Intel Stock (NASDAQ:INTC): Now Phenomenally Cheap with a 0.6x PEG Ratio

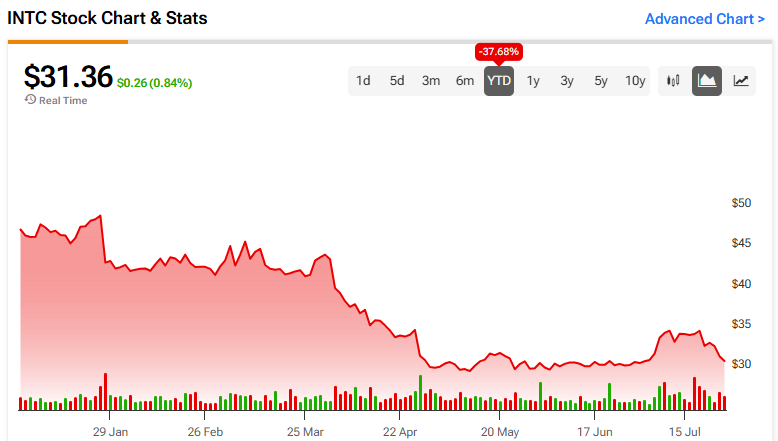

Intel (INTC) has underperformed its peers in the chip-making world in recent months and years. Down 37.7% since the beginning of the year and 32% over five years, the stock’s valuation is starting to become rather attractive based on projected growth in Client Computing Group (CCG) and Data Center and AI Group (DCAI). I’m bullish on Intel, with the firm trading at 30.3x non-GAAP forward earnings and a price-to-earnings-to-growth (PEG) ratio of 0.6x (1.0x or less is generally seen as undervalued).

Intel’s Failures

Intel has struggled to keep up with its peers in several respects in recent years, and analysts have noted several failings under the leadership of CEO Pat Gelsinger. The first of these is Microsoft’s (MSFT) decision to migrate away from Intel in favor of Qualcomm (QCOM) for its new Surface Copilot+ PC devices. This arguably highlights Intel’s lagging performance in PC processors.

In December, Intel launched its Meteor Lake processors with much fanfare. However, despite being the first Intel chipset to include a Neural Processing Unit (NPU) to support AI and featuring a combined CPU/GPU architecture, the artificial intelligence (AI) performance measured was just 34 TOPS (tera AI operations per second). For reference, Microsoft had mandated 40+ TOPS for the NPU alone.

In response to this negative feedback, Intel has gone ahead with the early announcement of its Lunar Lake chips, which boast 100+ Platform TOPS and 45+ NPU TOPS. However, some analysts have suggested that its second failing is the inability to match the power efficiency of the Qualcomm X Elite series and its need to use Taiwan Semiconductor Manufacturing (TSM) for production.

Finally, Intel’s foundry business has seen a drop in external revenues. While there’s nothing wrong with focusing on supplying Intel’s own needs from its foundries, it’s perhaps telling that external revenues have fallen. Even Intel is using TSMC’s foundries for its 3nm processes.

Intel’s Prospects

Despite these challenges and failings, Intel’s prospects remain strong. The company has registered strength in key segments like CCG and DCAI, with the former reporting 31% revenue growth in Q1. CCG represents more than half of the company’s revenues, and recent successes have been driven by Desktop revenue (+31%) and Notebook revenue (+37%) growth. CCG is a business unit that delivers consumer and commercial PCs, encompassing desktops, laptops, and related components.

Moreover, Intel has ambitious plans to become the second-largest external foundry by 2030, with significant orders already from companies like Microsoft. Microsoft has already placed orders for the 18A process node, which arguably says a lot about the company’s direction.

According to reports, Intel has reserved all high-NA EUV machines from ASML (ASML) and started taking delivery at the beginning of 2024 — being the first customer to do so. This is likely the reason for higher CapEx in Q1, but it also puts Intel on a good footing to compete technologically, going forward.

It’s also worth highlighting that many analysts believe Intel is best positioned to weather geopolitical tensions and a potential attack on Taiwan — the island is central to the global chip industry. That’s because Intel’s capacity continues to predominate in the U.S. and its allies.

Cheap Valuation

Analysts’ earnings projections for Intel are very strong. The company is projected to earn $1.08 per share in 2024, but this shoots up to $1.92 in 2025, according to 38 analysts providing earnings forecasts. This figure rises again to $2.50 in 2026, according to 10 analysts, and $3.18 in 2027, according to just two analysts.

At $31.36 per share, the stock is currently trading at 29x non-GAAP forward earnings, which looks cheap compared to many of its peers in the chip sector. However, the caveat is that many of its peers have been more exposed to the AI revolution. Nonetheless, Intel is still expected to grow earnings fast — as noted above — and this leads us to a PEG ratio of 0.6x. That’s very enticing.

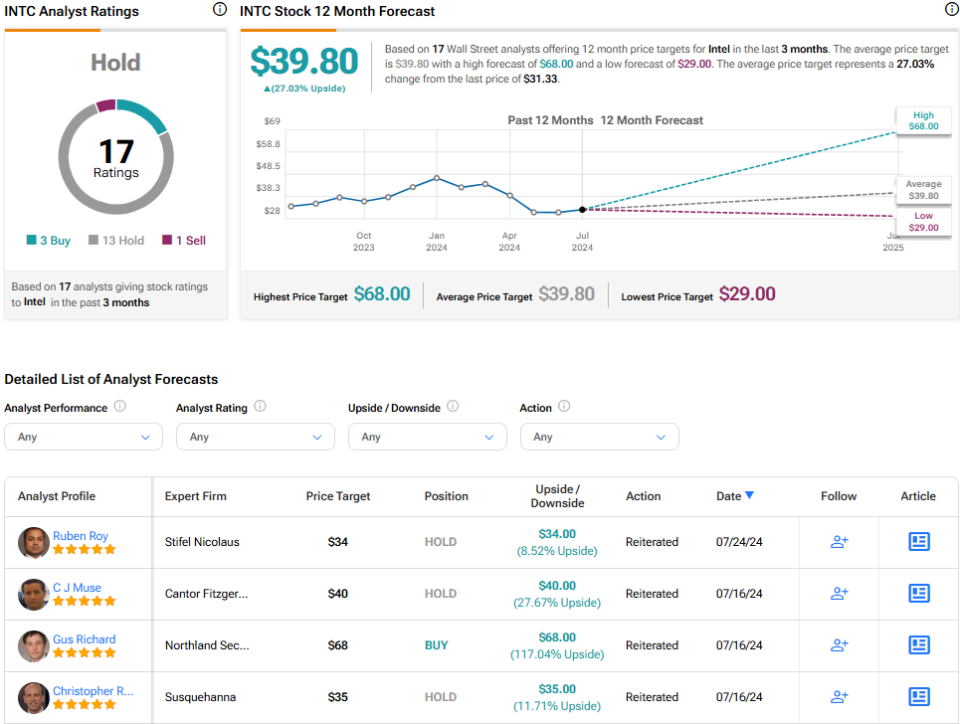

Is Intel Stock a Buy, According to Analysts?

On TipRanks, INTC comes in as a Hold based on three Buys, 13 Holds, and one Sell rating assigned by analysts in the past three months. The average Intel stock price target is $39.80, implying 27% upside potential.

The Bottom Line on Intel Stock

The earnings forecast and the valuation metrics for Intel are exceptionally attractive, and the upside expected from analysts reflects this. While the company’s track record isn’t great, I’m buoyed by the earnings forecast and the positive developments in the CCG and DCAI segments, making me bullish on the stock.