Forget AMD: 2 Tech Stocks to Buy Instead

The world’s five-most-valuable companies by market capitalization each have prominent positions in technology, leading areas such as consumer products, cloud computing, chip design, and software. As a result, tech stocks are crucial growth drivers in the stock market. The tech-rich Nasdaq Composite index has risen 304% over the past decade, significantly outperforming the S&P 500‘s 181% rise.

Consequently, it’s not a bad idea to dedicate some of your holdings to this high-growth industry. Chipmakers are particularly attractive now, creating the hardware that makes most tech possible. Among them is Advanced Micro Devices (NASDAQ: AMD), which holds the second-largest market share in graphics processing units (GPUs) and central processing units (CPUs). AMD supplies its chips to companies like Microsoft, Alphabet, and Amazon — and its stock has climbed 41% over the past 12 months.

However, AMD’s earnings have yet to catch up to that growth, making the stock overvalued. In fact, it is currently trading at 228 times its earnings, suggesting it could be best to consider better-valued investment options in this tech sector. So, forget AMD and consider buying these two tech stocks instead.

1. ASML Holding NV

The general public might not be as familiar with ASML Holding (NASDAQ: ASML) as AMD, as it doesn’t develop products for the consumer sector. However, ASML’s role is arguably more essential to the future of technology.

ASML is a Dutch semiconductor-equipment company and the world’s leading producer of lithography systems. The company’s deep ultraviolet (DUV) and extreme ultraviolet (EUV) systems are crucial components to manufacturing chips of all kinds, with the former specializing in larger chips and the latter capable of producing smaller and denser hardware.

The company has achieved an 83% share in the lithography market, enabling key sectors like telecommunications, data centers, cloud computing, and artificial intelligence (AI) to advance their technology. As a result, ASML boasts a prominent clientele, including leading chip manufacturers like Taiwan Semiconductor Manufacturing, Intel, and Samsung.

Over the past five years, ASML’s quarterly revenue has steadily risen 102%, with operating income climbing 159%. Meanwhile, free cash flow has skyrocketed 327%. Consistent earnings growth has been primarily driven by the fact that ASML’s foundry customers need to regularly purchase more EUV systems to stay competitive.

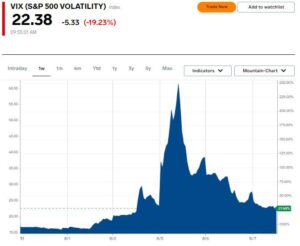

ASML’s stock has dipped 10% in the last month as the company has faced increased restrictions on chip exports to China, brought on by rising tensions between the U.S. and the East Asian nation. However, ASML’s monopolization of lithography systems remains a compelling reason to invest, as budding industries like AI drive chip demand and leading manufacturers build plants in the U.S.

The tech giant’s price-to-earnings (P/E) ratio currently sits at about 50, which doesn’t exactly scream bargain. However, that is considerably lower than AMD’s figure of 228, meaning ASML’s stock offers far more value. Meanwhile, ASML’s dominant and consistent growth over the long term makes it worth its premium share price.

2. Nvidia

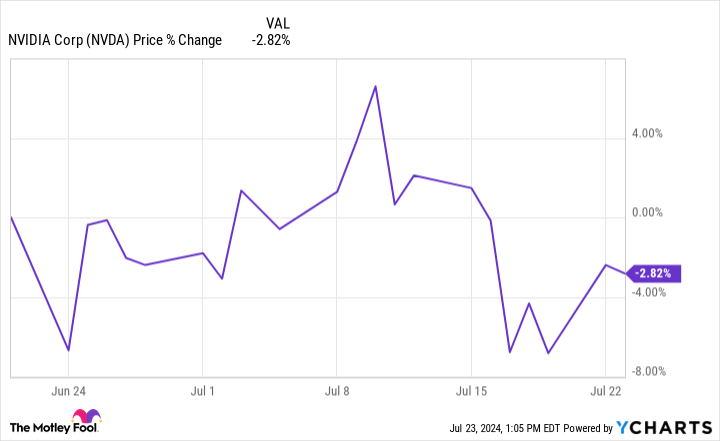

Nvidia (NASDAQ: NVDA) has experienced considerable volatility over the last month. After a series of peaks and valleys, its share price has fallen by about 3%, while rival AMD’s has tumbled by 4%. This chart shows the fluctuation Nvidia investors have endured over the past 30 days amid rising tensions between the U.S. and China.

But despite the recent sell-off, tech’s long-term growth potential and the crucial role that chips play in that development mean these companies remain attractive investments for the long haul. And like ASML, Nvidia holds one of the industry’s most dominant and reliable roles.

Nvidia’s desktop GPU market share jumped by more than 20 points over the last decade, hitting 88% this year. The company’s powerful chips have nearly wiped out the competition, with AMD’s GPU share falling from 35% to 12% in that period and Intel’s sinking to 0%. The difference saw Nvidia’s gaming revenue pop 18% year over year in the first quarter of fiscal 2025, while the same segment for AMD posted a sales decline of 47%.

Nvidia’s success in desktop GPUs has allowed it to expand and dominate other areas of tech. The company is now responsible for about 85% of the AI chip market.

Shares in Nvidia have climbed 177% in the last 12 months to $123 per share. However, its vast reach in tech and AI indicates it still has plenty more to offer investors, and Wall Street seems to agree. Two separate analyst firms have raised Nvidia’s price target, with Loop Captial increasing theirs from $120 to $175 per share and recommending buy. Meanwhile, Piper Sandler has raised their price target from $120 to $140 per share.

Nvidia’s P/E is high at 71, but it is still a far better value than AMD. Its massive growth potential in AI and multiple tech markets make its stock a better option than AMD and worth investing in today.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $688,005!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget AMD: 2 Tech Stocks to Buy Instead was originally published by The Motley Fool