Stocks Advance After BOJ Eases Worries Over Rates: Markets Wrap

(Bloomberg) — Shares rallied after the Bank of Japan’s deputy governor said it won’t raise interest rates if markets are unstable, comforting investors unnerved by a recent surge in the yen.

Most Read from Bloomberg

Japanese stocks rose after the yen fell by more than 2% against the dollar. Bank of Japan’s Deputy Governor Shinichi Uchida noted the recent volatility in Japanese markets, saying the BOJ’s rate path will shift if there’s an impact on the policy outlook. Equities in Taiwan and South Korea extended gains, while US futures also climbed.

Uchida’s comments offered much-needed reassurance to markets at a time when investors remained concerned whether the recent unwinding of the yen carry trade has run its course. The BOJ’s softening stance also served to remove one major uncertainty as traders continued to assess if the recent global selloff was an overreaction to weak US economic data.

“We wouldn’t say that markets will regain stability overnight, but investors appear to be taking the view that a large part of the selloff was technically driven and unlikely to persist,” said Homin Lee, senior macro strategist at Lombard Odier Singapore Ltd. “For markets like South Korea and Taiwan that are supported by decent fundamentals, we think there is scope for more recovery from this week’s selloff.”

A broad Asian gauge rose 1.6%. Chinese shares were marginally higher after four consecutive days of losses, following a mixed bag of trade data.

The Nikkei and the Topix indexes slid into a bear market on Monday after they dropped 20% from their July peaks. The Nikkei’s implied volatility touched its highest level since 2008 at the start of the week.

“Uchida-san’s comments can bring some stability to the Japanese equity market for now, but it cannot take the focus away from US economic data and recession concerns,” said Charu Chanana, head of currency strategy at Saxo Markets. “Putting in fresh carry trades remains tough in this environment of higher volatility and nervousness about the US economy.”

The yen carry trade unwinding among speculative investors was 50% to 60% done, Arindam Sandilya, co-head of global FX strategy, said on Bloomberg TV. Investors using the cheap currency to fund investments in higher-yielding assets were caught out when the yen surged 11% over the past month.

The Mexican peso, another carry trade target, also rose over 1% against the dollar Wednesday. The Australian dollar and its New Zealand counterpart both advanced too.

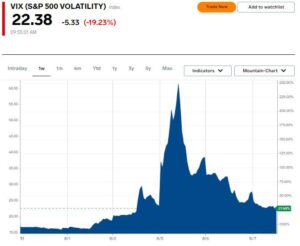

The S&P 500 and Nasdaq 100 rose on Tuesday — following a Japan-led rebound in Asia — with both climbing 1% after a global meltdown. Wall Street’s “fear gauge” — the VIX — saw its biggest plunge since 2010. Traders also moderated expectations of Federal Reserve rate cuts this year, with swaps predicting around 105 basis points of easing, versus as much as 150 basis points on Monday.

Treasury 10-year yields rose two basis points in Asian trading after jumping 10 basis points to 3.89% Tuesday. Oil was flat.

“We would characterize the recent market pullback as a textbook correction, after months of low volatility so far in 2024,” said Carol Schleif at BMO Family Office. “The lack of volatility before the past few weeks is unusual, and our current correction is actually quite normal, especially during August, which historically is a volatile time for markets given lighter trading volumes and the summer doldrums.”

A semblance of calm returned to markets on Tuesday, following a pullback fueled by weak economic data, underwhelming tech results, stretched positioning and poor seasonal trends. The wall of worry the market built up over the past few days drove the S&P 500 to the brink of a correction, with a drawdown of about 8.5% from the highs.

Key events this week:

-

US consumer credit, Wednesday

-

Germany industrial production, Thursday

-

US initial jobless claims, Thursday

-

Fed’s Thomas Barkin speaks, Thursday

-

China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 9:44 a.m. Tokyo time

-

Hang Seng futures rose 0.5%

-

Nikkei 225 futures (OSE) rose 0.3%

-

Japan’s Topix rose 0.5%

-

Australia’s S&P/ASX 200 fell 0.2%

-

Euro Stoxx 50 futures rose 0.5%

-

Nasdaq 100 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0926

-

The Japanese yen fell 0.5% to 145.11 per dollar

-

The offshore yuan was little changed at 7.1627 per dollar

-

The Australian dollar rose 0.2% to $0.6532

Cryptocurrencies

-

Bitcoin fell 0.8% to $56,114.51

-

Ether fell 1.5% to $2,452.71

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 3.90%

-

Japan’s 10-year yield was unchanged at 0.890%

-

Australia’s 10-year yield advanced six basis points to 4.08%

Commodities

-

West Texas Intermediate crude fell 0.3% to $73.01 a barrel

-

Spot gold fell 0.4% to $2,382.63 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.