Use the sell-off in tech stocks as a chance to buy the dip, UBS says

-

UBS sees the recent tech stock sell-off as a buy-the-dip opportunity for long-term investors.

-

The sell-off has been driven by an overall shift from large-cap to smaller-sized companies.

-

UBS cites attractive valuations, solid fundamentals, and fading technical factors as reason to stick with large-cap tech.

This month’s sell-off in technology stocks represents a buy-the-dip opportunity for long-term investors, according to a Monday note from UBS.

The sell-off was exacerbated by a rotation out of large-cap stocks and into smaller-sized companies, leading some to question if the years-long trend of mega-cap tech stocks outperforming the market is over.

But according to UBS, the recent decline in tech stocks is only temporary, and that should be apparent when mega-cap tech stocks report their second-quarter earnings results later this week.

“With results still due from some big firms this week, market volatility is likely to continue. But we think the tech sector should find support in the coming weeks and resume its leadership,” UBS said.

The confidence from UBS stems from a trifecta of factors: compelling valuations, fundamentals, and technicals.

“Tech valuations have become attractive again.”

The technology sector has experienced a 10% sell-off nearly every year over the past decade, so the recent 9% decline in the Nasdaq 100 is not out of the ordinary, according to UBS.

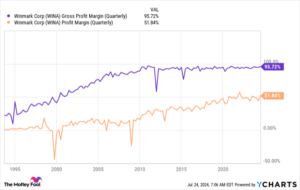

A healthy sell-off in tech stocks has led to more attractive valuations for the fast-growing sector, especially when compared to previous bubbles.

“While the tech sector appears to be expensive after the rally this year, price-to-earnings multiples remain much lower than in the dot-com era, when many tech stocks had much lower-quality earnings,” UBS said.

“Tech fundamentals remain solid.”

With Apple, Amazon, Microsoft, and Meta Platforms on deck this week to report earnings, UBS says the tech sector should see a net profit growth of 20% to 25% in the second-quarter.

“Today’s tech leaders also offer high-quality margins, strong free cash flows, and solid balance sheets, a positive driver amid slowing economic activity,” UBS said.

And that growth should last for many years as the AI revolution requires massive investments in architecture, like Nvidia’s GPU chips and new datacenters.

“As Alphabet CEO Sundar Pichai pointed out, ‘the risk of underinvesting is dramatically greater than the risk of overinvesting,” UBS highlighted.

“Technical factors supporting the rotation are likely to fade.”

Short-squeezes, call option activity, and bank hedging have fueled the rotational trade into small cap stocks, but that won’t last forever, according to UBS.

“The positioning influence on the rotation trade will soon dissipate, as such technicals typically do after about a month,” UBS said. “So, we think the environment remains favorable for quality tech stocks, and believe that investors should ensure they have sufficient exposure to AI beneficiaries within and outside the US.”

Read the original article on Business Insider