Coca-Cola Is a Rock-Solid Dividend Stock, but So Are These High-Yield Stocks That Are Down Between 13% and 30% Over the Last Year

Coca-Cola (NYSE: KO) is one of the most reliable dividend stocks out there. And it’s been on a tear, too — hitting a fresh all-time high on Friday after reporting strong earnings. With a yield of 2.9%, Coke is an excellent choice for reliable passive income. However, there are plenty of other options to add to a diversified income-producing portfolio.

Here’s why United Parcel Service (NYSE: UPS), Devon Energy (NYSE: DVN), and Air Products & Chemicals (NYSE: APD) are three dividend stocks to buy now.

UPS continues to test investor patience

Daniel Foelber (UPS): UPS is down over 30% in the past year and 45% from its all-time high. The stock is now hovering around a four-year low. And unfortunately, a great deal of the sell-off is justified.

UPS’ results have been awful. Revenue growth is negative. Operating margin has plummeted into the single digits. And to top it all off, UPS just lowered its guidance for full year 2024. It is now forecasting $93 billion in consolidated revenue, an adjusted operating margin of 9.4%, $4 billion in capital expenditures, and $500 million in stock buybacks. In the first quarter of 2024, UPS reaffirmed its prior targets, which called for $92 billion to $94.5 billion in consolidated revenue, an operating margin of 10% to 10.6%, and $4.5 billion in capital expenditures.

Anytime a company reports a bad quarter and revises its guidance down, there’s a good chance Wall Street is going to be unhappy. But UPS has built a habit of overpromising and underdelivering over the last few years, starkly contrasting the early part of the COVID-19 pandemic when it was blowing expectations out of the water.

In March, UPS gave an investor presentation discussing its big plans for a turnaround and a return to growth by 2026 — including $108 billion to $114 billion in revenue and higher margins. The event was an opportunity for UPS to reset expectations. But so far, UPS is moving in the opposite direction. How can investors expect UPS to hit its three-year goals if it can’t even get a handle on its near-term estimates?

Despite all the negatives, UPS stands out as a worthwhile turnaround play. The core issue is that it overexpanded shipping routes in anticipation of sustained higher delivery volumes. To its credit, UPS admitted in its March investor presentation that its forecast didn’t pan out. It is now backpedaling to try to align its business with demand. The good news is that UPS still commands a powerful global market position and has what it takes to successfully turn things around — it just may take longer than expected. In the meantime, the stock has a whopping 5.1% dividend yield, the most it has yielded in over 15 years. It’s a sizable incentive to be patient and hold the stock, but only if you have a long-term mindset and the understanding that the situation could continue getting worse before it gets better.

Look out for significant dividend increases from Devon Energy in the coming years

Lee Samaha (Devon Energy): Oil and gas company Devon Energy’s stock is down 13% over the last year. While that might not seem like a big deal, it is when you compare it to the 20.6% rise in the S&P 500 and the nearly 48% rise in Diamondback Energy, an oil and gas company of comparable size.

So why has the market fallen out of love with Devon Energy, particularly in a year when the price of oil per barrel has been either $70 or $80? One reason comes down to the market’s concern over its capital allocation policy. Instead of hiking its variable dividend, management has focused on initiating share buybacks on the basis that its share price materially undervalued the business.

In addition, in common with many other oil companies, Devon has been looking to take advantage of low valuations to acquire oil assets to generate future cash flows. That uncertainty is now over, and the deal looks attractive. Management recently announced a $5 billion deal to buy the Williston Basin business of privately held Grayson Mill Energy.

Based on the share price at the time of the deal of around $46.50 (the stock is around $46.33 at the time of writing), management estimates the addition of the new assets will mean Devon Energy will generate 9% of its market cap at a price of oil of $70 a barrel, 12% at $80 a barrel, and 14% at $90 a barrel. Those look like excellent valuations, provided the price of oil stays high, and suggest Devon Energy could substantially increase its overall dividend in the future.

Air Products generates steady cash flow to power its growing dividend

Scott Levine (Air Products): With so many to consider, it may feel overwhelming trying to find reliable dividend stocks to power your portfolio with prodigious passive income. Once investors discover Air Products, however, that unease should quickly melt away. Besides its consistent record of rewarding shareholders with a growing dividend, the company — a leader in the production and distribution of industrial gases — has simultaneously prioritized maintaining its financial health. And with the stock hanging on the discount rack, now seems like a great time to pick up Air Products stock along with its 2.7% forward dividend yield.

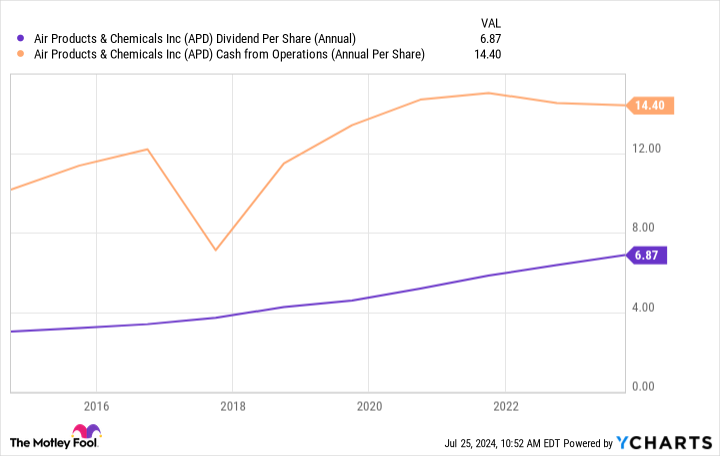

Growing its dividend for the past 41 years, Air Products has proved its steadfast dedication to shareholders, and there’s no indication from the company that this dedication will taper off anytime in the foreseeable future. The increases, moreover, aren’t nominal. Over the past 10 years, Air Products has hiked its dividend at a 9% compound annual growth rate. For skeptics who question whether this has imperiled the company’s financial well-being, the answer is simple: It certainly has not. Since 2014, Air Products has averaged a conservative payout ratio of 62%.

Add to this the fact that Air Products generates strong operating cash flow, and it’s clear that the company’s attention to its dividend hasn’t jeopardized its financial health.

Operating in more than 50 countries, Air Products provides its various industrial gases to customers found in more than 30 industries. That’s not to say that there still aren’t growth opportunities the company is pursuing. Air Products is committed to growing its hydrogen assets, developing hydrogen production assets in North America, Europe, and the Middle East.

With shares trading at 16.1 times operating cash flow, a discount to their five-year average cash-flow multiple of 17.4, today’s a great time to gas up on Air Products stock.

Should you invest $1,000 in United Parcel Service right now?

Before you buy stock in United Parcel Service, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and United Parcel Service wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

Coca-Cola Is a Rock-Solid Dividend Stock, but So Are These High-Yield Stocks That Are Down Between 13% and 30% Over the Last Year was originally published by The Motley Fool