Oil prices tread water ahead of OPEC meeting

Oil prices tread water ahead of OPEC meeting

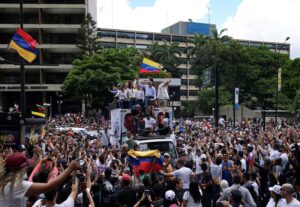

SINGAPORE: Oil prices were steady on Thursday on mixed market signals ahead of an OPEC meeting in Vienna, which analysts said was not expected to result in restrictions on crude output.International Brent crude oil futures were trading at $49.77 per barrel at 0200 GMT, up 5 cents from their last settlement, while U.S. West Texas Intermediate (WTI) crude was down 9 cents at $48.92 a barrel.The Organization of the Petroleum Exporting Countries (OPEC) is set for another showdown between Saudi Arabia and Iran when it meets on Thursday in the Austrian capital, with Riyadh trying to revive coordinated action or a formal oil output target, but Tehran refusing to cooperate.”An output ceiling has no benefit to us,” said Iranian Oil Minister Bijan Zanganeh as the country tries to recoup lost market share following the lifting of sanctions against it in January.Despite rising output by OPEC’s Middle Eastern producers, the group’s overall production has remained largely flat this year, currently standing at 32.5 million barrels per day (bpd), capped by disruptions especially in Nigeria, Libya and Venezuela.Citi said it expected oil prices to rise above $50 per barrel “in the near future” as attacks on oil infrastructure in Nigeria, power outages and payment issues in Venezuela and chaos in Libya have reined in total OPEC production even as Iran has ramped up harder and faster than expected.Because of supply disruptions elsewhere, the Middle East’s low cost producers see little reason to restrain output as overall market conditions have improved significantly for them this year.”Since January 20, oil prices have almost doubled from near $26 per barrel to almost $50 per barrel, at the same time total OPEC production has increased by around 100,000 bpd, despite heavy outages in Nigeria,” BMI Research said.”This indicates the strategy championed by Saudi Arabia… to let the oil market balance without intervening, is gradually playing out,” it added.Despite this, producers are eyeing China’s slowing economy with concern.”OPEC members will be keeping a close eye on China, with the low factory activity data that has been released possibly signalling a diminishing demand for oil ‘ something that could do real damage to oil prices,” said Mihir Kapadia, CEO at Sun Global Investments.Car sales in China, an important gauge for gasoline and, by extension, crude oil demand, have also fallen by almost a quarter since the end of 2015 to 2.12 million new registered vehicles in April.