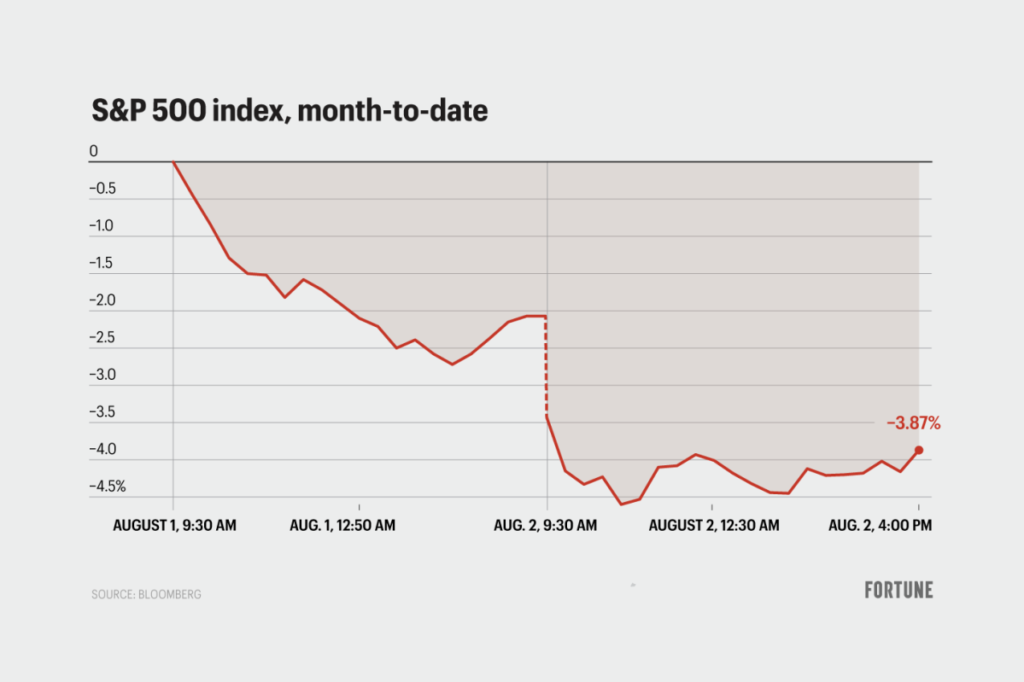

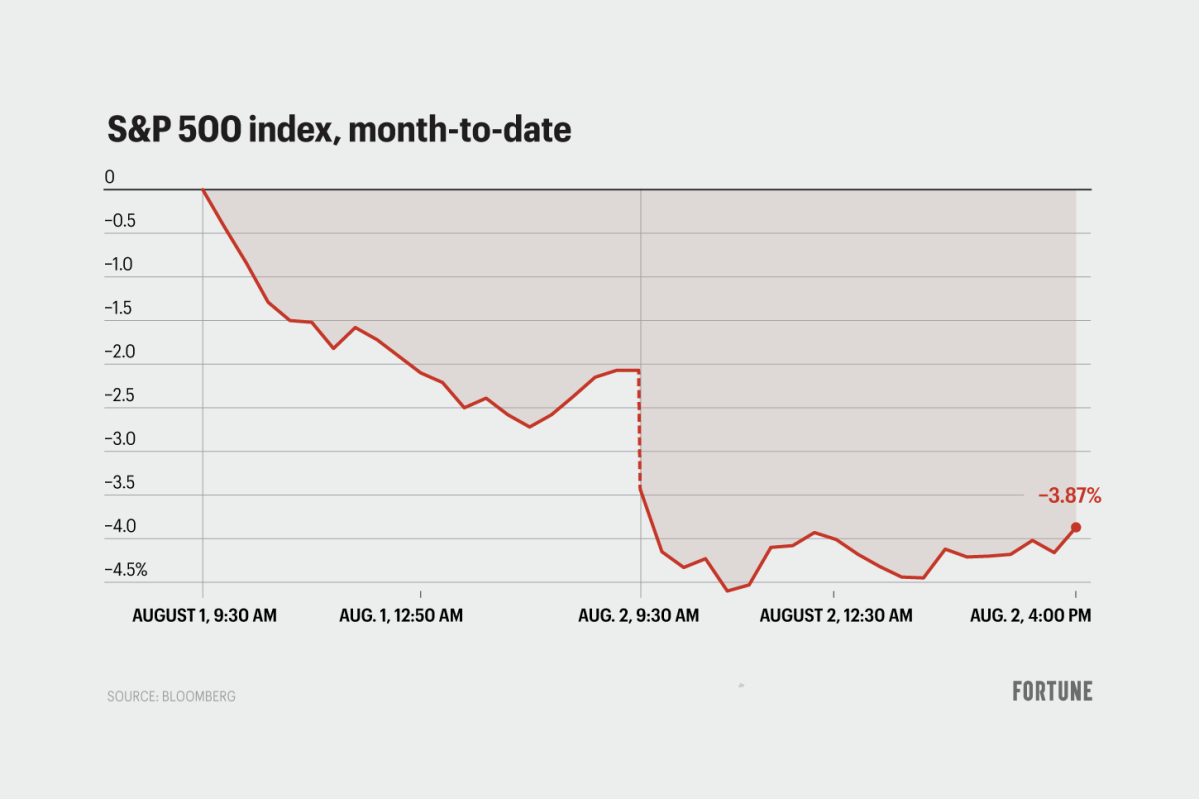

What’s behind the stock market’s brutal 2-day crash?

What a way to end the week. The market plunged again Friday, with the Dow closing down 600 points, the Nasdaq dropping 2.4% and the S&P off 6% from its recent all-time high.

Market watchers pointed to three main culprits for the swoon:

-

A weak jobs report reignited recession fears on Wall Street. The rise of the unemployment rate to 4.3% certainly seemed to spook investors. The new data from the Labor Department triggered the so-called Sahm Rule, which indicates the likely start of a recession once the unemployment rate’s three-month moving average exceeds that measure’s lowest point over the trailing 12 months. “We completely flipped from a position where a weaker economy was bullish to [one where] a weaker economy is bearish,” said Jay Hatfield, the CEO of Infrastructure Capital Advisors.

-

Short-term traders drove a global sell-off. According to Hatfield, short-term investors like hedge funds sold in droves over the past two days. He thinks they are hesitant to stay long on stocks now that earnings season is over. That said: “We think the chance of recession remains extraordinarily low,” Hatfield said, “and the sell-off is irrational.”

-

Investors wanted a rate cut. Hatfield agreed with investors who criticized the Federal Reserve for not cutting rates on Wednesday. He compared FED chair Jerome Powell, who said a cut could be “on the table” for September, to Inspector Clouseau, the fictional detective consistently outwitted in The Pink Panther films. “One of their three mandates is to be behind the curve,” Hatfield said of Powell’s Fed. “So until it’s entirely obvious to everyone else in the investing world that they should cut, they’re not going to cut.”

One factor experts say likely wasn’t at play? Steep losses from mega-cap names, Hatfield added, were likely not a big driver of the market dip. Intel shares plunged 26% after the company reported a big earnings miss and announced mass layoffs, while Amazon’s stock fell 9% after a disappointing earnings call. But Apple, America’s largest company, emerged from Friday’s session slightly up.

This story was originally featured on Fortune.com