Alphabet’s fund CapitalG cut stake in CrowdStrike before July global outage

(Reuters) -Google-parent Alphabet (NASDAQ:)’s independent growth fund CapitalG cut its stake in cybersecurity company CrowdStrike (NASDAQ:) , according to a regulatory filing on Friday, much before a global outage last month triggered by a software update.

The fund cut its stake to 427,895 class A shares from 855,789 shares. The change in holdings is as of June 30.

CrowdStrike did not immediately respond to a Reuters request for comment.

A worldwide tech outage on July 19 following a software update by CrowdStrike had crippled computer systems globally, affecting sectors ranging from healthcare and banking to aviation.

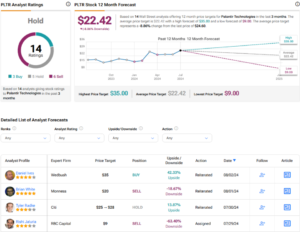

CrowdStrike shares have lost nearly 35% of the value since the outage as investors rethink their security strategy and regulators debate whether it is safe to have complex and critical software in the hands of a large companies.

The company was sued by shareholders on Wednesday over misleading and false assurances about its software which caused the global outage.

Delta CEO told CNBC earlier this week the outage cost the airline $500 million and it has hired a law firm to seek compensation from Microsoft (NASDAQ:) and CrowdStrike.