3 Stocks I Plan to Double Down On If the Stock Market Plunges

For nearly two years, the bulls have been wild on Wall Street. Since the ageless Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC) bottomed out in October 2022, they’ve all gone on to hit multiple record highs.

While history unequivocally shows that patience pays off handsomely on Wall Street, it also tells us that stocks rarely move up in a straight line. The prospect of a sizable decline in stocks appears to be building, which could open up meaningful opportunities to buy stakes high-quality companies at a discount.

The ingredients for a stock market plunge do exist

Let me preface this discussion by stating that it’s impossible to concretely predict, with any sustained accuracy over the long haul, when stock market corrections will begin, as well as know ahead of time how far the Dow Jones, S&P 500, and Nasdaq Composite could fall. Nevertheless, corrections, bear markets, and even crashes are a normal and inevitable part of the investing cycle.

As much as investors have enjoyed the relatively steady climb for the broader market since October 2022, the catalysts for a plunge do exist.

For one, Wall Street has been propelled by the euphoria surrounding artificial intelligence (AI). Although the “Magnificent Seven” have spent a small fortune on the hardware powering their AI-accelerated data centers, the reality is that there hasn’t been a next-big-thing innovation for three decades that’s avoided an early innings bubble.

Regardless of how game-changing or innovative the trend, investors always overestimate the adoption rate and utility of new technologies. With cracks becoming apparent in Nvidia‘s armor, it seems like a matter of when, not if, the AI bubble will burst.

Valuation is another undeniable concern for Wall Street.

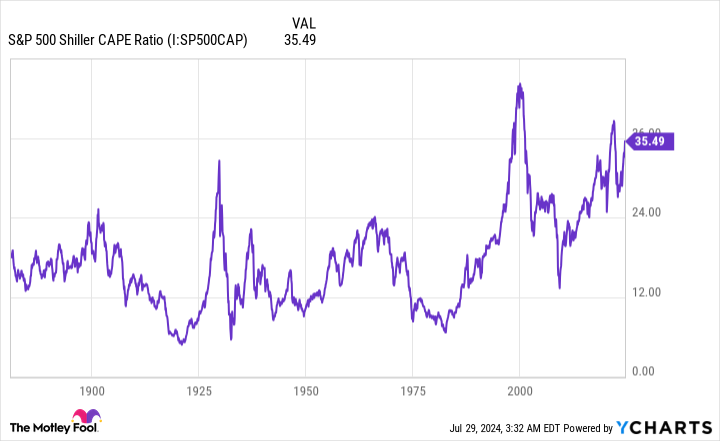

As of the closing bell on July 26, the S&P 500’s Shiller price-to-earnings (P/E) ratio — also known as the cyclically adjusted price-to-earnings ratio (Cape ratio) — stood at north of 35, which is more than double its average of 17.14, when back-tested to 1871.

More importantly, there have been six occasions in 153 years where the S&P 500’s Shiller P/E surpassed 30 during a bull market rally. All five previous instances were eventually followed by declines of 20% to 89% in the S&P 500, Nasdaq Composite, or Dow Jones Industrial Average.

Although the Shiller P/E ratio isn’t a timing tool, it does portend meaningful downside to come for Wall Street’s leading stock indexes.

Other factors, such as the longest Treasury yield-curve inversion in history, as well as the first notable decline in U.S. M2 money supply since the Great Depression, add fuel to the fire that a double-digit percentage downturn is warranted for Wall Street.

While stock market plunges can be unnerving over short periods, they’ve historically paved the way for patient investors to buy amazing stocks at a discount. If the stock market were to plunge in the coming weeks, months, or quarters, I’ll be looking to double my existing stakes in the following three stocks.

Visa and Mastercard

My biggest portfolio regret has nothing to do with selling a stock too early or purchasing what turned out to be a big-time loser. Rather, it’s not making payment facilitators Visa (NYSE: V) and Mastercard (NYSE: MA) core holdings when I purchased them for the first time during the COVID-19 crash in 2020.

Like most financial stocks, Visa and Mastercard are cyclical. This means they’re going to move in-tandem with the health of the U.S. and global economy. Even though economic contractions and recessions are normal and inevitable, they’re short-lived.

Only three of the 12 recessions that have taken place since the end of World War II reached the 12-month mark. This means Visa and Mastercard are well-positioned to take advantage of a steady increase in consumer and enterprise spending during lengthy periods of economic expansion.

Both companies offer extensive growth opportunities outside the confines of the U.S. Visa’s recently released fiscal third-quarter results featured 14% growth in currency-neutral cross-border payment volume. Meanwhile, Mastercard delivered 18% constant-currency cross-border payment volume growth in the March-ended quarter. Whether it’s organically or through acquisitions, Visa and Mastercard have a lengthy runway to expand the reach of their payment infrastructure into fast-growing, but chronically underbanked, emerging markets.

These two companies have also avoided the temptation of dipping their proverbial toes into the lending arena. By remaining solely focused on payment facilitation, Visa and Mastercard avoid the direct hit lenders take via loan losses and credit delinquencies. Not having to set aside capital during periods of economic turbulence is a competitive edge that cannot be overstated enough.

Furthermore, shares of Visa and Mastercard remain reasonably priced. While their forward P/E ratios of 23 (Visa) and 26 (Mastercard) are higher than the broad-based S&P 500’s forward P/E, Visa and Mastercard are growing faster than the average S&P 500 company, and they’re trading at respective discounts of 19% (Visa) and 34% (Mastercard) to their average forward-year earnings multiple over the last five years.

Visa and Mastercard collectively account for less than 1% of my invested assets. If the stock market plunges, I’ll be looking to more than double my stake in both companies.

Fiverr International

The third stock I plan to double down on if the stock market plunges is a company that’s already among my top-20 holdings (for context, I hold positions in 37 companies at the time of this writing). I’m talking about online-services marketplace Fiverr International (NYSE: FVRR).

It’s no secret that the labor market and U.S. economy are often tethered at the hip. If economic activity weakens or a recession takes shape, it’s perfectly normal for the unemployment rate to rise. This means Fiverr is cyclical and will, ultimately, benefit from periods of economic expansion lasting substantially longer than contractions.

But there’s more to like about Fiverr over the long run than just disproportionately long periods of economic expansion.

On a macro basis, Fiverr is going to benefit from the post-pandemic shift of the labor market. While some workers returned to their office-based jobs, more people than ever are working remotely. A more remote workforce plays right into the hands of Fiverr’s online marketplace for freelancers.

Though there are a number of online-services websites for jobseekers and freelancers to choose from, Fiverr has stood out for its uniqueness. Instead of following the pack and allowing freelancers to price their services on an hourly basis, Fiverr’s freelancers price their jobs as completed tasks. This is a considerably more cost-transparent way for freelancers to market their services, and it’s absolutely resonated with buyers. Despite some modest recent weakness in aggregate buyers on Fiverr’s platform, spend per buyer has continued to climb.

Best of all, Fiverr’s take rate is tops among freelancer marketplaces. The take rate describes the percentage of each deal negotiated on its platform, including fees, that it gets to keep. While most of Fiverr’s peers have take rates in the mid-to-high teens, Fiverr’s climbed to 32.3% in the first quarter. This means it’s able to collect far more than its competitors, yet isn’t driving away the foundation (buyers and freelancers) that make its business tick.

Doubling my stake in Fiverr during a big correction would increase its weighing in my portfolio to around 3%. This seems more than reasonable for a promising company with a long growth runway that’s valued at just 9 times forward-year earnings.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,554!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,185!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $340,492!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of July 29, 2024

Sean Williams has positions in Fiverr International, Mastercard, and Visa. The Motley Fool has positions in and recommends Fiverr International, Mastercard, Nvidia, and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

3 Stocks I Plan to Double Down On If the Stock Market Plunges was originally published by The Motley Fool