Spain poised to become Europe’s data center capital as Amazon and Meta invest billions to kickstart development

Developing more industries and businesses in emptier regions in Spain is a major common goal across the political aisle.

Spain wants to become a hub for the European data center industry. It also wants to stop companies from building too many data centers.

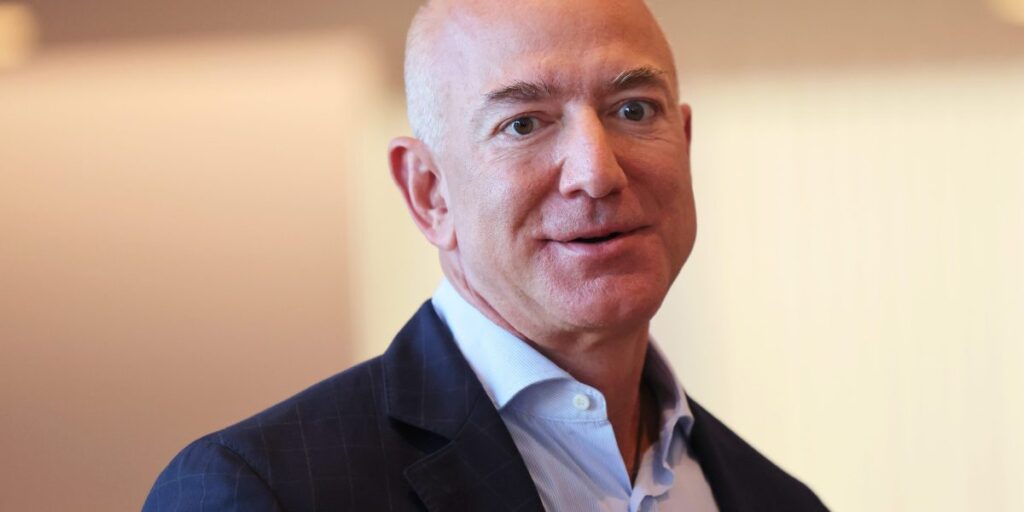

This year, the government endorsed plans by some of the world’s largest technology companies, including Amazon.com Inc. and Microsoft Corp., to construct data centers in the country. At the same time, it purposefully avoids granting electricity grid connections to many others, according to three people familiar with the matter.

One reason for this is the government’s view that the industry is overestimating by at least three times what Spain’s demand for data center capacity will be in the next five to seven years.

While licensing to build centers is controlled by local and regional authorities, the central government found a way to steer the industry’s strategy by leveraging on its grip over access to the power grid, which is vital for the projects’ vast energy needs.

A political point of friction is that many of the power grid access requests are for still-to-be-developed centers around the heavily populated Madrid region — which is governed by Isabel Diaz Ayuso of the conservative People’s Party, one of Socialist Prime Minister Pedro Sanchez’s most outspoken critics. The PP governs most of the country’s 17 regions and largest cities.

The central government’s stance is that it’s unnecessary to build data centers near Madrid given the large amount of empty space available elsewhere.

Spain is one of western Europe’s biggest countries but it also has some of the most densely populated cities — leaving large swathes of sparsely occupied land. Developing more industries and businesses in these emptier areas is a major common goal across the political aisle.

Data center operators argue that their sites need to be close to large cities, where consumers and economic activity are located. Spain DC, an industry group, estimates that the country will need to invest almost €100 billion ($109 billion) through 2040 to adapt its power networks to meet demand. Utilities have raised concerns about the grid’s capacity to match needs.

“We’re not asking taxpayers to pay for power grid capacity, as investors are prepared to do it,” said Maximo Escriche, vice president of sales at data center operator AQ Compute. “But we’ll need a stronger network for Spain to compete with bigger European hubs.”

In other parts of Europe, some operators are also seeing backlogs in getting grid connections and are being pushed into new locations.

Meanwhile, some companies are already seeing advantages in building in less populated areas of Spain. Amazon announced in May it would invest €15.7 billion to expand its data centers in the northeastern region of Aragon, and Meta Platforms Inc. is building a center near the city of Talavera de la Reina.

For now, the tensions aren’t affecting the plans of large Spanish firms.

On Wednesday, Iberdrola SA, the country’s largest power utility, said it’s in advanced talks with data center developers to create joint ventures.

And a day earlier, real estate firm Merlin Properties Socimi SA announced it was raising almost €1 billion in a share sale to expand its data center business. It’s already building three centers.