2 Growth Stocks to Buy in 2024 and Hold for at Least a Decade

The stock market has fluctuated greatly in recent years, highlighting the importance of dedicating a portion of your holdings to reliable long-term growth stocks.

Macroeconomic headwinds saw the S&P 500 index plunge 20% in 2022. Excitement over tech stocks and artificial intelligence (AI) prompted a recovery the following year, with the same index rising 24% in 2023. Meanwhile, the S&P 500 has popped 14% so far this year, and it is on track to at least equal last year’s growth.

However, recent market uncertainty fueled by unforeseeable events like a global pandemic and a subsequent economic downturn suggests it’s not a bad idea to fortify your portfolio with historically reliable investments. The tech market is an excellent place to start, known for its wealth of growth stocks that have boosted the Nasdaq Technology Sector by 370% over the last decade. For reference, the S&P 500 has risen 176% in that period.

So, here are two growth stocks to buy in 2024 and hold for at least a decade.

1. Amazon: A surprisingly great value

Amazon (NASDAQ: AMZN) has delivered impressive growth in its 30 years of business. Over the last decade alone, its stock has climbed more than 1,000%. Meanwhile, annual revenue has risen 545%, and operating income skyrocketed over 20,000%. The company’s success is mainly owed to consistent reinvestment in its business, which has seen it expand to the far corners of tech.

Amazon has become a behemoth of a brand, with solid positions in markets such as e-commerce, cloud computing, video streaming, grocery, AI, and more. The company has achieved leading market shares in multiple industries, with growth catalysts across tech that could boost earnings for years.

Moreover, according to a recent Blomberg report, the company’s cash hoard is expected to swell to $100 billion in 2024. The figure could see Amazon introduce its first dividend in the near future, with Ami Asset Management’s Andrew Zamfotis stating, “A dividend might be inevitable, and would really signal that it is going to be more focused on spending and profitable growth.”

The company has previously been hyperfocused on reinvestment. However, with its free cash flow projected to nearly double this year, conditions could be ripe for a cash reward to investors.

Shares in Amazon are up about 20% year to date, outperforming the S&P 500 by about 6 points. Yet, consistent sales growth has kept the company’s stock a value.

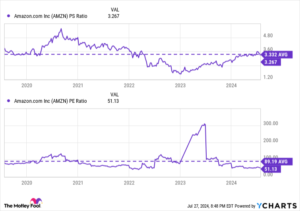

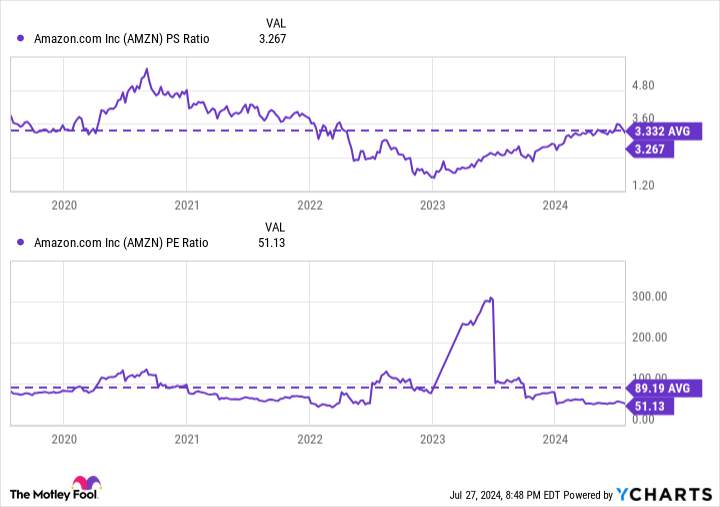

The table above shows that Amazon’s price-to-sales (P/S) ratio is at an attractive 3 and about in line with its five-year average. Its price-to-earnings (P/E) ratio is high at 51, yet well below its five-year average, signaling a buying opportunity. For reference, Amazon’s stock has risen 88% in the last five years while maintaining this average.

Being below its average for both metrics represents a bargain, making Amazon a no-brainer growth stock to buy in 2024.

2. Alphabet: Reliable financial growth

Like Amazon, Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) has enjoyed stellar gains in its time. Its stock has soared 458% since 2014, with annual revenue and operating income rising 365% and 411%, respectively.

The company’s success stems from an impressive roster of subsidiaries, which includes brands like Google, Chrome, Android, YouTube, and even Fitbit. These products have elevated Alphabet’s business, allowing it to hit $61 billion in free cash flow this year. The company has used its abundance of cash to invest heavily in AI and reward loyal investors, introducing its first dividend in June with a quarterly payout of $0.20 per share.

Alphabet’s new dividend is a promising vote of confidence from executives, representing the belief that the company will continue expanding its earnings for the foreseeable future.

On July 23, Alphabet reported its second quarter of 2024 earnings. The company delivered revenue growth of 14% year over year, with operating income jumping 26%. Alphabet profited from significant gains in its Google Cloud segment, where revenue rose 28% year over year, and operating income almost tripled.

Google Cloud is the world’s third-largest cloud platform after Amazon Web Services (AWS) and Microsoft‘s Azure. However, Google Cloud has made impressive strides this year, consistently beating its competitors in growth. Alphabet’s business has long been centered around digital advertising, which remains a lucrative division. Still, cloud computing will likely be a key growth driver over the next decade as AI continues to boost the industry.

Alphabet is easily one of the most reliable growth stocks, with years of consistent financial and share price appreciation. Its P/E currently sits at an attractive 24, below its five-year average and lower than many of its rivals’. In addition to generating reliable financial gains, Alphabet is a growth stock you can buy now and hold indefinitely.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $683,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Growth Stocks to Buy in 2024 and Hold for at Least a Decade was originally published by The Motley Fool