Why a full-fledged bear market is still unlikely even after the latest sharp sell-off

-

Bank of America says the recent stock market sell-off is unlikely to be the start of a new bear market.

-

Credit markets remain stable, and only three of 10 signals of a market peak have flashed.

-

“Several of our sentiment signals suggest that sentiment did not hit euphoric levels typically seen at the end of bull markets,” BofA said.

The stock market’s recent sharp sell-off is unlikely to transform into a full-fledged bear market, according to Bank of America.

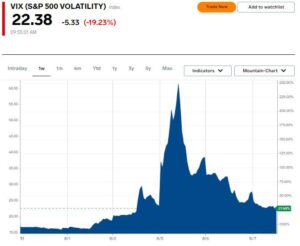

The S&P 500 fell as much as 8% since its record high in July, while the Nasdaq 100 plunged more than 10%. The sell-off was driven by a weak July jobs report, the unwind of the yen carry trade, and concerns of an imminent recession.

But according to Bank of America strategist Savita Subramanian, the tell-tale signs of a stock market peak have yet to materialize.

Instead of this being a stock market peak that’s on the precipice of a massive drawdown, it’s more than likely just a typical correction that occurs on average every single year.

For perspective, Subramanian pointed to stock market history to highlight that pullbacks in the market are common.

“5%+ pullbacks are common, occurring over three times per year on average since 1930 (this marks the second one this year after April). Larger corrections are less frequent but still common, with 10%+ corrections occurring once per year on average (the last one was in fall 2023),” Subramanian wrote in a note on Monday.

The fact that credit markets remain stable gives Subramanian confidence that the recent sell-off is a common pullback rather than the beginning of a true bear market.

“So far, credit markets are subdued with a trough-to-peak widening of 70bp for high-yield spreads through last Friday,” Subramanian said.

Typically during panics that evolve into bear markets, bond investors demand a higher premium for their risky junk debt relative to Treasurys, but that has yet to materialize.

The BofA US High Yield option adjusted spread, which measures the difference in yields between junk bonds and Treasury bonds, is at just 3.93%, well below its 5.33% average since inception in 1996.

For perspective, prior stock market panics in 2020 and 2008 led the spread to soar to 9.82% and 21.82%, respectively.

“The recent spread widening can be described as normalization from extremely tight levels toward fair value. Spread widening beyond 450-475 would be concerning, according to our credit strategists,” Subramanian said.

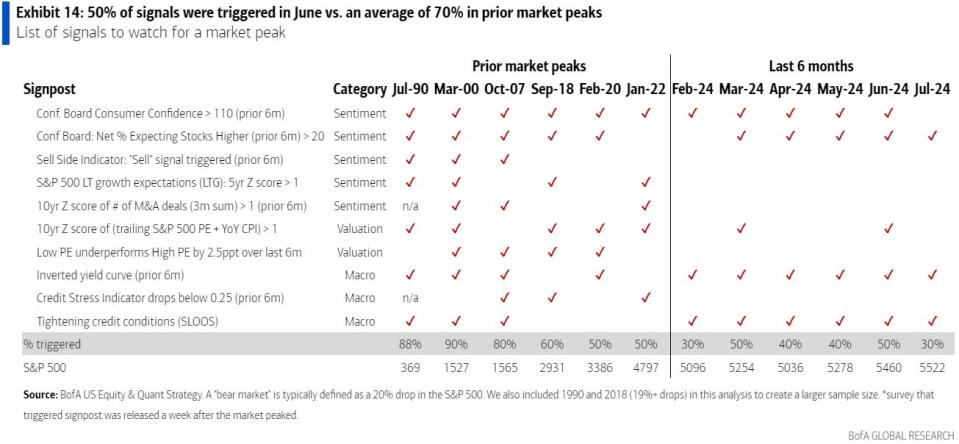

What’s more, Subramanian tracks 10 signals that, when most of them flash, signals that a major stock market peak has occurred.

But as of July, just three of the 10 signals have flashed, according to the note, which was a stepdown from the 5 signals that flashed in June.

“We saw a maximum of 50% of these signals triggered in June, below the average of 70% triggered in prior market peaks,” Subramanian said.

The three stock market peak signals that flashed in July include the net percentage of respondents to the Conference Board survey exceeding 20 when asked if they expect the stock market to keep rising, an inverted yield curve, and tightening credit conditions based on the Senior Loan Officer Opinion Survey.

But seven other signals tied to investor sentiment, valuations, and macro data have yet to flash.

“Several of our sentiment signals, including our Sell Side Indicator, suggest that sentiment did not hit euphoric levels typically seen at the end of bull markets,” Subramanian said.

Instead of preparing for a prolonged market sell-off, Subramanian recommends investors go bargain hunting and focus on buying high quality stocks.

Read the original article on Business Insider