Jim Cramer Called This Dividend Stock’s Quarter A Blowout, Time To Invest?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Tech stocks have had a rough few weeks in the market as investors look for signs of weakness in the AI-fueled tech boom. This prompts investors to seek stability in dividend-paying stocks with an established track record. Jim Cramer recently highlighted a dividend-paying company that may keep delivering solid returns for investors.

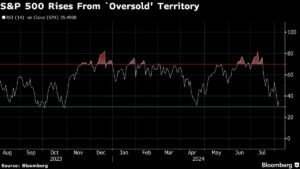

Cramer has said lately that the market may be amid the ‘great broadening.’ This means moving away from the Magnificent Seven tech stocks and toward other parts of the market. It could represent a shift toward small-cap and large-cap stocks in sectors that may not get much attention.

Check it out: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Cummins (NYSE:CMI) may be one of those underrecognized opportunities. Cummins Inc. was founded in 1919 to build engines. It has since moved beyond that with five business sections: components, engine, distribution, power systems, and Accelera by Cummins. From its roots in Indiana, it has a global manufacturing and service network and employs over 75,000 people. It has benefited from the energy transition. Cummins is committed to its Destination Zero strategy, which features products such as advanced diesel, natural gas, electric, and hybrid powertrains and powertrain-related components.

Cummins had record quarterly sales in the second quarter of 2024, with revenue at $8.8 billion. It also raised its full-year 2024 revenue guidance to be down 3% to flat due to stronger-than-expected demand across several markets. In July, it announced that its next dividend would be increased from $1.68 per share to $1.82 per share, an 8.3% bump. Cummins has increased its dividend for 15 years in a row. It has an annual payout of $7.28 and a dividend yield of 2.38%.

Cramer interviewed Cummins CEO Jennifer Rumsey on the results, pointing out that Cummins had not only a blowout quarter but a better quarter than many of the companies it sells to. As part of Cummins’s Destination Zero strategy, it is making strides in battery and zero-emissions technology. Rumsey said the company spends record amounts on research and development to push this initiative forward. It also invests $1 billion in a U.S.-based manufacturing plant for its HELM engine platform. HELM stands for higher efficiency, lower emissions, and multiple fuels and is a fuel-agnostic platform that works for natural gas, diesel and hydrogen engines. This range of solutions may give Cummins more flexibility depending on where customer demand heads.

Don’t Miss:

Cummins stock has risen by nearly 83% in the past five years. It has a P/E ratio of 21. Its multiple paths for growth may mean that despite its long history, there is still plenty of room for innovation and growth. It also connects to artificial intelligence by providing backup generators for data centers, helping combat grid instability.

Rumsey and Cramer also discussed the potential for hydrogen engines. While hydrogen has been slow to take off as an alternative fuel source, Rumsey said that hydrogen is particularly well suited for applications like heavy-duty, weight-sensitive trucks and traveling long distances. She stressed that the timeline for hydrogen is longer than some of the other projects Cummins is working on.

Cummins does face some challenges ahead, including a slowdown in the demand for freight trucking, which will impact the sales of some of its engines, but its diversification provides some level of safety. Cramer said the stock was a buy back in April. It has a consensus buy rating with an implied 5.04% upside based on the three most recent analyst ratings. With a steady track record and plans for expansion ahead, Cummins looks to truck along for years to come.

Better Than Cummins?

The current high interest rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through dividend stocks… Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities, and Benzinga has identified some of the most attractive options for you to consider.

For example, the Jeff Bezos-backed investment platform just launched its Private Credit Fund, which provides access to a pool of short-term loans backed by residential real estate with a target 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This article Jim Cramer Called This Dividend Stock’s Quarter A Blowout, Time To Invest? originally appeared on Benzinga.com