1 Stock I Wouldn’t Touch With a 10-Foot Pole — and Here’s Why

Once upon a time, Peloton Interactive (NASDAQ: PTON) was a hot ticket. Millions of people were stuck at home during the lockdowns of the coronavirus pandemic, so Peloton’s home gym equipment was flying off the shelves. Annual sales soared from $1.8 billion in 2019 to $2.0 billion in 2022. At its peak, Peloton’s stock was worth $167 per share with a market cap of $49.3 billion.

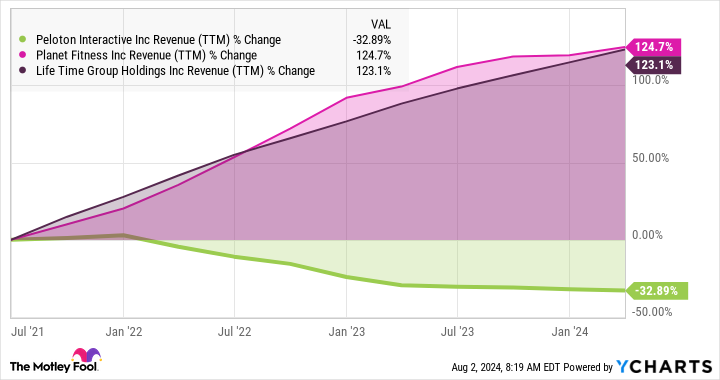

But the company started to fall apart as soon as the pandemic faded out and people returned to the gym. More traditional fitness companies such as Planet Fitness (NYSE: PLNT) and Life Time Group (NYSE: LTH) more than doubled their trailing sales in the last three years while Peloton’s revenue fell by one-third instead:

This is a pretty familiar story nowadays, and some fallen stars from the lockdown era sure look like thrilling investment ideas right now. But Peloton is a different story, and I would not touch the “buy” button for this stock with a 10-foot pole.

Here’s why.

Five signs of Peloton’s demise

You could call Peloton a turnaround story, but it’s not working out (pun intended).

I already showed you Peloton’s sales trend but that’s just the start of a terrifying tale. Dig deeper if you dare, but you won’t like what you find below Peloton’s rickety surface.

-

Peloton hasn’t posted a quarterly profit since the spring of 2021.

-

Free cash flow has also stayed negative throughout this period, with the exception of an $8.6 million cash profit in the first quarter of 2024.

-

To keep the lights on, Peloton has raised $860 million of new debt in three years — during an inflation crisis with soaring interest rates.

-

Private equity firms were reportedly considering a buyout earlier this year, but they seem to have back off since Peloton hasn’t reported a firm offer in three months.

-

The number of active subscriptions to Peloton’s connected fitness services hasn’t really moved since the end of 2022. Overall membership is down from 6.9 million to 6.6 million names over the same period. And Peloton’s paid app subscriptions fell 21% year-over-year in the recent third-quarter report. In other words, there are fewer Peloton customers, especially in the class that’s willing to pay subscription fees for its workout services.

Moreover, former Netflix CFO Barry McCarthy stepped down from Peloton’s CEO office three months ago, so the difficult turnaround effort is managed by a pair of interim co-CEOs. The leadership change was paired with Peloton laying off 15% of its staff, as the company “simply had no other way to bring its spending in line with its revenue.”

I’m painting this dark picture in broad strokes, but the message should be clear. Peloton has lots of problems and few solutions.

Better ideas for those thinking about Peloton stock in 2024

One or two of these issues could exist and still leave room for Peloton to reach new heights in the long run. But the challenges, missteps, and desperate financial moves are too many and too serious. They add up to a sad ending for a once-thrilling growth story.

So if you’re looking for former lockdown stars with a bright long-term future, I’m afraid Peloton won’t fit the bill. Media-streaming technologist Roku is a better bet, as are freelance services expert Fiverr International and remote video conferencing veteran Zoom Video. You should consider these promising growth stocks and keep your hands off of Peloton.

This ex-star has fallen and I don’t think it can get up. Not even if I dared to reach out with a ten-foot pole.

Should you invest $1,000 in Peloton Interactive right now?

Before you buy stock in Peloton Interactive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Peloton Interactive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Anders Bylund has positions in Fiverr International, Netflix, and Roku. The Motley Fool has positions in and recommends Fiverr International, Netflix, Peloton Interactive, Planet Fitness, Roku, and Zoom Video Communications. The Motley Fool has a disclosure policy.

1 Stock I Wouldn’t Touch With a 10-Foot Pole — and Here’s Why was originally published by The Motley Fool