Mortgage and refinance rates today, August 6, 2024: The 30-year rate finally drops below 6%

Most mortgage rates have decreased today. According to Zillow data, the average 30-year fixed rate dropped 20 basis points to 5.92%, finally under 6%. The 15-year fixed rate also fell 14 basis points to 5.21%.

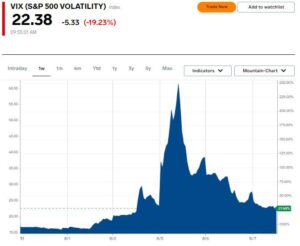

The Federal Reserve announced at last Wednesday’s meeting that it wasn’t cutting the federal funds rate yet. On Friday, the Bureau of Labor Statistics released the latest jobs report, which revealed that the economy is cooling off — one thing the Fed has been wanting before it slashes the Fed rate. Now, some are pushing for the Fed to decrease its rate before its next meeting in September. While an early cut isn’t necessarily likely, it is possible. For now, we can expect mortgage rates to stay lower and maybe even continue to trend downward.

Dig deeper: What the Fed rate decision means for bank accounts, CDs, loans, and credit cards

Today’s mortgage rates

Here are the current mortgage rates, according to our latest Zillow data:

-

30-year fixed: 5.92%

-

20-year fixed: 5.62%

-

15-year fixed: 5.21%

-

5/1 ARM: 5.86%

-

7/1 ARM: 5.77%

-

30-year FHA: 5.41%

-

15-year FHA: 4.82%

-

5/1 FHA: 5.06%

-

30-year VA: 5.20%

-

15-year VA: 4.64%

-

5/1 VA: 5.70%

Remember that these are the national averages and rounded to the nearest hundredth.

Dig deeper: Is it a good time to buy a house?

Today’s mortgage refinance rates

These are the current mortgage refinance rates, according to the latest Zillow data:

-

30-year fixed: 6.63%

-

20-year fixed: 5.70%

-

15-year fixed: 5.63%

-

5/1 ARM: 6.03%

-

7/1 ARM: 5.69%

-

30-year FHA: 5.60%

-

15-year FHA: 4.83%

-

5/1 FHA: 5.13%

-

30-year VA: 5.33%

-

15-year VA: 4.43%

-

5/1 VA: 5.58%

Again, the numbers provided are national averages rounded to the nearest hundredth. Although it’s not always the case, mortgage refinance rates tend to be a little higher than purchase rates.

Yahoo Finance mortgage calculator

A mortgage calculator can help you see how various mortgage term lengths and interest rates will affect your monthly payments. Use the free Yahoo Finance mortgage calculator to play around with different outcomes.

Our calculator also considers factors like property taxes and homeowners insurance when calculating your estimated monthly mortgage payment. This gives you a better idea of your total monthly payment than if you just looked at mortgage principal and interest.

30-year vs. 15-year fixed mortgage rates

As a rule of thumb, 15-year mortgage rates are lower than 30-year mortgage rates. When comparing 15- versus 30-year mortgage rates, know that the shorter term will save you money on interest in the long run. However, your monthly payments will be higher because you’re paying off the same loan amount in half the time.

For example, with a $400,000 mortgage with a 30-year term and a 5.92% rate, you’ll make a monthly payment of about $2,378 toward your mortgage principal and interest. As interest accumulates over decades, you’ll end up paying $455,960 in interest.

If you get a $400,000 15-year mortgage with a 5.21% rate, you’ll pay about $3,207 monthly toward your principal and interest. However, you’ll only pay $177,279 in interest over the years.

If that 15-year mortgage monthly payment is too high, remember you can always make extra mortgage payments on your 30-year loan to pay off your mortgage faster and ultimately pay less interest.

Fixed-rate vs. adjustable-rate mortgages

With a fixed-rate mortgage, your rate is locked in from day one. However, you will get a new rate if you refinance your mortgage.

An adjustable-rate mortgage keeps your rate the same for a set period of time. Then the rate will go up or down depending on several factors, such as the economy and the maximum amount your rate can change according to your contract. For example, with a 7/1 ARM, your rate would be locked in for the first seven years, then change every year for the remainder of your term.

Adjustable rates sometimes start lower than fixed rates, but once the initial rate-lock period ends, you risk your interest rate going up.

Dig deeper: Adjustable-rate vs. fixed-rate mortgage — Which should you choose?

When will mortgage rates finally drop?

Mortgage rates have been inching downward overall, but the shifts have been gradual and at times minimal. In Fannie Mae’s Housing Forecast for July, the government-sponsored enterprise said it expects 30-year fixed rates to end 2024 at 6.7% and 2025 at 6.2%. The Mortgage Bankers Association predicted a slightly lower rate of 6.6% by Q4 2024 and 6.0% by the end of 2025. So while rates may drop later this year, they probably won’t fall dramatically until well into 2025.

The trajectory of future mortgage rates will largely depend on the Federal Reserve’s decision on whether or not to cut the federal funds rate at its meetings throughout the year. The federal funds rate doesn’t directly impact mortgage rates, but it is a good indicator of how the economy is doing overall. So when the Fed rate drops, mortgage rates typically go down too. The next Federal Reserve announcement will be September 18, but there are speculations that the Fed could lower its rate earlier.

Mortgage rates today: FAQs

What is today’s 30-year fixed rate?

According to Zillow data, today’s 30-year fixed rate is 5.92%. This is the national average, so keep in mind the average in your state or city could be different. Your rate will also vary depending on your personal finances.

Are mortgage rates expected to drop?

Yes, mortgage rates are expected to inch down in 2024. However, we likely won’t see more aggressive rate drops until 2025.

Will mortgage rates go down in 2024?

Mortgage rates will likely continue to go down in 2024, then more significantly in 2025.