3 Dividend Stocks to Double Up on Right Now

Investors looking for dividend stocks to buy often stop with a high dividend yield. A good dividend stock, however, may not yield much but pays you regularly — and even better, pays you more and more with time. That’s the only real way to earn income from dividend stocks. And once you understand the importance of dividend stability and growth, picking the right stocks to buy becomes that much easier. For instance, few dividend stocks look so compelling that you’d want to double up on them right now. Here are three to start with.

Big growth plans to boost dividends

My first stock pick for income investors today is NextEra Energy (NYSE: NEE). It’s a dividend powerhouse, with a growing payout year after year backed by earnings growth. Of course, NextEra Energy’s incredible foothold in two big industries helps.

NextEra Energy owns and operates the largest utility in the U.S., Florida Power & Light Company (FPL). It is also the largest producer of energy from wind and solar and a top player in energy storage. So while its utility business generates stable earnings and cash flows, clean energy is the company’s growth driver. Combined, the two businesses allow NextEra Energy to pay steady and growing dividends — it grew its dividend at a compound annual growth rate (CAGR) of nearly 10% over the past 20 years, driven by around 9% growth in its adjusted earnings per share (EPS).

NextEra Energy expects to grow adjusted EPS by 6% to 8% through 2027 and believes it should be able to grow its annual dividend by around 10% through 2026. The company plans to pump $65 billion to $70 billion into its renewables business alone over the next four years, and that’s where its earnings and dividend growth should come from. So even if NextEra Energy stock’s 2.8% yield doesn’t appeal to you much, the stock’s regular dividend raises could still fetch handsome returns.

A rock-solid Dividend King

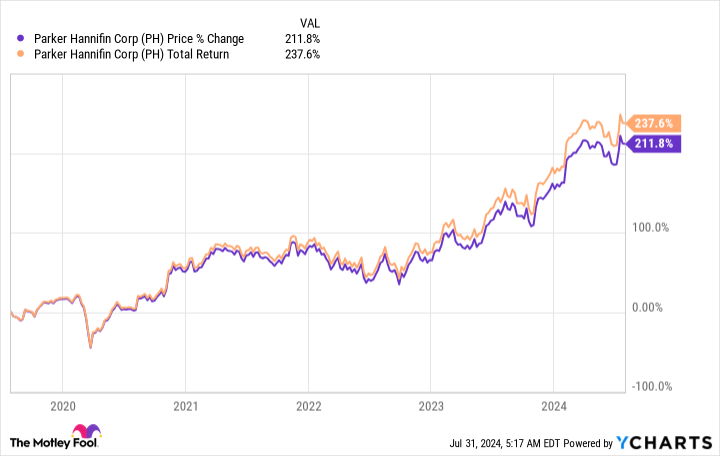

You may be surprised to see an industrials stock that yields 1.2% on a list of dividend stocks to double up on, but you’d be even more surprised once you know what an incredible dividend stock Parker-Hannifin (NYSE: PH) is. Parker-Hannifin is a Dividend King with a 68-year record of annual dividend increases. Its dividend has also grown at an impressive CAGR of 14% between 2019 and 2024. That’s one of the strongest dividend profiles I’ve seen in a while.

What’s the key to Parker-Hannifin’s dividend track record? Parker-Hannifin is the leader in motion and control technologies and makes a broad set of products within hydraulics, filtration, pneumatics, and more. Its most important market is aerospace and defense, but it also serves transportation, industrial equipment, off-highway, and energy customers. Parker-Hannifin has grown steadily in recent years through acquisitions and greater focus on products with a longer life cycle that will ride secular trends like electrification and digitalization.

Parker-Hannifin shares have rallied more than 200% in the past five years. Here’s why the stock is still an incredible buy: The company expects to grow its free cash flow by 50% and double its dividend over the next five years. That should mean bigger dividends for shareholders year after year, all of which should also reflect in the stock’s price.

The market’s fear is a buy signal

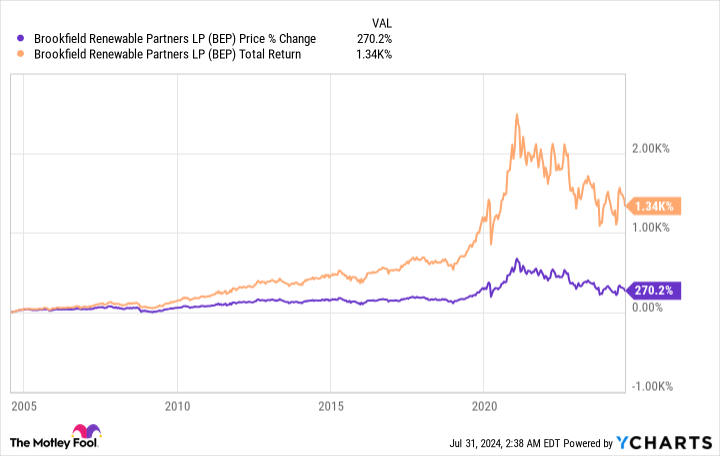

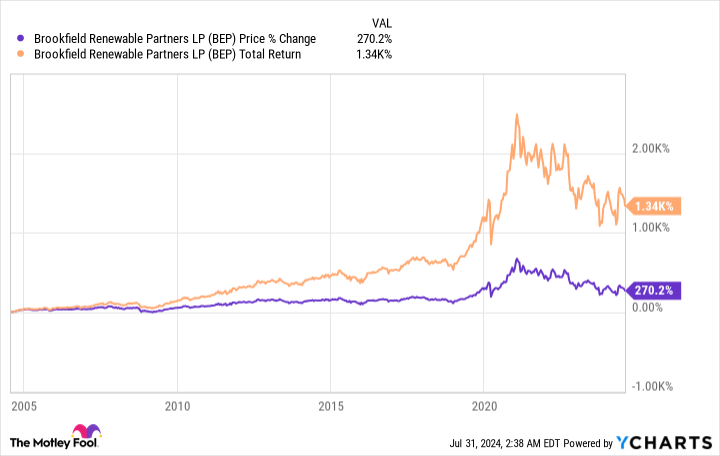

In its latest letter to shareholders, Brookfield Renewable (NYSE: BEPC)(NYSE: BEP) called itself a “key enabler of one of the most significant growth trends in recent history.” It was referring to digitalization, artificial intelligence, and cloud computing. No, Brookfield Renewable isn’t a tech company — it’s a renewable energy company.

The thing is, demand for sustainable electricity, and therefore clean energy, should rise alongside global digitalization and data center build-out. Brookfield Renewable should be a key beneficiary, as it is one of the world’s largest publicly traded renewable energy companies and almost 40% of its development pipeline is outside of the U.S., spread across Europe, Asia-Pacific, and South America. The company recently signed a landmark deal with tech giant Microsoft to deliver more than 10.5 gigawatts of new renewable energy capacity between 2026 and 2030 to support its cloud services.

In short, there are massive growth opportunities for Brookfield Renewable. The company is already growing steadily, with its funds from operations (FFO) per unit rising at a 12% CAGR between 2016 and 2023 and dividend growing at a 6% rate over the past couple of decades. That dividend growth has made patient investors a lot of money in the stock.

Brookfield Renewable expects to invest $7 billion to $8 billion into growth over the next five years and is targeting at least 10% annual FFO and 5% to 9% dividend growth through 2028. Combine that with a yield of 5%-plus, and Brookfield Renewable stock could fetch you double-digit annualized returns. It’s an opportune time to buy, what with shares of both the corporate and partnership down double-digits in the past year or so. Investors in the U.S. may want to buy corporate shares though to avoid filing a K-1 tax form and foreign tax withholding.

Should you invest $1,000 in Brookfield Renewable right now?

Before you buy stock in Brookfield Renewable, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Renewable wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $717,050!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Brookfield Renewable, Microsoft, and NextEra Energy. The Motley Fool recommends Brookfield Renewable Partners and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Dividend Stocks to Double Up on Right Now was originally published by The Motley Fool