2 charts show why the stock market sell-off isn’t done yet

The roaring stock market rally of 2024 has finally hit a pause.

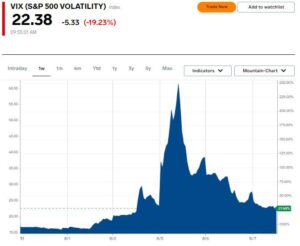

The S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) tallied their worst one-day drops since 2022 on Wednesday and extended those losses on Thursday. Over the past 10 days the benchmark S&P 500 is down about 3%, while the Nasdaq is down more than 6%.

The recent pause in the rally’s chug higher aligns with calls from equity strategists in our recently released third volume of the Yahoo Finance Chartbook. Truist co-chief investment officer Keith Lerner noted that in years when the S&P 500 has risen more than 10% in the first half of the year, the second half usually sees an average pullback of about 9%.

Through the end of June, the S&P 500 was up about 14%.

“This choppier market action of late, which we have been anticipating, likely has further to go in terms of price and time,” Lerner wrote in a note to clients on Thursday.

Tech has been the clear leader of the recent market drawdown. Information Technology and Communication Services are the only two of the 11 sectors in the S&P 500 with negative returns over the past month. In an interview with Yahoo Finance, Lerner reasoned that the recent sell-off in Tech made sense given how far up the sector had run.

In late June, tech had outperformed the S&P 500 on a rolling two-month basis by the most since 2002, per Lerner’s research. Lerner reasons that, like a rubber band that becomes overstretched, there’s usually a snapback from extreme levels of outperformance in markets.

“When we get that stretched, a little bit of bad news can go a long way,” Lerner said.

The “little bit of news” came via earnings reports from Alphabet (GOOGL, GOOG) and Tesla (TSLA) after the bell on Tuesday leading into Wednesday’s sell-off. Lerner noted that the earnings weren’t bad but failed to impress investors, who had a high bar entering this reporting season.

Earnings from Apple (AAPL), Meta (META), Microsoft (MSFT), and Amazon (AMZN) expected next week will prove the next test for investor sentiment in the tech sector. Lerner reasoned that, after the market reset over the past few trading sessions, there’s a chance technology’s latest swath of earnings can surpass investors’ now-trimmed expectations.

“I think the secular story of this bull market is still intact,” Lerner said. “Money will come back there. I just think more likely you need a resting period and kind of a pause that refreshes.”

BMO Capital Markets chief investment strategist Brian Belski also highlighted the likelihood of a pause in stocks’ climb higher in the latest edition of our Chartbook. Similarly to Lerner’s analysis, Belski’s work shows that going back to 1949, the second year of a bull market sees a roughly 9% average pullback. The most recent bull market started in October 2022.

Belski told Yahoo Finance on Tuesday that the market was “ripe for a pullback from a sentiment perspective.” But to Belski, this is a “buying opportunity.” His research shows that markets typically bounce back an average of 14.5% from the bottom of the second-year bull market drawdowns he studied.

“Stocks will be higher at year-end,” Belski said.

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance