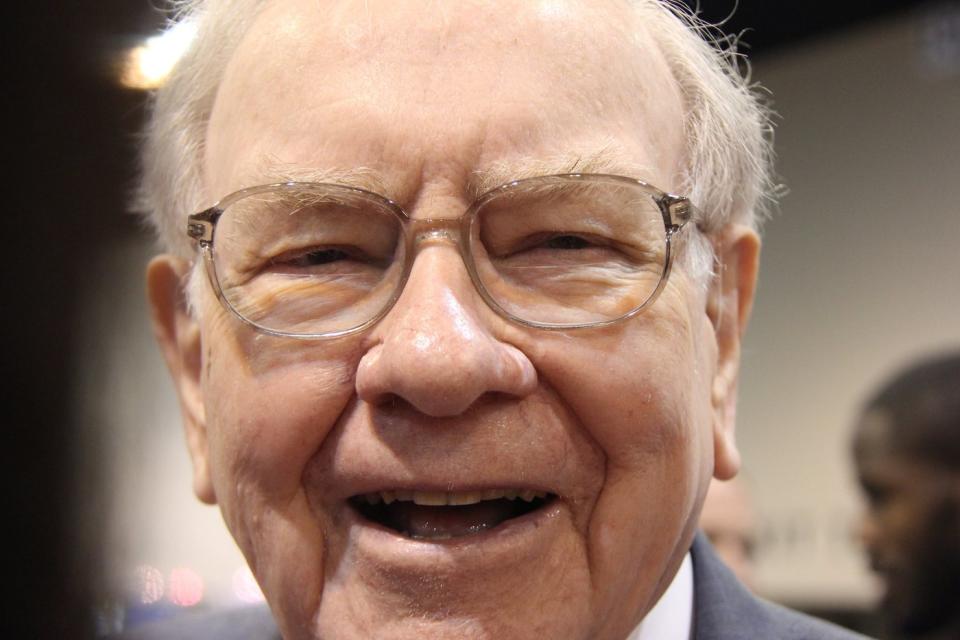

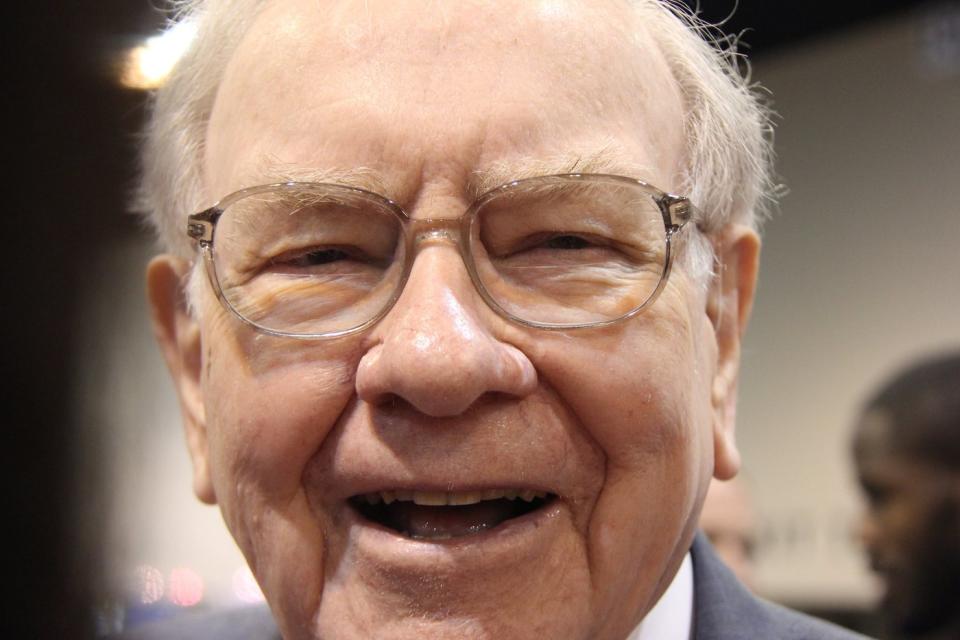

1 Low-Risk Stock That Should Outperform the S&P 500, According to Warren Buffett

Warren Buffett made Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) what is today through the principles of value investing. One of the main ideas behind value investing is that a stock trading at good value (based on certain valuation metrics) will eventually outperform the overall market while also offering less downside risk than other investments.

That value investing strategy has paid off wonderfully for Berkshire and its investors. Buffett’s produced an average compound annual gain of 19.8% for shareholders since taking over the business in 1965. By comparison, the S&P 500 produced an average total return of 10.2% in that time. That massive outperformance stems from Buffett’s ability to identify great companies trading at a fair value, and sometimes an even better-than-fair value.

In his most recent letter to shareholders, Buffett suggested another stock that should perform better than the average American company, and it could turn out to be a great value stock for investors.

A portfolio full of incredible businesses

Buffett highlighted several of Berkshire Hathaway’s biggest stock holdings in his 2023 letter to shareholders published earlier this year.

He’s continuously bought shares of Occidental Petroleum (NYSE: OXY) since the start of 2022. He’s built a sizable position in the oil company, amounting to 28.8% of the shares outstanding. Berkshire also holds about $8 billion worth of preferred shares, which it received in exchange for helping finance Occidental’s acquisition of Anadarko in 2019. Buffett praised Occidental’s management and said he expects to hold the stock indefinitely.

Buffett also called out longtime holdings American Express (NYSE: AXP) and Coca-Cola (NYSE: KO) as businesses he never plans to sell. Both have strong international brands that Buffett loves and core products and services that he called “timeless essentials.” Despite the fact that Buffett hasn’t bought a single share of either company in over 20 years, they remain two of Berkshire’s largest holdings.

Buffett mentioned Berkshire’s giant stake in Apple (NASDAQ: AAPL), but only in passing. The Oracle of Omaha called Apple “a better business than any we own” at last year’s shareholder meeting. That said, he’s sold off some shares recently, purposefully taking the capital gains amid a favorable tax environment. He assured shareholders that he expects Apple to remain the largest holding in Berkshire’s equity portfolio for a long time during this year’s shareholder meeting.

All of the companies above might look attractive at their current share prices. They all have very strong competitive positions and good earnings prospects that should support their current valuations. But not a single one of them is the stock Buffett says has better-than-average return potential with less downside risk. (Although in a way, all of them are.)

In fact, Berkshire Hathaway itself is the company Buffett calls out in his letter to shareholders. “After 59 years of assemblage, the company now owns either a portion or 100% of various businesses that, on a weighted basis, have somewhat better prospects than exist at most large American companies,” he wrote.

But it’s not just that Berkshire’s portfolio of stocks and wholly owned subsidiaries are full of great companies, the conglomerate is also well positioned to avoid financial ruin thanks to one more big holding on Berkshire’s balance sheet.

A big insurance policy for the insurance company

Berkshire has a massive equity portfolio, which is partly funded by the float from its insurance businesses. But there’s another side to Buffett’s investment portfolio for Berkshire Hathaway, and it’s growing extremely quickly.

Over the last few years, Berkshire has seen its position in short-term Treasury bonds balloon. Buffett said he expected it to reach $200 billion by the end of the second quarter.

That massive position in cash equivalents means Berkshire “should also operate with materially less risk of permanent loss of capital,” Buffett wrote. While some may deem holding that much cash as a drag on Buffett’s portfolio, those T-bills are yielding over 5% for Berkshire shareholders. That’s an excellent ballast to the equity portfolio and core operations at Berkshire.

All of it amounts to an insurance policy on the rest of Berkshire Hathaway. On top of that, it puts Buffett and his fellow portfolio managers in a position to be able to seize market opportunities if and when they present themselves. For example, Buffett was in a position to invest $10 billion in Occidental in 2019, seeing a potential opportunity. He previously made a similar deal with another top holding, Bank of America. More opportunities will surely present themselves, and Berkshire is ready for them when they do.

A great company trading at a fair price

It’s important to note that Berkshire isn’t just a conglomerate full of great businesses and a massive cash pile on its balance sheet. The stock also trades at a fair price which means it can live up to Buffett’s expectation of outperforming the market.

Shares currently trade for around 19.6 times forward earnings. That might seem high compared to other financial stocks. But when you factor in Berkshire’s cash position, its equity portfolio, the strength of its core operations, and Buffett’s ongoing share repurchases, it’s a fair valuation. That’s evidenced by its price-to-book value ratio of 1.6, which is much more in line with other insurance companies and financial stocks.

While the share price has climbed considerably higher since Buffett penned his letter to shareholders earlier this year, investors can still expect better-than-average results from Berkshire stock going forward.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has positions in Apple. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

1 Low-Risk Stock That Should Outperform the S&P 500, According to Warren Buffett was originally published by The Motley Fool