Intel’s Stock has Slumped 27%. Here’s Why It Remains a Buy in the Second Half of 2024

Intel (NASDAQ: INTC) has hit more than a few speedbumps over the last decade. The company was once the most prominent player in chips, a go-to supplier for many tech firms, and a leader in manufacturing. Yet the rising competition in its space over the last decade has left it struggling to stay relevant, and its stock is down by 40% since 2014.

However, the company has gradually begun to turn things around in the last year. In response to the surging artificial intelligence (AI) trend, Intel has debuted a new line of AI-enabled chips that are priced significantly lower than similar offerings from its rivals. Meanwhile, Intel is getting back to its roots by refocusing on manufacturing.

Taiwan Semiconductor Manufacturing (TSMC) (NYSE: TSM) won away much of its foundry market share over the last decade. Now, Intel is looking to lead the industry again by prioritizing filling a gap in the market — a scarcity of high-end chip manufacturing capacity in the U.S. Intel plans to build multiple plants in the U.S., which could lead to it gaining market share and profiting from the high demand for AI chips.

However, a recent earnings release has once again seen Intel lose investors’ trust. On Aug. 1, the company released its second quarter of 2024 earnings that missed Wall Street forecasts and saw its share price plunge 27% on Friday.

Yet, Intel remains an attractive long-term buy. The company is investing billions into the chip foundry market, which could majorly pay off over the long term. So, despite a recent slump, Intel’s stock remains a buy in the second half of 2024. Here’s why.

It’s getting worse before it gets better

Intel posted its Q2 2024 earnings last Thursday. Revenue fell just under 1% year over year, missing expectations by $150 million. Non-GAAP earnings per share of $0.02 also missed expectations by $0.08. The less-than-ideal earnings came with the news that Intel was suspending its Q4 dividend and laying off 15,000 employees, only exasperating investor concern.

However, Intel’s slip demonstrates why it’s crucial to keep a long-term perspective when investing in tech. Over the last year, the company has made many moves that show it is playing the long game, willing to give up earnings growth in the present for significant gains in the future.

For instance, increased production on Intel’s AI-enabled Core Ultra PC chips contributed to some losses in Q2. However, as CEO Pat Gelsinger explained, “We believe the trade-offs are worth it. The AI PC will grow from less than 10% of the market today to greater than 50% in 2026.”Meanwhile, Intel CFO David Zinsner revealed a recent shift from manufacturing its Intel 3 and 4 chip wafers in Ireland to Oregon, which should mean higher costs immediately but wider gross margins in the future.

Intel has gone all in on expanding its foundry capacity in the U.S., a move that could see it become the biggest AI chip manufacturer in North America and Europe in the coming years. However, manufacturing is a notoriously expensive industry to expand in, which is why many chipmakers like Nvidia and AMD choose to outsource their foundry needs. As a result, Intel’s recent quarterly results show it is going through growing pains as it invests in its future.

Meanwhile, Intel has a solid manufacturing outlook. Increasingly tense relations between the U.S. and China could threaten the West’s access to TSMC’s manufacturing facilities, negatively impacting many chip companies. Yet, Intel is the leading recipient of financial support from President Biden’s CHIPS Act. The company will receive a grant worth $8.5 billion and $11 billion in loans from other sources to help it build at least four chip fabs in the U.S. It has already begun construction on an Ohio facility that intends to be the world’s largest AI chip factory.

Rival TSMC will also receive a grant worth $6.6 billion and $5 billion in loans to build a Phoenix plant. However, Intel’s position in both design and manufacturing could give it an edge in the chip market, profiting from attractive operating margins and more control of its in-house products.

Intel is too big of a bargain to ignore

Intel’s shares took a deep dive this month. While the sell-off hasn’t been great for current investors, it has made its valuation more attractive for new ones.

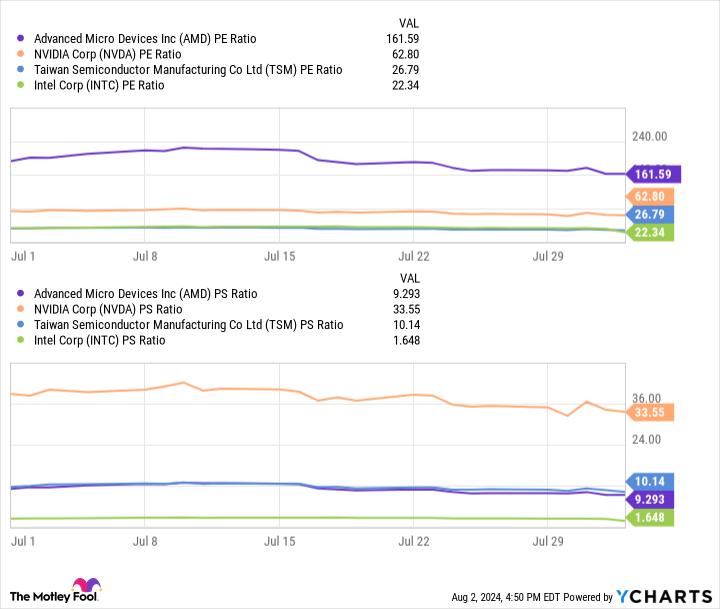

This table shows that Intel is by far the best-valued stock in the AI chip market, with a lower price-to-earnings ratio (P/E) and price-to-sales ratio (P/S) than some of the industry’s most prominent companies.

For reference, Intel’s 12-month average P/E and P/S are 67 and 3, indicating its stock is trading at a better value than it has in a year.

Intel’s valuation makes it a no-brainer chip investment in 2024 and worth considering after a recent slump.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $615,516!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Intel’s Stock has Slumped 27%. Here’s Why It Remains a Buy in the Second Half of 2024 was originally published by The Motley Fool