Is Nvidia Stock a Buy Now?

AI market darling Nvidia (NASDAQ: NVDA) has cooled off, dropping roughly 15% since peaking at a $3.3 trillion market cap just a few weeks ago. Despite the recent stumble, the stock has gained over 100% over the past year. Volatility is normal for any stock that rises so much in a short amount of time.

But Nvidia’s current dip isn’t an automatic buying opportunity. Question marks are starting to pile up as the company prepares to announce second-quarter earnings in a few weeks.

Here are the risks investors should consider before buying the stock today.

Is Nvidia’s market share under attack?

The artificial intelligence (AI) race began in early 2023 with the viral arrival of ChatGPT. Nvidia’s GPUs, which can optimize for AI applications using proprietary software, quickly established a dominant market share. Industry estimates have pegged Nvidia’s AI market share as high as 70% to 95%. Research from TechInsights estimates Nvidia accounted for 98% of total data center GPU revenue in 2023.

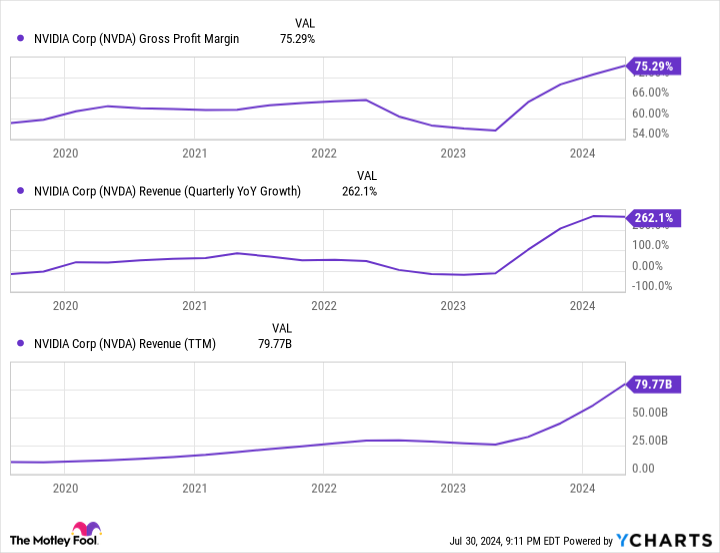

Nvidia’s financials back that up; revenue growth accelerated to nearly 300%. Technology CEOs like Elon Musk openly pleaded they couldn’t get Nvidia’s chips fast enough. Such high demand has done wonders for Nvidia’s pricing power, too. Gross profit margins have expanded significantly to over 75%:

But it’s hard staying on top when everyone is coming for your crown, and many of these big chip spenders may not enjoy being at Nvidia’s mercy. It’s known that competitors like Intel and AMD are pushing alternatives, and big technology companies like Amazon, Alphabet, and Meta Platforms are building custom AI chips.

Alphabet may have struck the first known blow to Nvidia’s dominance. Apple (NASDAQ: AAPL) recently disclosed that it used 2,048 of Alphabet’s TPU v5p chips to build the AI that will run on iOS devices. For its server AI model, Apple deployed 8,192 TPU v4 processors. These tensor processing units (TPUs) are purpose-built to train AI models. Apple didn’t say it didn’t use Nvidia chips, but omitted Nvidia when describing its hardware and software build.

Heading into earnings with sky-high expectations

Apple’s tie-up with Alphabet is significant for multiple reasons.

First, Apple’s AI project is critically important, and the company chose Alphabet’s chips despite the perception that Nvidia was the de facto industry leader and go-to chip vendor. It’s just one instance, but it’s now fair to question whether Nvidia’s AI moat is as wide as initially thought.

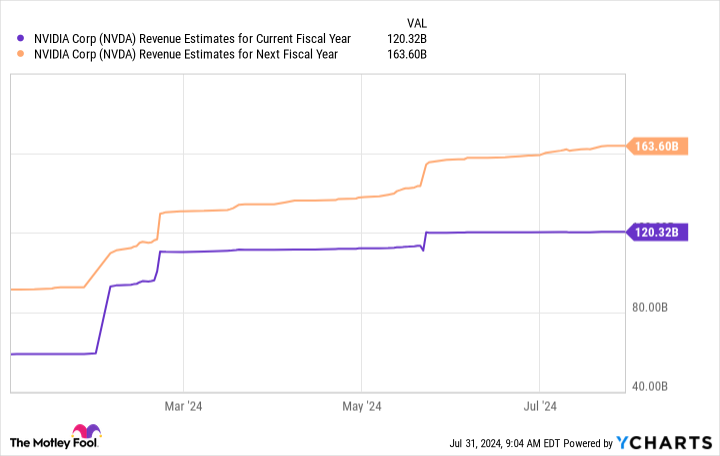

Second, analysts’ revenue estimates remain very optimistic despite potential competitive pressure. You can see that estimates for 2024 and 2025 are as high as ever:

Third, genuine competitive pressures would likely threaten Nvidia’s gross profit margins, which (as you saw in the first chart) have expanded beyond 75%. Over the past five years, Nvidia’s gross margins have averaged 63%. Even if Nvidia retains the lion’s share of the AI chip market, it may no longer do so at any price. Prices may have to come down to compete.

How should investors approach Nvidia today?

The potential downside in both revenue and gross margins should concern investors. I’m not saying that Nvidia can’t or won’t remain the leading AI chip company. But it’s becoming increasingly plausible that deep-pocketed competitors can win business. Many of these big technology companies building custom AI chips are currently Nvidia’s largest customers!

Maybe the broader demand for AI chips will be so great that Nvidia can grow while ceding some of its market share. The risk is that it can’t, that Nvidia’s AI revenue could peak and then moderate or even decline as other AI chips flood the market. Q2 earnings could easily be another blowout quarter. Investors will want to pay close attention to management’s full-year guidance, which should reveal future sales momentum.

Nvidia could prove volatile as Wall Street chews on these questions. Investors may want to consider waiting to see how Q2 earnings look before aggressively buying shares. At the very least, consider dollar-cost averaging your Nvidia investments. That’s a smart way to manage uncertain markets or falling stock prices. By investing a fixed amount at regular intervals, you can lower your average cost per share over time. This method helps you buy more when prices are low, offering a strategic advantage in volatile markets.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Apple, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Is Nvidia Stock a Buy Now? was originally published by The Motley Fool