Weekly Stock List

Summary

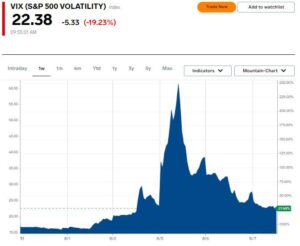

Focusing on Min Vol stocks can be a relatively safer investment strategy during turbulent times — and the current economic environment certainly is challenging. The so-called “Magnificent 7” were leading the markets higher and now are leading the market lower. There was an initial shift from Big Tech to small-caps and then a bit of a shift back. But now there’s an overall downshift in equities of all stripes. Meanwhile, the economy is hard to read. The labor market is cooling, inflation hasn’t fallen enough, interest rates are still elevated, and yet GDP is steady. Did the Fed wait too long to start cutting interest rates? Yet as the market fluctuates, we note that investors exit equities at their own peril. That’s because long-term returns from stocks consistently have outpaced long-term returns from other asset classes. Argus believes that Min Vol is an all-weather strategy that is timely in any investing climate. Academic literature and, more to the point, returns history, indicate that Min Vol can deliver market-matching returns on an absolu

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level