Here’s How Much Money You’d Have Now If You Invested $10,000 in Warren Buffett’s Favorite ETF 10 Years Ago

Fire is hot. Ice is cold. Water is wet. Some statements are so self-evident they don’t need to be made. However, I’ll add one more to the list: Warren Buffett knows how to make money.

Buffett’s net worth currently stands at nearly $138 billion. He amassed this fortune by buying businesses (notably including Berkshire Hathaway) and investing in stocks. But Buffett has also bought some exchange-traded funds (ETFs) along the way.

Could you rack up hefty profits by investing in ETFs that Buffett likes? Yep. Here’s how much money you’d have now if you invested $10,000 in Buffett’s favorite ETF 10 years ago.

Buffett’s favorite ETF

We first have to determine which ETF is Buffett’s favorite. The good news is that the list of potential candidates is short. Buffett has bought only two ETFs for Berkshire Hathaway’s portfolio. Berkshire (and therefore Buffett) owns stakes in the Vanguard S&P 500 ETF (NYSEMKT: VOO) and the SPDR S&P 500 ETF Trust (NYSEMKT: SPY). Both funds attempt to track the performance of the S&P 500 index.

Which is Buffett’s favorite? The evidence points to the Vanguard ETF.

For one thing, Berkshire owns a little more of the Vanguard S&P 500 ETF than it does the SPDR S&P 500 ETF Trust. The conglomerate’s position in the Vanguard ETF tops $21.5 million, while its stake in the SPDR ETF stands close to $21.4 million.

Buffett’s 2013 letter to Berkshire Hathaway shareholders also supports the premise that he likes the Vanguard ETF better. In that letter, the legendary investor explained that he recommended in his will that 90% of the cash inherited by his family be invested in “a very low-cost S&P 500 index fund.” He added, “I suggest Vanguard’s.”

For what it’s worth, the Vanguard S&P 500 ETF meets Buffett’s “very low-cost” criterion better than the SPDR S&P 500 ETF Trust does. The Vanguard ETF’s annual expense ratio is only 0.03% versus an expense ratio of 0.0945% for the SPDR ETF.

Adding up the dollars

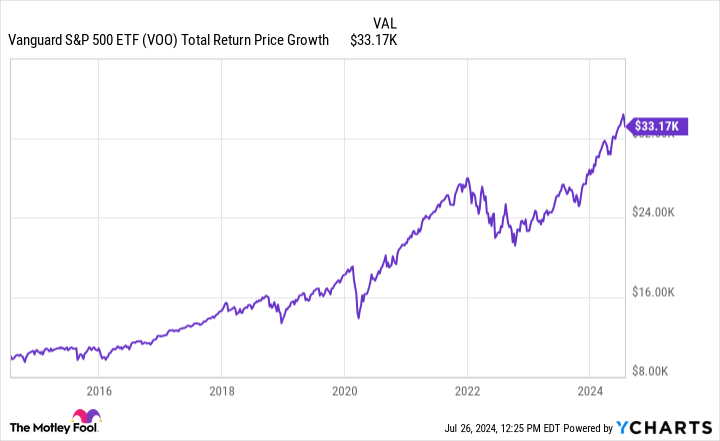

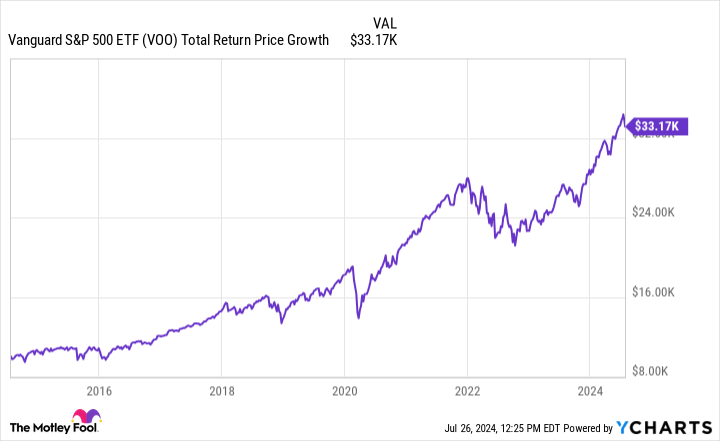

So how much money would you have if you invested $10,000 in the Vanguard S&P 500 ETF 10 years ago? There are two answers to the question.

Based on price appreciation alone, your initial $10,000 would have grown to roughly $27,650 during the 10 years. The total would have been even higher if the S&P 500 had not pulled back somewhat in recent days.

However, this return assumes you didn’t invest any of the dividends the Vanguard ETF paid during the period. If you had reinvested those dividends, your $10,000 would have grown into a whopping $33,170.

By the way, you would have made close to the same profits if you invested $10,000 in Buffett’s second-favorite ETF 10 years ago. The SPDR S&P ETF Trust would have grown your initial investment to roughly $27,600 based on price appreciation alone and to $32,970 with dividends reinvested.

Is Buffett’s favorite ETF a smart pick to buy now?

Any time is a good time to invest in the Vanguard S&P 500 ETF, in my opinion. Over the long run, the S&P 500 should perform well — and so should this ETF.

The Vanguard ETF offers diversification across a large number of stocks in multiple sectors and industries. Its costs are low. Buffett wrote to Berkshire shareholders more than a decade ago that this combination is “virtually certain to get satisfactory results.” I think he’s right. After all, Buffett knows how to make money.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Keith Speights has positions in Berkshire Hathaway and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Berkshire Hathaway and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Here’s How Much Money You’d Have Now If You Invested $10,000 in Warren Buffett’s Favorite ETF 10 Years Ago was originally published by The Motley Fool