3 High-Yield Dividend Stocks to Buy and Hold Forever

The stock market’s recent sell-off has some investors concerned about their investments and even the overall health of the U.S. economy. But over many people’s investing lifetimes, markets will sometimes go up and sometimes go down, and changes can happen rather quickly. If the recent volatility has you looking for more stable investments, consider a few established cash-generating companies that have a long history of dividend payments. Here are three that you can likely buy and hold forever.

Family-backed

Ford Motor Company (NYSE: F) has one of the richest histories in the automotive industry, but it currently faces numerous challenges. The company is struggling in China. It’s working to improve vehicle quality, leading the industry in U.S. recalls for three straight years. And it’s losing billions annually with its electric vehicle (EV) division. But those challenges have given investors an opportunity to buy shares of Ford at a price-to-earnings ratio of 10 times, with a dividend yield topping 6.1% at recent prices.

Despite its challenges, Ford has an impeccable balance sheet, with plenty of cash flow thanks to its gasoline-powered trucks, SUVs, and commercial vans. The automaker also has $27 billion in cash with roughly $45 billion in liquidity. That’s plenty of capital to invest in long-term growth strategies, and in returning value to shareholders.

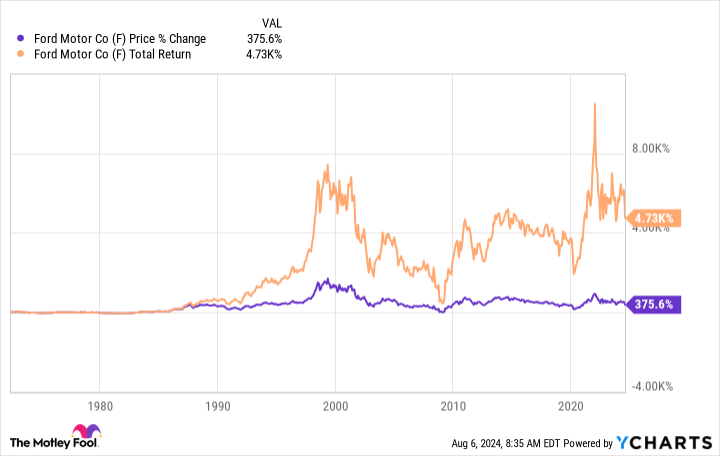

Ford has committed to returning 40% to 50% of free cash flow to investors. Unlike many companies that do both share buybacks and dividends, Ford will almost certainly deliver those returns purely in dividends. That’s because the Ford family owns a separate class of shares that come with 40% voting power as well as the dividend, which is widely known to be loved by the family. For that reason, expect Ford’s focus to continue to be on its healthy dividend.

Look at the graph below to see the difference in the value of owning Ford shares and reinvesting its dividend, compared to its stock price gains alone.

Adapting to smokeless

Amid the decline of traditional cigarettes, Altria Group (NYSE: MO) is focused on providing adult smokers with a variety of smoke-free substitutes that include e-vapor, heated tobacco, and oral tobacco. It’s a transition that won’t be easy or cheap, especially as investors have grown accustomed to the cash cow of cigarettes over the decades, but it’s necessary for future growth. Altria already has a wide portfolio of smoke-free products, including NJOY and LLC (which is currently the only e-vapor manufacturer to receive market authorization from the U.S. Food and Drug Administration).

Investors shouldn’t worry about the decline of cigarettes yet, at least when it comes to the dividend payout. Last year, Altria paid out $6.8 billion in dividends and spent an additional $1 billion on share repurchases. It still reduced its debt-to-assets ratio, and generated free cash flow of roughly $9 billion to cover everything.

While the company is adapting to consumer preference changes, what hasn’t changed for Altria Group investors is its staggering dividend yield, recently at 7.9%. And for investors worried about the U.S. economy, rest assured that Altria’s business performs well during downturns, as people purchase tobacco products regardless of economic uncertainty.

Altria isn’t a growth stock, and it’s in the middle of a major transition to smokeless products, but it will remain one of the best dividend stocks for the foreseeable future.

Healthcare juggernaut

Johnson & Johnson (NYSE: JNJ) has proven to be a strong, consistent, and sustainable business over the decades, and the company continues to evolve. Consider that it has 25 platforms or products that generate over $1 billion in sales annually, and that 65% of its sales come from markets where it’s No. 1 or No. 2 globally. Just last year, J&J spun off its consumer health business to focus on medical devices and innovative medicines to increase its growth rate.

When it comes to its dividend, the company doesn’t play around. It’s logged over 60 consecutive years of dividend increases, and over the past five years, it’s returned over 60% of its free cash flow to shareholders through dividends and share buybacks — its forward dividend yield tops 3%.

J&J is focusing on accelerating growth, returns massive value to shareholders, and boasts a diverse portfolio of products, so what’s the catch? Currently, the biggest drawback of owning this stock is the uncertainty that comes with lawsuits. In May, J&J announced its third attempt to resolve issues relating to talc-based product lawsuits, and if it can finally put the issue to rest, it’ll be a boost to the stock. Long-term, however, investors will still likely be talking about J&J’s consistent and increasing dividend in 10 years, and they likely won’t be discussing 2024 lawsuits.

Bottom line

Ultimately, while all three of these companies face some challenges, investors can rest assured that they can reap the rewards of dividends while they wait for the companies to work through challenges and continue to prosper. Ford, Altria Group, and Johnson & Johnson will continue to provide passive income for years, helping investors sleep more soundly at night even during economic downturns.

Should you invest $1,000 in Johnson & Johnson right now?

Before you buy stock in Johnson & Johnson, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Johnson & Johnson wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $606,079!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

Daniel Miller has positions in Ford Motor Company. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks to Buy and Hold Forever was originally published by The Motley Fool