Why I Just Bought This Stock With an Ultra-High 7.4% Dividend Yield

I recently went on a shopping spree. It wasn’t to the local mall. I didn’t buy online, either. Instead, I put some of my cash to work by investing in several stocks.

Enbridge (NYSE: ENB) was one of them. It was the first time I invested in the Canadian midstream energy company. Here are three key reasons why I just loaded up on the stock.

1. The dividend (of course)

The headline of this article gives away a major reason why I bought Enbridge: It’s the dividend, of course. Enbridge’s ultra-high dividend yield of nearly 7.4% was very enticing. I don’t need the income at this point, but that high yield gives the stock a big head start in generating a market-beating total return.

I especially like Enbridge’s dividend track record. The company has increased its dividend for 29 consecutive years. Thanks in large part to this dividend growth, Enbridge has delivered an average total return of around 12% since 2004.

I’m confident in Enbridge’s ability to keep this impressive streak of dividend hikes going, too. The company continues to maintain a distributable cash flow payout range of between 60% and 70%. Enbridge has a manageable leverage ratio and prioritizes investments that don’t require a tremendous amount of capital. I believe the juicy dividend is highly reliable.

2. Attractive valuation

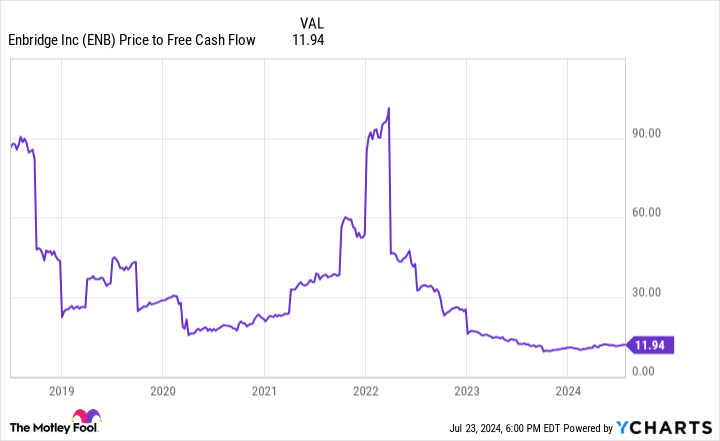

Generally speaking, a price-to-free-cash-flow (P/FCF) ratio below 15 is considered attractive. Enbridge’s multiple is under 12.

Even better, Enbridge’s P/FCF ratio is near its lowest point in years. And it’s not because business is bad. The company’s adjusted earnings and distributable cash flow grew 8% and 9% year over year, respectively, in its latest quarter.

I might be concerned that Enbridge is a value trap if I thought its free cash flow was likely to decline. However, I don’t think that’s going to happen — even if oil and gas prices fall significantly. Over 98% of Enbridge’s earnings stem from cost-of-service or take-or-pay contracted assets. The company has hardly any commodity price exposure.

3. Solid growth prospects

To be sure, Enbridge hasn’t delivered tremendous share-price gains so far in 2024. I think, though, that the midstream energy leader has good growth prospects.

Enbridge is investing like it expects to grow. The company is planning an expansion next year for its Gray Oak pipeline in the Permian basin to 120,000 barrels per day. It recently completed an expansion of its Ingleside, Texas, crude oil storage and export terminal to 18 million barrels.

Steady progress is being made with the Woodfibre liquefied natural gas (LNG) export facility near Vancouver, Canada. Enbridge agreed to acquire a 19% interest in its Whistler joint venture to construct a natural gas pipeline connecting the Permian Basin with the U.S. Gulf Coast.

I think the artificial intelligence (AI) boom will also provide a nice tailwind for Enbridge. The company’s pipelines are within 50 miles of 45% of the natural gas power generation facilities in North America. CEO Greg Ebel said in Enbridge’s first-quarter earnings call that the opportunity to serve data centers “will take some time to ramp up” but is “forecasted to require a material increase in power generation.”

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $688,005!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Keith Speights has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool has a disclosure policy.

Why I Just Bought This Stock With an Ultra-High 7.4% Dividend Yield was originally published by The Motley Fool