Stocks are approaching a ‘watershed’ moment as rate cuts unlock opportunity in unloved areas of the market, Wharton professor Jeremy Siegel says

-

The stock market is about to see a major shift once the Fed cuts rates, Jeremy Siegel said.

-

The top economist thinks value stocks could start outperforming growth stocks once the Fed eases policy.

-

Cooling inflation data supports a Fed rate cut by September, Siegel predicted.

Stocks are about to reverse a long-running trend as rate cuts unlock an unsung area of the market, according to top economist Jeremy Siegel.

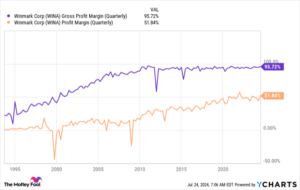

The Wharton School finance professor pointed to opportunity lurking in value stocks, an unloved group of the market that’s underperformed this year when compared to growth stocks.

The S&P 500 Value index has climbed just 8% so far this year, according to S&P Global data. Those are far more muted returns than those seen in the S&P 500 Growth index, which has soared 20% from levels in January.

Growth stocks have outperformed partly due to Wall Street’s AI craze, which has ignited investor fervor for growth stocks, like mega-cap tech firms.

But doubts are scaling over whether generative artificial intelligence is as revolutionary as investors originally priced in, Siegel said. Meanwhile, the Fed looks poised to soon issue its first rate cut, which could unlock more movement on the market’s value side, he predicted.

“You’re not going to get value moving until the Fed drops rates, and more and more, when you see that rate drops are in the cards for the Fed, I think that narrative could very well continue,” Siegel said in an interview with CNBC on Friday. “This really could be a watershed in terms of a trend we’ve seen for many many months, if not many years, of growth beating value.”

Recent inflation data also makes the case for a soon-to-come Fed cut, Siegel said. The personal consumption expenditures price index, which is the Fed’s preferred measure of inflation, continued to cool last month, fueling more hope that central bankers will soon ease up on monetary policy.

“Forward-looking, I think inflation looks very, very good,” Siegel said, adding that an unexpectedly hot price reading wouldn’t change the downward path of rates this year. “I don’t think it changes the narrative of it at all that J. Powell is going to tee up a rate cut for the September meeting,” he added.

Fed officials are set to convene this Tuesday and Wednesday to discuss their next policy move. Markets are pricing in a 96% chance the Fed will keep rates level on Wednesday but a 100% chance central bankers will cut rates at least 25 basis points by September, according to the CME FedWatch tool.

Read the original article on Business Insider