3 No-Brainer Stocks to Buy With $500 Right Now

Over the last 19 months, the bulls have been in charge on Wall Street. Continued growth for the U.S. economy, coupled with the rise of artificial intelligence (AI) and stock-split euphoria, have pushed the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite to multiple record-closing highs.

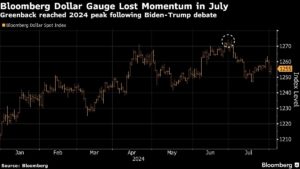

However, corrections are a normal and inevitable part of the investing cycle. Following their recent peaks, the Dow, S&P 500, and Nasdaq Composite have retraced by 1.6%, 3.6%, and 6.9%, respectively, as of the closing bell on July 29. Even though it’s impossible to predict when these downturns will start or where the bottom will be, history has shown that every correction is eventually wiped away by a bull market rally.

In other words, stock market corrections are an invitation for opportunistic long-term investors to pounce.

Making matters even better, most online brokers have eliminated barriers that had previously kept retail investors from participating on Wall Street. With most brokerages shelving minimum deposit requirements and commission fees for common stock trades on major U.S. exchanges, any amount of money — even $500 — can be the ideal amount to invest.

If you have $500 to put to work on Wall Street, and you’re absolutely certain this isn’t cash you’ll need for emergencies or to pay bills, the following three stocks stand out as no-brainer buys right now.

NextEra Energy

The first phenomenal stock that investors can confidently add to their portfolios with $500 right now is America’s largest electric utility, NextEra Energy (NYSE: NEE).

Last year, utility stocks performed miserably. The culprit was the Federal Reserve’s aggressive rate-hiking cycle, which sent short-term Treasury yields soaring. Instead of investors seeking out time-tested utility stocks for their steady income, they chose to purchase short-term Treasury bills, which offer more principal protection and comparable (or higher) yields.

The good news for NextEra Energy is that the nation’s central bank is nearing the start of a rate-easing cycle. An environment where interest rates are declining tends to be favorable to high-yielding utility stocks.

But what’s far more important than monetary policy is the growth and differentiation NextEra brings to the table for its shareholders. Whereas most electric utilities are slow-growing, NextEra expects to deliver median adjusted annual earnings per share (EPS) growth of 7% through 2027, along with 10% expected annualized dividend growth through 2026. The company’s not-so-subtle secret is its focus on renewable energy.

NextEra Energy has 72 gigawatts (GW) of operating capacity, nearly half of which is devoted to renewable energy sources, which includes wind and solar. No electric utility in the world is currently generating more capacity from wind and solar than NextEra. Though these investments in clean-energy solutions haven’t been cheap, they’re meaningfully reducing electric generation costs and pumping up the company’s adjusted EPS growth.

Take note that NextEra has no intention of taking its foot off the accelerator. Between 2024 and 2027, an estimated 36.5 GW to 46.5 GW of renewable energy capacity is expected to come online. Lower interest rates and strong cash flow generation should (pardon the pun) fuel this shift to a greener future.

Lastly, NextEra’s forward price-to-earnings (P/E) ratio of 20 marks a 21% discount to its average forward earnings multiple over the last five years.

Starbucks

A second no-brainer stock that’s begging to be bought with $500 right now is leading coffee chain Starbucks (NASDAQ: SBUX).

There’s no beating around the bush (or the cappuccino foam) that Starbucks has been an abysmal performer since its stock peaked in 2021. Its current 40% drawdown from its all-time high represents one of its largest peak-to-trough moves of the century. While the operating performance of restaurants doesn’t turn around at the drop of a dime, Starbucks has repeatedly demonstrated throughout its history that it has the tools and innovative capacity to make its patient investors richer.

The biggest factor working in Starbucks’ favor is that it has a loyal customer base. Regardless of the commodity- or labor-based inflationary pressures the company has faced, it’s rarely had any trouble raising its prices and staying ahead of the inflationary curve. Pricing power and brand loyalty are two key ingredients to long-term success for restaurant chains.

To build on this point, Starbucks ended March with 32.8 million active U.S. Rewards Members. In exchange for a free drink or food item every now and then, Rewards Members tend to spend more per ticket, are more likely to use mobile ordering, and store their payment information on their smartphone. In other words, these habitual customers help to expedite lines and are making Starbucks’ stores more efficient.

Don’t count out the company’s innovative capacity, either. Although newly introduced drinks haven’t resonated with customers of late, there’s more to innovation than just crafting new beverages. Starbucks’ addition of video to its drive-thru ordering boards during the COVID-19 pandemic, coupled with the introduction of new food products catering to the lunch crowd, are just some examples of the way the company has used innovation to drive traffic into its stores and encourage high-margin purchases.

Incremental operating improvements should be expected from the company’s China stores, as well. Following three years of stringent COVID-19 lockdowns in China, the burgeoning middle class for the world’s No. 2 economy is still finding its footing. Comparable-store sales should improve in the company’s second most-important market next year.

Shares of Starbucks can be purchased right now for less than 19 times forward-year EPS, which equates to a 33% discount to its average forward-year EPS multiple from the prior five years.

Intel

The third no-brainer stock that makes for an amazing buy right now is none other than legacy semiconductor behemoth Intel (NASDAQ: INTC).

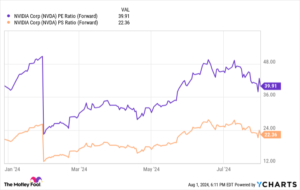

It’s been something of a painful slog for Intel shareholders, who’ve had to watch Nvidia‘s stock skyrocket, largely due to its success in AI-accelerated data centers. Nvidia’s graphics processing units (GPUs) accounted for an estimated 98% of the GPUs shipped for use in high-compute data centers in 2023.

Thankfully for Intel, it hasn’t missed the AI boat and has numerous catalysts in its sails beyond AI to look forward to.

With regard to AI, Intel unveiled its Gaudi 3 AI-accelerating chip in April. The expectation is that this Nvidia-rivaling chip will begin rolling out on a large-scale basis to customers this quarter. With Nvidia struggling to meet demand, Intel shouldn’t have any trouble finding buyers for its AI hardware.

Although high-growth trends (ahem, AI) tend to get all the buzz on Wall Street, it’s important to recognize that Intel’s legacy segments are still vital to its success. Even though central processing units (CPUs) used in personal computing and traditional data centers aren’t the growth story they once were, Intel has retained its market share dominance in CPUs. The company’s Client Computing Group should remain a core driver of cash flow for years to come.

The abundant cash flow Intel generates from its legacy operations can be repurposed to faster-growing initiatives. For instance, Intel is building out its Foundry Services segment from scratch. Despite higher-than-anticipated near-term losses from this expansion, Intel intends to become the world’s No. 2 chip fabricator by the turn of the decade.

Intel also holds a majority stake in advanced driver assistance systems and autonomous driving solutions company Mobileye Global, which it spun off in October 2022. With next-gen vehicles becoming more reliant on technology, Mobileye would seem to have a path to sustained double-digit sales growth over the long run.

The final piece of the puzzle for Intel is that it’s historically cheap. Shares are trading at 24% above book value, which is near an all-time low, and the company has the potential to deliver north of $3 in EPS by 2027.

Should you invest $1,000 in NextEra Energy right now?

Before you buy stock in NextEra Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $683,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Sean Williams has positions in Intel and NextEra Energy. The Motley Fool has positions in and recommends NextEra Energy, Nvidia, and Starbucks. The Motley Fool recommends Intel and Mobileye Global and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

3 No-Brainer Stocks to Buy With $500 Right Now was originally published by The Motley Fool