Stock market turmoil ‘only half complete’, warns Wall Street giant

The global stock market rout has a long way to go, analysis by a Wall Street bank has indicated, as European markets once again turn negative.

JP Morgan analysts have issued the warning about so-called “carry trades”, which are thought to have partly caused the turmoil on financial markets that wiped £40bn off the FTSE 100 on Monday.

Carry trades involve borrowing at low cost in one currency to achieve higher returns from investments in another currency.

One of the most recent examples has been to borrow Japanese yen but traders have been unwinding these deals after the Bank of Japan decided to raise interest rates for only the second time in 17 years last week.

Traders scrambled to sell higher risk, dollar-denominated assets to cover suddenly higher borrowing costs, plus losses from foreign exchange rate changes and losses in asset values as share prices plunged.

Also, hedge funds that conduct carry trades use computer models to help maximize their returns versus their risks. They needed to sell shares to maintain acceptable risk profiles.

Arindam Sandilya, co-head of global FX strategy at the bank, told Bloomberg TV: “We are not done by any stretch.

“The carry trade unwind, at least within the speculative investing community, is somewhere between 50pc to 60pc complete.”

Read the latest updates below.

06:14 PM BST

Signing off…

That’s all from me for tonight. Thanks for reading.

See you tomorrow for more breaking business news.

06:07 PM BST

‘Sigh of relief’ for investors as stocks regain lost ground

Danni Hewson, head of financial analysis at AJ Bell, has weighed in on today’s trading.

“It was a day when investors breathed a sigh of relief and more than a few indulged in a spot of bargain hunting,” she said.

“Whilst nerves are still very much on show and it was less ‘turnaround Tuesday’ and more ‘trying hard Tuesday’, some ground was made up after Monday’s rather spectacular market meltdown.

“It was illuminating to see those companies that immediately regained some lost ground. On London’s FTSE 100 Rolls-Royce and Melrose Industries were the stock picks of choice. On Wall Street Nvidia bounced back whilst Apple couldn’t shake the jitters associated with Berkshire Hathaway’s decision to cut its stake.

“Even investing rock stars got their fingers singed yesterday, though Warren Buffett’s stock empire was among those stocks narrowing losses today.”

06:04 PM BST

HSBC hires former Blair adviser amid brewing China tensions

In case you missed this story earlier today: HSBC has hired a former senior adviser to Sir Tony Blair to help navigate the West’s growing diplomatic rift with China.

David Quarrey, who has held a variety of UK government roles, is set to become the bank’s new head of public affairs amid rising geopolitical tensions.

The top diplomat is currently an ambassador for the UK at Nato and has enjoyed a star-studded civil service career.

He served as private secretary to Sir Tony between 2004 and 2006 during the latter years of his premiership.

Our chief business correspondent Michael Bow has the latest:

The 58-year-old also held senior roles in the Foreign Office, including as head of the UK team in the United Nations Security Council. In 2015 he was appointed ambassador to Israel, serving until 2019.

The appointment marks a coup for HSBC, one of the world’s biggest banks operating in over 60 countries across the globe.

The lender is often forced to strike a balance between its two largest markets, China and the UK, amid rising tensions between the East and the West.

It has faced criticism in the past for putting relations with China, which accounts for its largest market by revenue, ahead of its Western interests, and was roundly condemned for supporting a draconian human rights crackdown in Hong Kong.

The bank also has a significant presence in the US, with the prospects of a second Donald Trump presidency and renewed US-China tensions adding further risks for HSBC.

Mr Quarrey will replace Sir Sherard Cowper-Coles, who stepped down from the bank after making controversial comments about the UK’s relationship with China.

05:54 PM BST

Falkland Islands ends £120m floating dock talks in blow to Titanic shipbuilder

The Titanic shipbuilder Harland & Wolff has been plunged deeper into crisis after the Falkland Islands withdrew from £120m contract talks.

The Belfast-based company had previously been chosen as the preferred candidate to build a new floating dock for the British overseas territory.

But on Tuesday it revealed the Falkland Islands government (FIG) had “decided to cease further contractual negotiations”.

Our industry editor Matt Oliver has the full story:

The London-listed company told investors: “Despite productive discussions, FIG and Harland & Wolff were unable to reach a mutually acceptable commercial position.

“FIG acknowledges the effort and commitment demonstrated by Harland & Wolff throughout this process.”

Work on the project had been scheduled to start later this year and was set to involve the construction, transportation and installation of four floating pontoons, each about 90 metres long.

The contract’s cancellation piles further pressure on Harland as it battles for survival under the weight of a heavy debt burden.

Its chief executive, John Wood, departed at the end of last month after the Government declined to provide a £200m loan guarantee.

New managers have since been parachuted in by creditors and the company has extended borrowing facilities with its Wall Street lender Riverstone by a further $25m (£20m), to $140m.

05:44 PM BST

German pharmacy chain ditches Tesla cars over Musk’s Trump support

The German pharmacy chain Dirk Rossmann has said it will no long buy Tesla cars for its fleet because of Elon Musk’s support for Donald Trump.

The company, which has more than 4,700 branches across Europe, said on Tuesday it would continue to use the 34 Teslas it already owns for sustainability reasons but would find an alternative supplier for future vehicles.

Raoul Rossmann, the company’s chief executive and son of its namesake founder, said: “Elon Musk makes no secret of his support for Donald Trump. Trump has repeatedly described climate change as a hoax.

“This attitude is in stark contrast to Tesla’s mission to contribute to environmental protection through the production of electric cars.”

It comes after Tesla chief Mr Musk, who bought X (formerly Twitter) for $44 billion in 2022, formally endorsed the former US president Trump in a post on the social network last month after Mr Trump survived an assassination attempt.

04:59 PM BST

FTSE 100 closes in the green

London’s premier index ended today’s session up 0.23pc, regaining stability after yesterday’s drop.

At 4:30pm the pound was worth 1.2707 dollars compared to 1.2765 dollars at the previous close.

04:36 PM BST

Democrats heap pressure on Federal Home Loan Banks as election nears

US Democrats are heaping pressure on the Federal Home Loan Bank (FHLB) system in a bid to ease a housing crisis across the Atlantic in the run-up to November’s election.

Lawmakers have urged the FHLBs – a collection of 11 banks that provide a stream of cash to other lenders to support housing and infrastructure investments – urging their bosses to plough more money into affordable housing and community schemes.

It comes as Democratic senators scramble to convince voters that they are addressing the sky-high cost of housing across the nation.

Lawmakers have argued that FHLBs should be doing more to fix the crisis because they are sitting on billions of dollars of excess cash after making record profits propping up regional banks last year.

In letters sent to the FHLBs, senators including Catherine Cortez Masto, Elizabeth Warren and Ron Wyden also criticised high levels of executive pay at these institutions.

04:16 PM BST

Holiday Inn boss ‘troubled and saddened’ after hotels targeted by far right

The boss of Holiday Inn’s parent company has said it was “troubling and saddening” to see UK hotels targeted by far right rioters over recent days.

Elie Maalouf, chief executive at IneterContinental Hotels Group (IHG), said: “It’s really very, very unfortunate, and our first priority is the safety and security of our of the hotel teams, of anybody staying in the hotels.”

Hundreds of rioters attacked the Holiday Inn Express hotel in Rotherham, which has previously been used to house asylum seekers, on Sunday, clashing with police. A second hotel in Tamworth was also targeted.

“We’re grateful to the Home Office, the police, the authorities, for working very hard, at risk for themselves, to reestablish safety, order and calm,” said Mr Maalouf.

It comes as the company, which also owns the Regent, Crowne Plaza and InterContinental hotel brands, posted a 12pc rise in operating profits for the six months to 30 June.

The company opened 126 hotels in the first half of the year and signed on 384 properties, equating to more than two per day.

04:04 PM BST

Cryptocurrencies claw back losses

Bitcoin and Ether have trudged upwards, delivering a brief respite for investors after panic in global markets spilled into cryptocurrencies.

Bitcoin was up by more than 4pc at the time of writing, while Ether had risen by more than 5pc.

It comes after Bitcoin yesterday sunk below $50,000 (£39,350) for the first time in months while Ether was hit by its steepest plunge since 2021.

However, experts warned gains may be short-lived as broader economic and geopolitical worries weigh on sentiment.

Sean McNulty, director of trading at Arbelos Markets, said: “We are seeing buying on the dip, but generally sentiment is still cautious on concerns that this is the start of a larger deleveraging process.”

03:51 PM BST

Fuller’s swoops for Warwickshire pub company

Fuller’s, the London-based pub group, has mounted a major expansion north of the Capital.

It has bought the Warwickshire-based Lovely Pubs firm for £22.5m, giving Fuller’s a foothold far from its Southern heartlands. Lovely Pubs runs seven sites in affluent towns such as Alveston, Monkspath and Chadwick End.

Fuller’s chief executive, Simon Emeny, said: “These seven outstanding sites are a perfect fit with our existing estate both in terms of their premium operational style and their geographical location.”

Fuller’s shares fell by more than 3pc today.

03:35 PM BST

Goldman Sach tells investors to profit from stocks rout

Investors typically profit when they buy after a 5pc sell-off in US stocks, according to Goldman Sachs.

David Kostin, who leads the Wall Street bank’s strategy team, said buying after a slump of the scale witnessed over the past month has usually been profitable.

Since 1980, the S&P 500 has generated a median return of 6pc in the three months that followed a 5pc decline from a recent high.

Mr Kostin told clients: “Corrections of 10pc have also been attractive buying opportunities more often than not.”

David Waddell, chief executive at Waddell & Associates, added:

The market by any metric is ‘oversold’ and due for a bounce.

The lingering question now is whether the concerns that pushed the market into a cascade of selling are alleviated. Pockets of volatility are expected to continue.

With that, I will hand over this blog to Daniel Woolfson, who will be monitoring the markets and sending updates here.

03:11 PM BST

US stocks rise in rebound from global rout

Wall Street stocks opened higher after three straight days of losses that included Monday’s global rout.

The Dow Jones Industrial Average was up 1pc at 39,093.46, with the broad-based S&P 500 rising 0.9pc to 5,231.79.

The tech-rich Nasdaq Composite Index advanced 1.1pc to 16,356.25.

Briefing.com analyst Patrick O’Hare said that while there were signs of some bargain hunting, “it is fair to say that it is not a hard-charging rebound effort given the scope of recent losses”.

Major indices fell more than 2.5pc on Monday in a move seen as a reflection of worries about a US recession following Friday’s disappointing jobs data.

02:49 PM BST

Virgin Atlantic to review Israel return amid Iran conflict fears

Virgin Atlantic executives will meet to review the airline’s plans to resume flights to Israel amid mounting fears about escalating tensions in the Middle East.

Our transport industry editor Christopher Jasper has the latest:

Virgin Atlantic is currently set to restart services to Tel Aviv on September 5 after pulling out of the route last October in the wake of Hamas’ terrorist attacks.

However, with numerous international carriers suspending flights this week amid concern that the Israel-Palestine conflict may intensify, Virgin is being forced to rethink its plans.

US Secretary of State Antony Blinken said on Sunday that Iran and its proxies may attack Israel in the coming days following the assassination of a senior Hezbollah commander in Beirut and Hamas’s top political leader in Tehran.

Meanwhile, British nationals have been urged to leave Lebanon in the event of an Israeli invasion of the border area.

A Virgin spokesman said: “We’re conducting risk assessments all the time. Our plans for Tel Aviv will be reviewed at the next meeting of our operational and commercial teams.”

Virgin has been planning to serve Tel Aviv on a daily basis during the coming winter season using Airbus A330 widebody jets carrying up to 264 passengers and a dozen crew.

02:36 PM BST

Wall Street stocks edge higher as trading begins

US stock markets rose after the sharp sell-off on Monday, although the rebound was not similar to the scale seen in Japan.

The Dow Jones Industrial Average rose 1.16 points at the open to 38,704.43.

The S&P 500 opened higher by 17.73 points, or 0.3pc, at 5,204.06, while the Nasdaq Composite was up 63.7 points, or 0.4pc, to 16,263.70.

02:19 PM BST

Gas prices rebound from global rout

Wholesale gas prices have bounced back after the global rout in markets sent commodity prices tumbling amid concerns about a US recession.

Dutch front-month futures rose as much as 4.4pc after slumping 3.1pc on Monday in line with a drop in the price of oil.

Traders have been wary of a potential retailiation by Iran against Israel over the killing of senior figures in Hezbollah and Hamas last week.

It comes as the hot weather in Europe boosts demand for air conditioning.

The UK’s equivalent gas contract has risen as much as 4pc.

01:55 PM BST

Saudi Aramco profits fall amid Opec supply cuts

Saudi oil giant Aramco reported profits of $29.1bn (£23bn) in the second quarter, a slight drop from the same period last year as output remained subdued.

The decrease of 3.4pc “mainly reflects the impact of lower crude oil volumes sold and weakening refining margins”, the company said.

Saudi Arabia, the world’s biggest crude exporter, is currently producing roughly nine million barrels per day (bpd), well below its capacity of 12m bpd.

Riyadh-based company Jadwa Investment said last week that production averaged 8.8m bpd in June.

The relatively low figure reflects cuts dating back to October 2022, when the Opec+ bloc of oil producers announced it would reduce output by two million bpd to boost prices. Saudi Arabia co-leads the cartel with Russia.

In April 2023, several Opec+ members announced they would further slash production by more than one million bpd, and in June 2023, Riyadh announced an additional voluntary cut of one million bpd.

“Output will remain at similar levels until at least October”, at which point an Opec+ agreement announced in June this year will allow “for gradual monthly increases”, Jadwa said.

Aramco is the jewel of the Saudi economy and the main source of revenue for Crown Prince Mohammed bin Salman’s Vision 2030 reform agenda, which aims to set the Gulf kingdom up for a prosperous post-oil future.

01:52 PM BST

Stock market turmoil ‘only half complete’, warns Wall Street giant

The global stock market rout has a long way to go, analysis by a Wall Street bank has indicated, as European markets once again turn negative.

JP Morgan analysts have issued the warning about so-called “carry trades”, which are thought to have partly caused the turmoil on financial markets that wiped £40bn off the FTSE 100 on Monday.

Carry trades involve borrowing at low cost in one currency to achieve higher returns from investments in another currency.

One of the most recent examples has been to borrow Japanese yen but traders have been unwinding these deals after the Bank of Japan decided to raise interest rates for only the second time in 17 years last week.

Traders scrambled to sell higher risk, dollar-denominated assets to cover suddenly higher borrowing costs, plus losses from foreign exchange rate changes and losses in asset values as share prices plunged.

Also, hedge funds that conduct carry trades use computer models to help maximize their returns versus their risks. They needed to sell shares to maintain acceptable risk profiles.

Arindam Sandilya, co-head of global FX strategy at the bank, told Bloomberg TV:

We are not done by any stretch.

The carry trade unwind, at least within the speculative investing community, is somewhere between 50pc to 60pc complete.

01:23 PM BST

Global markets hit by race to unwind ‘carry trades’

The mayhem that swept across world markets this week was partly caused by a market strategy known as the “carry trade.”

Carry trades involve borrowing at low cost in one currency to achieve higher returns from investments in another currency.

One of the most recent examples has been to borrow Japanese yen, expecting the currency to remain cheap against the US dollar and for Japanese interest rates to remain low.

The borrowed funds would then be invested in US stocks and Treasury bonds in anticipation of a higher return.

However, traders have been unwinding these deals – rushing to sell US dollars – after the Bank of Japan decided to raise interest rates for only the second time in 17 years last week. The Bank of Japan has kept interest rates at or near zero for years, trying to encourage more spending and spur economic growth.

Higher interest rates tend to boost the value of a nation’s currency, and the Japanese yen surged against the US dollar.

Traders scrambled to sell higher risk, dollar-denominated assets to cover suddenly higher borrowing costs, plus losses from foreign exchange rate changes and losses in asset values as share prices plunged.

Also, hedge funds that conduct carry trades use computer models to help maximize their returns versus their risks. They needed to sell shares to maintain acceptable risk profiles.

01:05 PM BST

Starmer’s planning overhaul triggers construction boom

Keir Starmer’s planning blitz has sparked a boom in construction with house building activity surging in July at the fastest pace in nearly two years.

Our economics reporter Melissa Lawrford has the latest:

Housing activity jumped nearly four percentage points to hit 51.5 in July, according to the S&P Global UK Construction purchasing managers index (PMI).

This was the fastest pace of growth since September 2022 when the Liz Truss mini-Budget sent mortgage rates soaring and kickstarted the housing downturn that sent housebuilding into the doldrums.

The growth follows Labour’s decisive general election victory at the start of July, after the party campaigned on a manifesto promise to “get Britain building again” and build 1.5m homes over the next five years.

Within days of winning, Rachel Reeves used her first major speech as Chancellor to announce she would reintroduce mandatory housing targets for local authorities and unlock green belt land for development.

The jump in housebuilding meant the overall construction PMI rose sharply from 52.2 in June to 55.3 in July, the fastest rate of growth in the sector since May 2022.

Andrew Harker, economics director at S&P Global, said the construction sector was “roaring ahead”.

Kelly Boorman, national head of construction at RSM UK, said: “This reflects positive sentiment in response to the government’s focus on local housing targets with greater transparency towards planning and infrastructure.”

12:49 PM BST

US stock markets on track to rise after sell-off

Wall Street’s main stock indexes rose in premarket trading as investors looked for bargains after the global rout in share prices.

Most megacap and growth stocks, which together lost $200bn (£158bn) in market value on Monday, gained in premarket trading with Nvidia bouncing back 2.8pc.

Both the S&P 500 and the Nasdaq Composite posted losses of at least 3pc each in the last session after weak economic data raised worries of a US recession and the unwinding of sharp positions of carry trades that fund high-yielding assets.

US central bank policymakers pushed back on Monday against the notion that weaker-than-expected July jobs data means the economy is in recessionary freefall, but also warned that the Fed will need to cut rates to avoid such an outcome.

Traders currently see an about 79pc chance of a 50-basis-point rate cut in September, down from 85pc on Monday, according to CME’s FedWatch Tool.

Top brokerages including J.P. Morgan, Citigroup and Wells Fargo have forecast a 50-basis-point interest rate cut by the US central bank in September after a surprisingly weak employment report for July.

In premarket trading, the Dow Jones Industrial Average was up 0.7pc, the S&P 500 was up 0.9pc and the tech-heavy Nasdaq 100 had gained 1.1pc.

12:09 PM BST

Domino’s Pizza downgrades profit expectations as orders decline

Domino’s Pizza warned it expects profits to be on the weak side of forecasts as households cut back on takeaway orders in the first half of the year.

The company said underlying profits would be “towards the lower end of the current range of market expectations”.

Shares in the UK franchise of the US pizza group fell as much as 7.8pc after it downgraded its predictions for the year, having said in March that underlying earnings before profits and charges would be in line with market expectations.

It came as total orders in the first half of the year slipped nearly 1pc to 35.1m, with revenues down 1.8pc to £326.8m.

Chief executive Andrew Rennie said admitted the company had suffered a “slow start to the year”, adding it is “executing well in an uncertain market” after a boost from the Euros football tournament.

11:52 AM BST

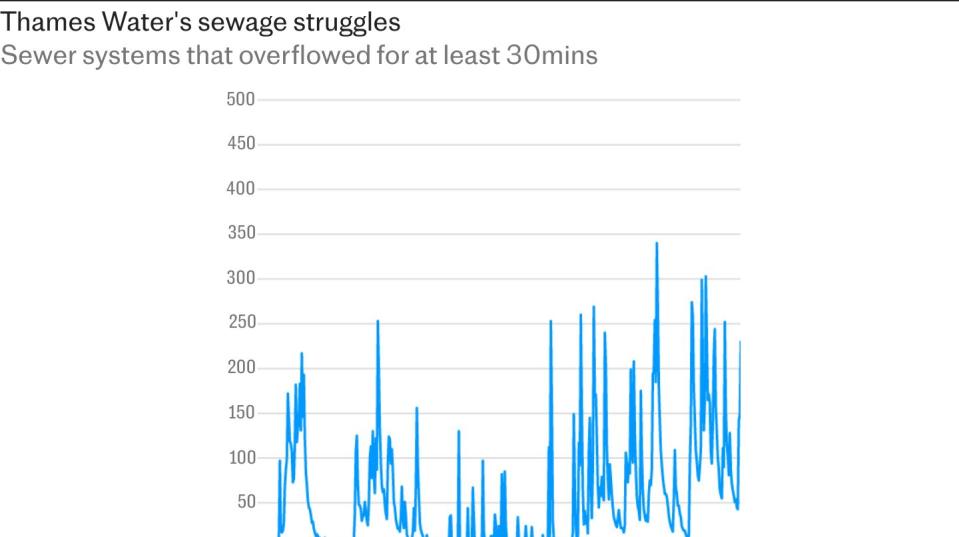

Thames Water faces new cash crunch after £104m fine

Thames Water’s cash crisis has deepened after it was hit with a £104m fine for a “catalogue” of sewage failings.

Luke Barr has the story:

Britain’s largest water supplier has been handed the penalty by regulator Ofwat just weeks after warning it only has enough money to survive until May 2025.

This latest fine, which accounts for 9pc of Thames Water’s turnover, will reduce the company’s dwindling cash pile further and increase the risk of a government-backed bailout.

As well as penalising Thames, Ofwat also hit Yorkshire Water and Northumbrian Water with fines of £47m and £17m respectively.

Read how Thames Water’s financial woes are piling up.

11:26 AM BST

Abrdn’s search for new boss goes on despite return to profit

Abrdn’s interim chief executive Jason Windsor said that the company’s search for a permanent head is “still in motion” as it announced a return to profit.

Our reporter Adam Mawardi has the details:

The asset manager was expected to announce today that Mr Windsor, a former Permission Homes and Aviva executive, would become its permanent chief executive following the departure of Stephen Bird in May.

Mr Windsor, Abrdn’s chief financial officer, was chosen to temporarily take control of the business as interim group chief executive during the recruitment process which included the consideration of external candidates.

He has since been tipped as the favoured candidate to take control of the London-listed money manager.

However, delivering the company’s half-year results, the interim boss told The Telegraph: “There is no news on that today. The process is still in motion.”

Abrdn swung to £187m in half-year pre-tax profits from £169m in losses recorded during the same period last year.

The company reduced operating expenses by 9pc to £539m as part of plans to save £150m in costs by the end of 2025.

Mr Windsor said there are no plans to increase job cuts beyond the 500 role reductions announced in January.

11:10 AM BST

Stocks rebound runs out of steam as recession fears remain

The FTSE 100 deepened its losses triggered by fears of a US recession as a rebound in stock markets ran out of steam.

The UK’s blue chip index was down 0.4pc having risen as much as 0.6pc earlier in a bounce back from Monday’s sell-off, which saw more than £40bn wiped off the value of Britain’s most-valuable traded companies.

Stock markets in Paris, Frankfurt, Milan and Madrid all turned red after earlier gains.

There had been hopes of a “Turnaround Tuesday” after Japan’s benchmark Nikkei 225 jumped 10.2pc, bouncing back from a plunge of 12.4pc in its worst rout since Black Monday in 1987.

Meanwhile, the pound was lower against both the dollar and the euro as investors unwound complex so-called carry trades, despite data showing Britain’s construction activity grew at its fastest pace in more than two years in July.

Saxo’s head of FX strategy Charu Chanana said:

Although markets are regaining some calm after a two-day rout, recession concerns are unlikely to disappear soon.

US economic data may not be weakening unilaterally, but the broadening weakness could keep markets volatile until the Fed intervenes, verbally or through action.

10:52 AM BST

GSK cleared of Zantac drug causing woman’s cancer in second key legal victory

GSK has won its latest trial over allegations that its heartburn drug caused cancer after a jury found its Zantac drug had not caused a woman’s cancer.

Our reporter Adam Mawardi has the details:

An Illinois jury concluded that discontinued drug Zantac was not responsible for a woman’s colorectal cancer following a two-week trial.

It is the second Zantac lawsuit to proceed to trial and is the second favourable decision for the UK drugmaker, having won the first case in May.

In an update shared on the London Stock Exchange, GSK said the latest outcome is “consistent” with scientific consensus that there is no reliable evidence that Zantac, also known as ranitidine, increases the risk of any cancer.

The company said: “GSK will continue to vigorously defend itself against all other claims.”

GSK still faces further legal action after more than 70,000 lawsuits were allowed by a Delaware judge in June. The pharmaceutical company is appealing that decision.

Analysts previously claimed that GSK’s potential settlement costs could reach $3bn.

GSK’s share price is down 1.3pc.

10:37 AM BST

Pound falls as investors unwind popular ‘carry’ trades

The pound remains lower against both the dollar and the euro as hedge funds and other major investors were forced to unwind popular so-called carry trades.

Sterling was down 0.5pc against the greenback to $1.272 – its lowest level in a month – as the sharp increase in the value of the yen forced traders to sell-off assets they wanted to keep to adhere to their risk models.

The euro was up 0.2p against the pound at 85.8p even as PMI data showed Britain’s construction sector growing at its fastest pace in two years, while the eurozone construction sector remained firmly in contraction territory in July.

Joe Tuckey, head of FX analysis at Argentex, said: “As market participants close their ‘winning’ trades, the long sterling positioning will have been heavily moderated.”

He added that the pound’s “long-term fundamentals remain more constructive than those of the eurozone”.

Surprised to see EURGBP holding on here. I don’t think the EZ economy is in as dire straits as implied by the surveys, but the gap between soggy EZ and strong UK data is now quite stark, across sectors …

— Claus Vistesen (@ClausVistesen) August 6, 2024

10:18 AM BST

Standard Chartered told to fix plan for potential collapse

Standard Chartered has been told to up its game by the Bank of England after “shortcomings” were detected in its plan to deal with a bank collapse.

Our reporter Michael Bow has the details:

The FTSE 100 lender, led by Bill Winters, was the only bank out of eight UK institutions assessed by the Bank of England to be flagged for having “shortcomings” in its so-called resolution plan.

The Bank has been assessing how well prepared UK lenders are to cope with a hypothetical bank collapse. The collapse of Silicon Valley Bank last year and rescue of Credit Suisse by UBS has made such planning more urgent.

The Bank said overall lenders were well prepared for an imaginary collapse of their institution, and taxpayers would be protected if any bank did go under.

However Barclays, HSBC, Lloyds and Virgin were all ordered to make improvements to their plans for resolution while Nationwide, Natwest and Santander were all given a clean bill of health.

Standard Chartered fell down on its ability to push through a restructuring plan if one were needed.

The Bank’s deputy governor for resolution Dave Ramsden said: “We welcome the progress made by the major UK banks. Resolvability will never be ‘done’ and there will always be lessons to learn from putting the regime into practice.”

10:03 AM BST

People got carried away with sell-off, say analysts

The recovery in European markets has not been as clear cut as it was in Japan overnight as concerns about the US economy linger.

The FTSE 100 briefly dipped into negative territory and was last up 0.2pc, while the Cac 40 in France was down 0.1pc.

That said, the European “fear gauge” – the Euro Stoxx volatility index – has cooled down to 27.8 points after hitting its highest level since the early days of the Ukraine war March 2022 at 40.8 on Monday.

IG chief market strategist Chris Beauchamp said:

If you wake up in the morning to discover that Japan is down 10-12pc, it’s going to scare the daylights out of the sanest person in the world, so it’s understandable that people take flight.

On the flipside, I think people got a bit carried away yesterday and it always seems very dramatic at the time.

It’s normal to see weakness this time of year. The question is – was that enough to reset markets or is there going to be more?

09:48 AM BST

UK construction sector expands at fastest pace in two years

Construction activity increased at its fastest pace in more than two years last month, a closely watched survey showed, as it rebounded from a slowdown in investment in the lead up to the general election.

The S&P Global UK Construction PMI rose sharply to 55.3 in July from 52.2 in June, which was above the 50 mark separating growth from contraction for a fifth consecutive month.

The rate of expansion in output was the fastest since May 2022 as construction firms remained strongly optimistic that activity will expand over the coming year.

Andrew Harker, economics director at S&P Global, said:

The election-related slowdown in growth seen in June proved to be temporary, with the pace of expansion roaring ahead in July.

Firms saw the strongest increases in new orders and activity since 2022 as paused projects were released amid reports of improved customer confidence.

The strength of demand moved the sector closer to capacity, bringing a recent period of improving supplier performance to an end.

There were also signs of inflationary pressures picking up, something that will need to be watched closely if demand strength continues in the months ahead.

09:28 AM BST

Paris declines despite European stocks rebound

European shares rebounded slightly after hitting six-month lows on Monday, tracking a recovery across Asian markets.

The continent-wide Stoxx 600 was up as much as 1pc after logging its steepest three-day decline since June 2022, closing below the key 500-point mark for a second day.

However, the Cac 40 in Paris was last down 0.4pc having begun the day in positive territory, while the Dax in Frankfurt reduced its gains as jitters about a potential US recession remain.

Among individual stock moves, Italian bank Monte dei Paschi di Siena surged 8.2poc after it raised its profit outlook.

Adecco gained nearly 5pc even as the Swiss staffing company flagged bleak hiring trends to persist in the third quarter.

Shares of Zalando gained 4pc after the online fashion marketplace reported an 18.5pc rise in its operating profit for the second quarter.

Abrdn gained 5.2pc despite the British asset manager reporting a modest dip in its assets under management in the six months ended June 30.

09:14 AM BST

Oil rebounds from seven-month lows

Energy stocks have climbed as much as 1pc across the FTSE 100 and FTSE 250 as oil prices briefly rebounded from their seven-month lows.

Brent crude, the international benchmark, had climbed above $77 a barrel amid gains in Asian shares overnight.

However, Brent has slipped back to be flat on the day at just above $76, having tumbled more than 5pc over the previous three trading sessions.

Traders are still bracing for a retaliatory attack by Iran on Israel for the assassinations of senior figures within Hezbollah and Hamas, although Tehran has reiterated it wants to avoid all-out war.

Brent came within cents of $75 a barrel on Monday before rebounding after output from Libya’s Sharara field stopped completely amid a political battle for control over the North African nation.

08:50 AM BST

FTSE 100 rebounds after recession fears knock £40bn off index

The FTSE 100 joined the rebound in broader markets a day after recession fears in the United States triggered a brutal sell-off.

The blue-chip index index was up 0.3pc, after logging its worst fall in more than a year on Monday, wiping more than £40bn off the index.

The mid-cap FTSE 250 index added 0.6pc having fallen to its lowest level in more than three months in the previous session.

Weaker US data in the last week stoked recession fears in the world’s biggest economy, pushing investors to safe-haven assets amid a sell-off that battered markets globally.

However, losses began to be pulled back after data on Monday showed a rebound in US services sector activity from four-year lows in July, alongside comments from Fed policymakers that partially soothed investors.

In London, InterContinental Hotels Group advanced as much ass 4.2pc after the Holiday Inn-owner reported a 3.2pc rise in revenue per available room (RevPAR) in the second quarter.

Keller Group rose as much as 13.8pc to top the FTSE 250 after the engineering contractor reported its half-yearly results.

Heavy-weight banks gained 1.7pc after a check from the Band of England showed that Britain’s top eight lenders could be wound down in a crisis without the immediate need for taxpayer cash.

08:33 AM BST

Rightmove shares fall as it ends deal with OpenRent

Rightmove shares dropped after the online property portal revealed it will terminate its contract with online letting agent OpenRent from September.

The company fell 5.2pc to the bottom of the FTSE 100 after it revealed it could not agree conditions with the start up.

Rightmove maintained its revenue guidance for the year in an update to shareholders but admitted that it predicts membership for landlords to its portal is expected to decline by up to 3pc.

08:22 AM BST

German factory orders rise faster than expected

German factory orders rose in June for the first time in five months in a sign of hope after Europe’s largest economy unexpected contracted in the second quarter.

Demand increased by 3.9pc compared to May, when it dropped by a revised 1.7pc, according to federal statistics agency Destatis.

Incoming orders were well ahead of economist predictions of a 0.5pc gain, which the rise driven by its car industry.

It comes after Germany’s GDP fell by 0.1pc in the three months to June, leaving it on the brink of recession.

Economists are calling on the European Central Bank to cut interest rates to help stimulate demand:

I might not have been close but my forecasted 2% gain for German factory orders was much closer than consensus. A surge in car orders & a big ammunition order helped. But both look set to reverse next month. Core orders are broadly stagnant at historic lows. Get on with it ECB. pic.twitter.com/z13mSADcbC

— Oliver Rakau (@OliverRakau) August 6, 2024

08:04 AM BST

UK markets rise after sell-off

Stock markets in London rebounded slightly after the sharp-sell off over the last two trading sessions.

The FTSE 100 began the day 0.3pc higher at 8,032.84 while the midcap FTSE 250 gained 0.6pc to 20,359.14.

07:55 AM BST

Australia holds interest rates at 12-year high

Australia’s central bank held interest rates steady at a 12-year high overnight and warned that a cut is “not on the agenda” as it battles stubbornly high inflation.

The Reserve Bank of Australia, which left the key rate at 4.35pc, had even considered raising rates, governor Michele Bullock warned.

“A rate cut is not on the agenda in the near term given what we know,” she told a news conference, saying high prices might lead rates to stay “higher for longer”.

She added: “I know this is not what people want to hear.”

The central bank’s board could still raise interest rates if needed to curb inflation, she said.

Australia’s annual inflation rate eased a little to 3.8pc in June but remains well above the RBA’s target range of 2pc to 3pc.

The central bank is closely watching world stock market ructions, she said, blaming the volatility in part on a reaction to economic news at a time of “considerable uncertainty” about the outlook.

07:48 AM BST

Reeves refuses to rule out capital gains tax raid

Rachel Reeves has refused to rule out increasing capital gains tax as she warned that she would have to take difficult decisions to fill a £22bn black hole in the public finances.

The Chancellor said Britain must strike the “right balance” on tax when she delivers her first Budget on October 30.

Labour ruled out raising income tax, national insurance or VAT in its election manifesto.

Ms Reeves told Bloomberg Television: “Of course you need to bring in the revenue to fund vital public services, but we’ve also got to grow the economy and I won’t do anything that makes it harder to achieve that economic growth and prosperity.”

She added that the overall tax burden “has got too high.”

She said: “I want to bring that tax burden down because I want to make Britain the best place to start and grow a business and I want working people to keep more of their own money in their pockets.”

07:40 AM BST

Water companies face £168m fine over sewage spills

Closer to home, Thames Water, Yorkshire Water and Northumbrian Water could face a combined £168m penalty following an investigation into their sewage treatment works.

Regulator Ofwat said it had “uncovered a catalogue of failure” by three of England’s biggest water companies resulting in “excessive spills from storm overflows”.

Ofwat’s chief executive David Black said: “Our investigation has shown how they routinely released sewage into our rivers and seas, rather than ensuring that this only happens in exceptional circumstances as the law intends.”

The penalties proposed will see Thames Water fined £104m, Yorkshire Water fined £47m and Northumbrian Water fined £17m.

07:32 AM BST

Japan’s PM calls for calm after stock market plunge

The prime minister of Japan urged restraint a day after a record selloff on Tokyo’s stock markets amid worries over the US economy and a stronger yen.

The benchmark Nikkei 225 index jumped 10.2pc overnight, or 3,217.04 points, to end at 34,675.46, while the broader Topix index added 9.3pc, or 207.06 points, to 2,434.21.

On Monday, the Nikkei plunged 12.4pc, or 4,451.28 points – the largest points drop in its history.

Prime Minister Fumio Kishida said Tuesday it was best to approach the sharp swings with a cool head as analysts predicted that volatility could continue for days.

Mr Kishida said: “The stock market has been moving again today, and I think it is important to judge this situation calmly.” Kishida said at a scheduled news conference.

“We will continue to monitor the situation with a sense of urgency and to carry out economic and fiscal management in close cooperation with the Bank of Japan.”

Nomura Securities said the market would likely remain volatile this week.

It said: “Today’s gain can be explained in one phrase: a technical rebound.”

07:31 AM BST

Stocks surge as traders pile on pressure for rate cuts amid recession fears

Asian stock markets bounced back from the brutal sell-off of the last two trading days as plunging bond yields ramp up pressure for interest rate cuts.

Tokyo’s benchmark Nikkei 225 index led gains as it jumped 10.2pc, or 3,217.04 points, to end at 34,675.46, a day after plunging 12.4pc in its worst rout since Black Monday in 1987.

Japan’s broader Topix index added 9.3pc, or 207.06 points, to 2,434.21, with nearly all Asian markets higher and the FTSE 100 on track to jump when trading begins.

However, many European markets – including Paris and Milan – are still on track to fall at the open.

Matt Simpson, senior market analyst at City Index, said: “We’re not yet sure if this is just a breather between water-boardings or there is more pain to follow.”

It comes after a rally in the $27 trillion US Treasury bond market on Monday raised pressure on the US Federal Reserve to begin cutting interest rates.

Yields on 10-year Treasury notes were back at 3.84pc, having been as low as 3.67pc at one stage.

Traders are betting there is an 83pc chance that the Federal Reserve will cut interest rates by half a percentage point at its next meeting in September, with a whole percentage point of cuts priced in by the end of the year.

Economist Campbell Harvey told Bloomberg that “the Fed likely realises now that they made a mistake last week” by leaving interest rates unchanged at their 23-year highs.

He added: “The Fed has waited too long to take action.”

07:22 AM BST

Good morning

Thanks for joining me. Japan’s benchmark Nikkei 225 index soared more than 10pc a day after it set markets tumbling in Europe and on Wall Street.

Asian markets were mostly higher but many European indexes are still expected to fall at the open amid a brutal sell-off.

5 things to start your day

1) Google abused its power to maintain monopoly on search, US court rules | Ruling comes after high-stakes battle between US government and tech giant

2) Flagship City office scheme opposed over lack of recycled carpets | Hackney councillors criticise ‘unambitious’ efforts to reuse local materials in new development in Shoreditch

3) Electric car sales forecast slashed as drivers turn to secondhand market | Demand weakens despite heavy discounting by car makers

4) Warren Buffett’s stock empire loses $15bn in global market crash | Money wiped from paper value of Berkshire Hathaway’s portfolio as its holdings Apple, Bank of America and Mitsubishi plummet in value

5) JK Rowling bankrolls legal fight against workplace gender police | Gender-critical discrimination cases are drumming up huge support as CrowdJustice takes off

What happened overnight

Japanese stocks rebounded sharply, clawing back most of the double-digit losses suffered on Monday in its steepest loss since 1987.

The Nikkei closed 10.2pc higher as investors bought into bargains after the 12.4pc rout of the day before.

Overnight, nearly all markets in Asia aside from Singapore saw gains.

The Kospi jumped 4.3pc to 2,546.64. Hong Kong’s Hang Seng index was up 0.5pc at 16,775.65 And in Australia, the S&P/ASX 200 edged 0.3pc higher to 7,677.50.

Taiwan’s Taiex was up 1.2pc after plunging 8.4pc the day before. The Shanghai Composite index, largely bypassed by Monday’s drama, was up just over 1 point, at 2,861.87.

It comes after the S&P 500 dropped 3pc for its worst day in nearly two years on Monday, closing at 5,186.33.

The Dow Jones Industrial Average reeled by 1,033 points, or 2.6pc, to 38,703.27, while the Nasdaq Composite slid 3.4pc to 16,200.08 as Apple, Nvidia and other Big Tech companies that used to be the stars of the stock market continued to wilt.