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro fell 0.1% to $1.0918

-

The British pound rose 0.2% to $1.2715

-

The Japanese yen fell 2% to 147.21 per dollar

Cryptocurrencies

-

Bitcoin rose 1.4% to $57,385.11

-

Ether rose 1% to $2,514.43

Bonds

-

The yield on 10-year Treasuries advanced four basis points to 3.93%

-

Germany’s 10-year yield advanced eight basis points to 2.28%

-

Britain’s 10-year yield advanced four basis points to 3.96%

Commodities

-

West Texas Intermediate crude rose 1.6% to $74.34 a barrel

-

Spot gold rose 0.3% to $2,397.45 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.